Chips with everything: An entrepreneur’s story

How a Kiwi engineer conquered Rutherford’s world of ion implantation.

Ion Man: The life and adventures of Bill Buckley, with Robert Tighe

How a Kiwi engineer conquered Rutherford’s world of ion implantation.

Ion Man: The life and adventures of Bill Buckley, with Robert Tighe

The legacy of Lord Ernest Rutherford can be counted in solid economic terms, even if New Zealand is better known for its phobia of all things nuclear.

In his new biography reviewed here a couple of weeks ago, Matthew Wright states that, in the absence of any serious commemoration of Rutherford’s achievements, Sir Peter Beck’s Rocket Lab has stepped up.

Although the company is now based in the United States, it remains a big contributor to the local economy, with manufacturing and launch facilities. Significantly, its Electron rocket, designed for the small-satellite orbital market, is propelled by nine engines bearing Rutherford’s name, each producing 24 kilonewtons thrust at sea level.

A later and larger rocket, the Neutron, was named after the subatomic particle that Rutherford first predicted in 1920. Rocket Lab is now worth about US$32 billion ($56b), a more than six-fold increase over the past year.

Space Minister Judith Collins produced more figures at the recent aerospace conference in Christchurch: “An economic report released earlier this year shows space sector revenues increased 53% to $2.68b in the five years to 2024, and the advanced aviation sector – which overlaps with the space sector – had a total estimated revenue of $530 million in 2024. Our space and advanced aviation sectors are more than just rockets, drones, and satellites. They’re about advanced manufacturing, AI and autonomy, earth monitoring, and next-generation mobility.”

The Neutron Therapeutics BNCT machine.

However, Beck’s tribute to Rutherford is not the only one, I learned from Ion Man, an autobiography of Bill Buckley, founder of Buckley Systems. Among his many ventures, Buckley has invested in an alternative cancer treatment that uses neutron therapy instead of radiation or chemotherapy.

I imagine local medical authorities, who spend millions on cancer research and treatment, will be eager to know about Buckley’s involvement in a company called Neutron Therapeutics, founded in 2015 to develop a boron neutron capture therapy (BNCT) machine.

The connection is that Buckley Systems, founded in 1987, is a world-leading supplier of magnets used in particle accelerators, on which the semiconductor industry is built. BNCT is a non-invasive treatment that is faster and more effective than chemo and has fewer side effects.

Patients are injected with a tumour-seeking drug containing boron. They are then exposed to a laser beam of low-energy neutrons, which are absorbed by the boron. This causes a reaction that emits particles that destroy the tumour cells while leaving healthy tissue untouched. Only one treatment is required.

Buckley Systems makes about half of the 10,000 parts that go into the nuBeam proton accelerator, which fires the neutron beam. The background to Neutron Therapeutics is explained at length in Ion Man, and it reveals Buckley as a man of a vision resembling that of Rutherford.

Unlike Rutherford, Buckley never went to university, yet he shares many of Rutherford’s attributes. One of them was to see the potential in future technology, such as BNCT, when others did not.

David Greenwald, chief executive of a US company that develops boron-based drugs, is quoted as saying Buckley’s investment has been crucial to developing BNCT as a mainstream cancer treatment.

That is still some years away but only two countries, Finland and Japan, have embraced it. Buckley’s role has been to produce a machine that replaces an original at a hospital in Helsinki that required a full-sized nuclear reactor. The cost is prohibitive at $25m, and they take a year or two to manufacture, but this is an area to watch for future developments.

This is not the only surprise to emerge from Buckley’s colourful life and the fact-packed account as told to Robert Tighe, author of Tony Quinn’s biography, Zero to 60. The first-hand version is often elucidated, and sometimes contradicted, by Tighe’s interviews with people involved in the Buckley businesses, as well as his outside interests in motorcycle manufacturing, yachting – including the America’s Cup, and speedway promotion.

Robert Tighe.

Like Rutherford, Buckley also came from a rural background and showed little promise at school due to dyslexia. But he was good at maths and could work out problems in his head.

He did an apprenticeship as a fitter and turner, and his lathing abilities soon landed him jobs that brought him into contact with a company called ANAC, one of the first high-tech startups to emerge from the University of Auckland.

ANAC was formed by nuclear physicists and, in the 1970s, it supplied nuclear labs with ion-implantation machines. These bombard elements such as silicon with electrically charged atoms to create semiconductors. But a slump in nuclear research and volatility in demand for gadgets such as digital watches and calculators put the company into receivership.

Buckley had built up a business making magnets for ANAC and grabbed the opportunity to buy its assets in 1982. Using designs by Hilton Glavish, Buckley managed to corner a big chunk of the world market.

Its success was attributed to Buckley’s machining skills and his customer service, based on delivering the perfect product. His competitors were mainly electrical engineers, whose finished products were not as reliable.

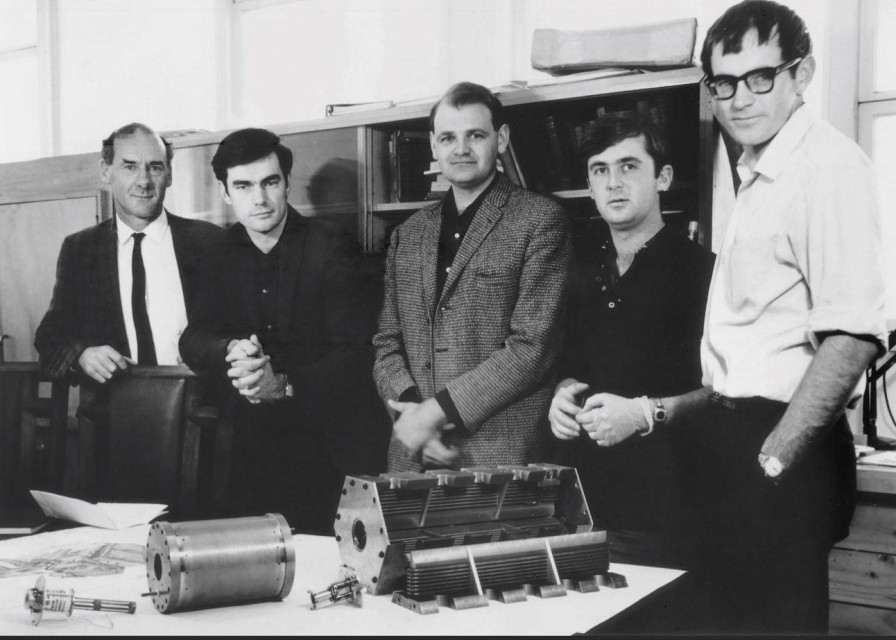

ANAC’s founders, with Hilton Glavish at centre. The others are (from left) Professor Edwin Collins, Ian Walker, John Ruffell and Barry MacKinnon.

In the 1990s, demand for semiconductors went off “off the charts”. An export award in 1996 was the first public recognition for a company that had remained under the radar. It moved to bigger premises and staff numbers rose to 80.

As the sole shareholder, and lacking an interest in becoming a public company, Buckley began to indulge in personal interests. Some proved costly and unsuccessful, such as the $6m spent on designing a grand prix motorcycle, the BSL 500. Five were built but the project failed for several reasons, from engineering lapses to racing rules that favoured the major Japanese manufacturers.

Bill Buckley’s BSL 500 could not match its Japanese rivals.

Buckley’s venture into maxi-yachts proved just as costly, although his mechanical skills contributed to Team New Zealand’s early America’s Cup victories. His own yacht, Maximus, did not deliver the hoped-for wins, although it did later under another owner.

Speedway racing at Western Springs was another of Buckley's passions, and he took over the promotional contract in 2002. But this, too, proved financially disastrous, given the constant opposition from the city council and some residents.

Buckley blames the failure of a world championship event in 2012 on council limits to crowd size and unrealistic noise level controls. After 19 years, Buckley estimates his speedway losses at $10m. “It’s been a nightmare and a bigger hassle than running my own business,” he says.

He has since turned his attention to the Baypark Speedway at Tauranga. After the book went to press, Auckland Council eventually forced speedway out of Western Springs.

Meanwhile, Buckley Systems had its own 'near-death' experiences. To cope with his racing activities, Buckley took his hands off the tiller by appointing a corporate-style chief executive in 2005. No doubt for defamation reasons, this person is not named. Buckley Systems soon reverted to business as usual under an owner-operator boss.

Bill Buckley does the welcome lap at the world championships at Western Springs in 2012.

The global financial crisis of 2008 brought orders to a standstill for a year, and the company faced an insolvency probe. Buckley accuses the bank of spending 18 months trying to close the business, which was saved when two major orders for synchrotrons came from American and Taiwanese buyers.

The bank refused to provide a letter of credit, so Buckley switched his business and got credit backing from Fletcher Challenge. The company in Taiwan, home of the world’s largest semiconductor industry, ordered 641 magnets. Then came an order from Toshiba in Japan.

Buckley Systems was back in business in a big way as a new market for semiconductors came from the invention of smartphones and smart TVs. Though no financials are provided, Buckley says the company has posted steady growth since the GFC to reach a staff peak of 600 and annual revenue in the tens of millions.

Flying the flag for New Zealand at the World Entrepreneur of the Year Award at Monte Carlo in 2012.

In 2011, Buckley was named New Zealand Entrepreneur of the Year, and other honours have followed. At 82, he is still running a business that provides parts for 90% of the world’s silicon chips and magnets, some as big as 60 tonnes, for touch screens and particle accelerators.

The clients comprise 40% semiconductor makers, 30% research facilities, and 30% medical. It has a handful of international competitors, but none has the same scale. The neutron therapy cancer treatment venture could be yet another game changer for a Kiwi whose legacy, like that of Rutherford, deserves to be told in book form.

Ion Man: The life and adventures of Bill Buckley, with Robert Tighe (Catch Phrase Media NZ).

Nevil Gibson is a former editor at large for NBR.

Sign up to get the latest stories and insights delivered to your inbox – free, every day.