The rise and fall of a corporate raider

Ron Brierley’s recollections are strictly business.

Ron Brierley’s recollections are strictly business.

Like the sea pirates of yore, corporate raiders have faded into the mists of time. Buying stakes in undervalued companies was once a profitable activity involving forced management changes, asset sales, or break‑ups.

The phenomenon was common between the 1970s and 1990s, producing sensational headlines in the business press. On Wall Street, it was linked to names such as Carl Icahn, T Boone Pickens, Saul Steinberg, and Victor Posner.

Aggressive strategies included hostile takeovers, greenmail, leveraged buyouts, and asset stripping. By the late 1980s and early 1990s, several developments sharply reduced traditional raiding.

Defensive measures such as poison pills, golden parachutes, and increased use of debt made hostile takeovers far more difficult. Regulatory and legislative responses led to tougher rules on protection of minority interests, insider trading, and takeover thresholds.

More recently, corporate raiding tactics have been associated with more benign terms such as private equity funds and “activist shareholders”, who use their stakes to influence board of directors and put public pressure on its management.

Private equity is reckoned to be more acceptable because it buys companies outright through negotiation and holds for several years while making operational improvements.

New Zealand’s role in corporate raiding was more pioneering than many might realise. This was due to historians being more interested in politics, the labour movement, and social change than financial developments and achievements in business.

Which brings us to Ronald A Brierley, who with publisher Henry Newrick has produced a modest book outlining the rise and fall of the country’s best-known corporate raider and one-time business knight.

Governor-General Sir Paul Reeves knighted Ron Brierley in 1988.

It is, of course, controversial that a man convicted of possessing child sex abuse material in 2021, after his retirement from high-profile business roles, should seek more public scrutiny.

The book does not mention Brierley's convictions.

So far, reaction has been negative toward the book’s existence, rather than its content. This column is not for those outraged at the publication, but anyone who might consider paying $50 to read it.

The History of Brierley Investments Ltd 1961-2021 delivers much of what it promises on the cover – “Not as boring as you think”.

No one with any knowledge of those seven decades in business would consider otherwise. Brierley was still in his teens when he got his first job – for which he “was not properly academically qualified”.

This is the first of many self-deprecatory observations that confirm Brierley’s ability to be under-estimated. He was employed as a secretary-accountant at a book-importing business that collapsed the following year.

Sir George Chapman was an investor and director of the company. He later played an influential role in the Muldoon governments of the 1970s and early 1980s as president of the National Party.

Sir George Chapman in 2019.

Brierley learnt receivership law the hard way when he had to tackle a top law firm (Bell Gully), a leading company director (Lyn Papps) and a future Chief Justice (Sir Richard Wild) to salvage his wages.

The company produced a racing tip sheet, which Brierley helped produce despite his lack of interest in horses. It inspired his own tip sheet, New Zealand Stocks & Shares, first published in November 1956.

Its role was to identify under- or over-valued shares, based on intensive study of accounts and annual reports. It eventually had 1600 subscribers, despite its lack of promotion.

The step up to a public company that could act and profit from such advice soon followed. The first R A Brierley Investments prospectus was registered on December 20, 1961, with three main principles: some companies were worth more 'dead' than alive; Australia and New Zealand were a single market; and money itself was an undervalued commodity.

A stock exchange listing was rejected – that didn't occur until 1970 – but the fledgling investment company was already pursuing its first raiding forays. Early targets were farmers’ co-ops, building societies and small finance companies, all of which sat on undervalued assets.

The next step, in 1965, was a larger public issue of shares, which succeeded despite some establishment pushback: the New Zealand Herald refused to publish advertising for the prospectus; the Attorney General (Ralph Hanan) lodged several charges of false pretences, all of which failed; and the Government tightened rules on soliciting funds from the public.

By then, Brierley was seldom out of the business pages, with takeover bids that included ailing picture theatres and even a billiard table business that was next to a school that wanted the property for expansion.

Forestry proved highly lucrative: “… it is incredible today to believe that they were just sitting there totally ignored by the investment community and waiting for me to come along,” Brierley says.

Deals in Australia through Industrial Equity (IEL) and the UK followed, with Brierley spying bargains such as a rubber company whose estates in Indonesia had been nationalised. Ownership was eventually restored and the operation sold at a profit to a larger company.

Dozens of such cases are quickly related, with Brierley in the early 1970s recruiting Peter V O’Brien (later an NBR columnist) as general manager and dealmakers such as Bruce Judge. Activity in Australia dominates this period in the book, which was produced there and where it is likely to find most of its readership.

IEL added a Hong Kong listing, Shanghai Dockyards, to its portfolio, turning it into Industrial Equity Pacific, which operated in the US. Among its investments was a ranch that covered more than a third of the island of Molokai in Hawaii. It proved to be worthless as development was impossible.

Molokai, an island in Hawaii, could not be developed.

A full chapter is devoted to what Brierley describes as “the most controversial takeover bid in New Zealand corporate history”. That's not an exaggeration, as the imbroglio involving Kempthorne Prosser, NZ Farmers Fertiliser and the creation of Ravensdown Fertiliser ran for nine months in 1977-78.

However, Brierley merely regurgitates the BIL annual report for his account rather than offer new insights. Long-established names such as Aulsebrooks and Bycroft (biscuits), Klipper (clothing), Northern Steam Ship, retailers Beaths and DIC, warehouse company Bing Harris and Gear Meat received the BIL treatment.

Brierley labels Gear Meat an “unmitigated disaster” as heavy losses and a strike forced its closure. This was partly offset by NZ Pulping Mills, where a swamp turned out to have two million tons of coal that a nearby dairy company quickly snapped up during the 1973 oil shock.

Many will be surprised that Brierley’s buccaneer reputation did not prevent him from “rubbing shoulders with the famous”, as one chapter is called. They include Queen Elizabeth II, who regularly visited the annual cricket match between the First Crusaders, an exclusive Melbourne club that had Brierley as a member, and the Royal Household at Windsor Castle.

Brierley, second from right, greets the Queen at a cricket match.

US President Ronald Reagan invited Brierley to meetings at the White House, as well as the opening of his Presidential Library in 1981 and 83rd birthday party in 1994. Deals were done with Rupert Murdoch, Kerry Packer, Robert Maxwell (who was a shareholder in BIL vehicle GPG), Robert Holmes à Court, and fellow Wellingtonian Sir Bob Jones.

Brierley notes he has outlived Jones, whom he admired for his business acumen, if not for being the butt of his practical jokes.

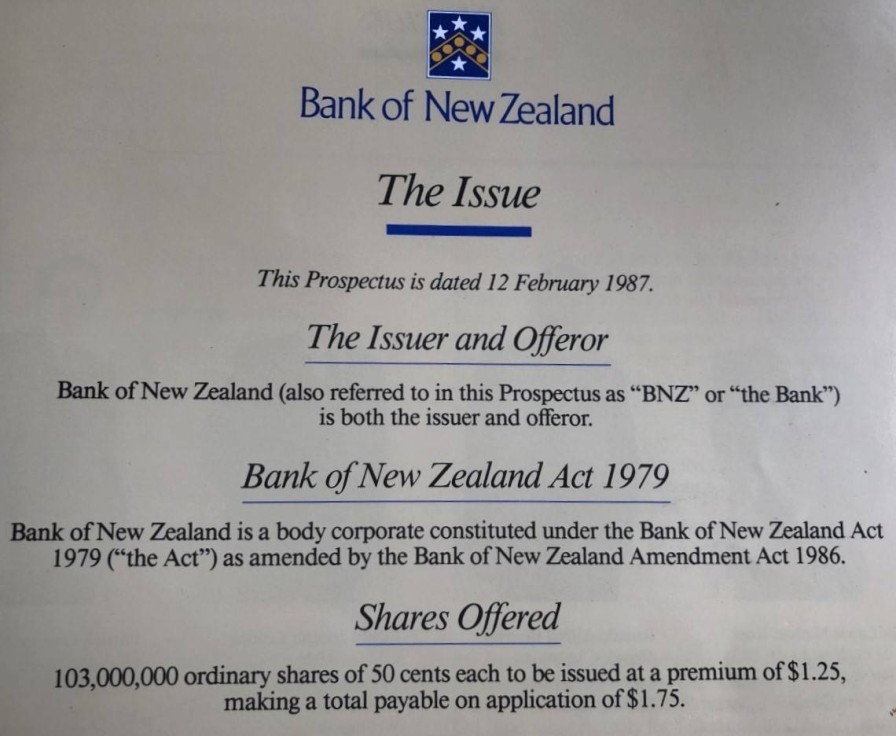

One episode that yields new information is Brierley’s account of his association with the Bank of New Zealand (BNZ), of which he was appointed a director by Finance Minister Roger Douglas after Labour’s election win in 1984.

BNZ was being prepared for privatisation in 1986, and Brierley was surprised to learn the board had little say in profligate lending policies that eventually led to its downfall in the recession that followed the 1987 sharemarket crash.

He reveals he made the decision not to give voting rights to shareholders taking up the 13% stake to be sold in a public float. Douglas got the blame for what Brierley says was an error of judgment made in haste while travelling to London.

Bank of New Zealand prospectus for public issue in 1987.

In the event, it didn’t matter, as the Government called off the sale of its shareholding, a lucky move for BIL, which was the successful bidder. As Brierley tells it, he didn’t agree with the BIL executives who made the bid, and he was later sacked as BNZ chairman at a time when he thought he had the most to offer.

The relationship with the BIL executives went further downhill with Brierley pushed to the sidelines on the ill-fated Air New Zealand privatisation and the purchase of Murdoch’s 50% Ansett stake.

As BIL’s decline continued after the 1987 crash, so did Brierley himself. “I was becoming tired at that stage and unwilling to resist the selling frenzy which gripped the company in its final years,” he says. He retired as chairman of BIL in 1989, becoming “founder president”, while still holding the reins at GPG.

GPG shareholders at the annual meeting at Ellerslie in 2011.

The sale of IEL to Adelaide Steamship in 1990 marked another end to BIL’s role as a raider, the same year that two of his successors, Paul Collins and Andrew Meehan, set up an office in Hong Kong to explore deals in Asia.

These, to reuse a phrase, produced more “unmitigated disasters” that eventually led to BIL being controlled by Malaysians and, in 1988, the board sacking Collins and Meehan as directors along with Bob Matthew and Rodney Price.

Defamation laws prevent me from repeating Brierley’s comments on his colleagues and company practices during this period of turmoil. He retired from the board of the “moribund” BIL on March 30, 2001, 40 years to the day he first formed the company.

While this linear account of BIL sticks to the basics, albeit with less detail in the latter years, it is bulked out by disparate items on many more companies, particularly Australian and British. A handful of Australian business journalists are praised for their prolific coverage but former NBR journalist Yvonne van Dongen’s biography (1990) is dismissed as “not very good” without explanation.

The text is followed by 40 pages of newspaper headline clippings from Brierley's private binder collection. They include an O’Brien column, who earlier produced his own version of NZ Stocks and Shares. The final clipping reports Brierley’s second 'retirement' due to ill health in 2019, aged 81.

That was the same year as his arrest at Sydney Airport after a tip-off about his possession of child abuse material on the eve of a trip to Fiji. He pleaded guilty to three charges – a total of 46,794 illegal images were found on his electronic devices – was stripped of his knighthood, and his name was erased from philanthropic gestures. He served a brief jail sentence.

Further charges were laid in March last year, but court action was stayed after evidence of dementia was presented. Newrick, the founder of NBR, was approached last year as a ‘last resort’ publisher of Brierley’s recollections, which are complemented by photographs, an index and a listing of all BIL Group personnel in 1990.

The History of Brierley Investments Ltd 1961-2021, by Ron Brierley (RAB Publishing).

Nevil Gibson is a former editor-at-large for NBR. He has contributed film and book reviews to various publications.

This is supplied content and not commissioned or paid for by NBR.

Sign up to get the latest stories and insights delivered to your inbox – free, every day.