The results of the Australian government's 4G spectrum auction are in - and have been immediately slammed by Telecommunications Users Association head Paul Brislen.

The Australian government raised $A1.96 billion ($NZ2.39 billion) or about a third less than forecast - leaving a $A1 billion hole in the government's budget.

If it translated on a straight per-capita basis, that would mean our government would reap around $474 million when our own 4G auction takes place before the end of October (estimates have been all over the map, from $200 million to $500 million).

As across the Tasman, the Crown is set to take bids for radio spectrum freed up by the digital TV changeover (the 700MHz airwaves involved are ideally suited for next-generation or "4G" faster mobile data networks).

But Sydney-based telecommunications analyst Paul Budde cautions it's too simplistic to simply divide the figure by population.

"I think the reality for New Zealand will be that the auction will generate less revenue per user than in Australia," Mr Budde says.

"It could even be significantly less if the government wants to sell all available spectrum now. New Zealand is a smaller market with smaller companies."

Not that the Australian auction itself is being regarded as any great shakes - at least by Mr Brislen.

"It's an appalling outcome for the telco market," he tells NBR.

"They priced the reserve so high - roughly double the $2.36 per megahertz per head the Europeans put on their equivalent spectrum - that Vodafone Australia pulled out and they’ve only managed to sell two-thirds of the spectrum."

Our government has yet to set a reserve, and finalise other fine print. The "debacle" of the Australian auction should give Treasury pause, Mr Brislen hopes, and see lower ambitions for a big windfall on this side of the Tasman. Economic Development Minister Steven Joyce has already acknowledged it's swings and slides, given high auction prices would likely flow through to higher mobile phone bills as Telecom, Vodafone and 2degrees seek to recoup costs.

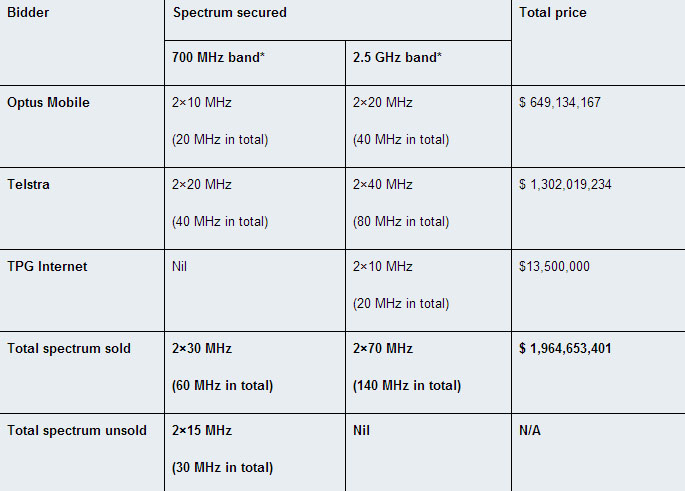

Click to zoom. Source: Australian Govt/ACMA

The Aussie 4G auction saw Telstra bid $A1.3 billion to secure two 40MHz blocks, and Optus collect two 20MHz blocks for $649 million. Surprise bidder TPG Internet picked up two 10MHz blocks of less desirable 2500MHz spectrum for $A13.5 million.

In Vodafone's absence, the sale prices were only marginally above reserve. And two juicy 15MHz blocks of 700MHz airwaves went begging.

Despite the Vodafone boycott depressing bids, Mr Brislen says the total was still too high.

"The sale price of nearly $A2 billion means there’s less money to invest in the actual network deployment. The same problem held up 3G rollout in Europe for the better part of a decade," he says.

"Telstra has cemented its role as dominant market force by buying double the spectrum of its only rival, Optus. That means it has won the 4G race before it’s deployed its network – it can put double the number of customers on its 4G network that Optus can and get the same quality of service"

Potential disaster for 2degrees

New Zealand needs to learn from this and do the opposite, the Tuanz boss says.

"We need a low reserve to encourage use, we need three or four even lots to ensure competition in 4G isn’t crushed and we need to make sure all three telcos (Vodafone, Telecom and 2degrees) can get hold of the spectrum and put it to good use."

The introduction of 2degrees into the mobile market has shaken up the sector like nothing else before it. New price points, new services, an astonishing growth rate – 2degrees is one of the most successful new entrants anywhere in the world," Mr Brislen says.

"But if it was forced to bid for 700MHz on this kind of scale, it would end up with management rights but no ability to use those rights. We certainly wouldn’t see a network on any scale from 2degrees for quite some time."

2degrees has appeal to the government to allocate it 4G spectrum at "a fair price," which it says is necessary to keep the market competitve (the majority US-owned carrier received its original 3G spectrum through the Hautaki Trust, which received the airwave rights free from the last Labour government. 2degrees now owns the spectrum).

Both Telecom (trialing 4G ahead of an October launch) and Vodafone NZ (already launched in Auckland) have 1800MHz and 2100MHz spectrum that can be used for next-generation networks. But both covet 4G as more cost effective, especially outside cities, and are banking on winning 700MHz spectrum at auction to bulk up their bandwidth.

Sell later, get more

Meanwhile, Mr Budde notes the Australian government's failure to sell all the 4G spectrum at its current auction could play into its hands long term.

"It will be able to get that money, not less, in a couple of years time as it is highly likely there will remain a shortage of spectrum in the booming mobile broadband market," he says.