Bookkeepers 2022: sizing up NZ’s $1.5b accounting industry

ANALYSIS: How much do NZ’s accounting firms make and how big are they?

ANALYSIS: How much do NZ’s accounting firms make and how big are they?

Accounting firms make money telling other people how to run their businesses.

Lots of money.

Globally, it’s an industry worth hundreds of billions of dollars every year.

In New Zealand, it’s no different.

The accounting firms seem to have a hand in everything, from bread-and-butter services such as audit and tax to, increasingly, consulting on all manner of projects with vague objectives such as ‘digital transformation’ and ESG.

They happily front as talking heads on almost anything, too.

But they rarely speak about themselves, or indeed, how their businesses are going. In fairness, nobody really asks.

So today, NBR is launching a new six-part series, Bookkeepers 2022, to open the books on nine of the country’s leading accounting firms.

That includes the most comprehensive set of financial data published about them for several years, as well as details about partner, staffing, and office numbers and how each has grown.

It reveals the collective annual turnover of New Zealand’s accounting industry could be close to $1.5 billion, a decimal point in an international context but potentially hundreds of millions of dollars more than just a few years ago.

It also shows these firms employ thousands of people across the country and that the battle for that talent is rapidly intensifying.

Today, we start with an overview of the size and shape of the industry and look at what’s been driving growth for the firms, as well as providing a spotlight on some of the smaller, but still significant, accountancy practices.

On Wednesday, we dive into the talent war, assessing how firms are attracting and retaining staff, capacity issues, and whether the allure of partnership is as strong as it used to be.

Finally, on Thursday, we’ll assess how these firms can maintain momentum, new areas of growth, and what major headwinds they’re facing.

“It’s certainly been an interesting time to take over,” says Deloitte chief executive Mike Horne, who assumed the role from long-running incumbent Thomas Pippos last June.

“But it’s been a supportive environment from a professional services perspective. There’s high market demand, our biggest constraint really is that access to talent.”

Look at the numbers

NBR sent surveys to 12 firms asking for an indication of revenue (by bracket), year-on-year growth, offices, and partner and staffing numbers. We received responses from nine (with Grant Thornton a notable exception among the larger firms) and spoke to the leadership at each.

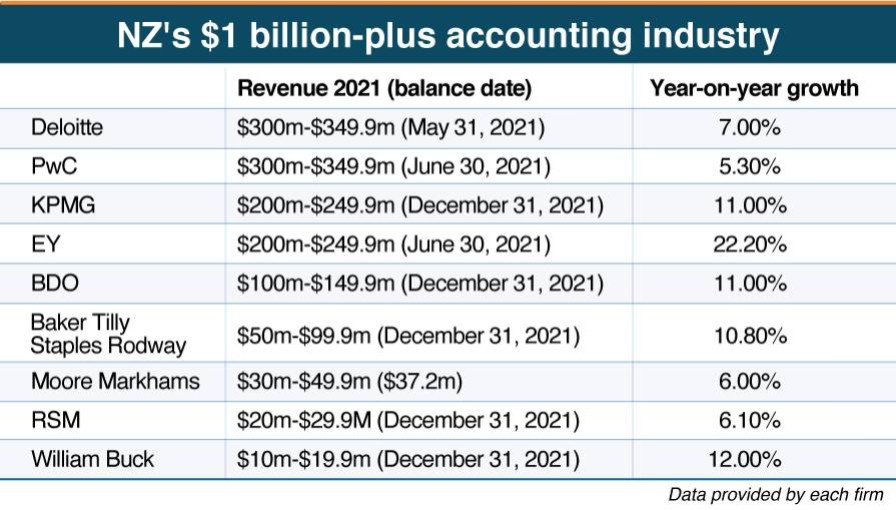

The firms are reluctant to provide specific revenue figures – they are private businesses and do not have to – but if each was at the higher end of the revenue bracket they claimed to be in, then these nine firms turn over a collective $1.55 billion a year (see table).

By comparison, an AFR survey of Australia’s 100 largest accounting firms, published late last year, said the firms there had grown by just over 4% to A$12.3b.

PwC was the largest by revenue at A$2.43b, followed by Deloitte at A$2.1b, and EY at just over A$2b.

Here, where industry data is much more opaque, each firm prefers a different metric when sizing themselves up against peers.

The local arms of the so-called Big Four accounting firms – PwC, Deloitte, KPMG, EY – clearly dominate but two other firms that are part of global networks – BDO and Baker Tilly Staples Rodway – are not far behind.

By revenue, Deloitte and PwC are clearly largest in the $300 million to $349.9m bracket, followed by the rest of the Big Four and KPMG and EY in the $200m-$249.9m range.

EY had the strongest year-on-year-growth at 22.2%, while BDO is pushing its case to move up from mid-tier status after growing 11% in the year ended December 31, 2021. It expects to record revenue north of $150m next year (see more in tomorrow’s Bookkeepers 2022: the battle for talent).

“Look at the numbers, they’ll speak for themselves,” BDO New Zealand national chair David O’Connor says. “We used to be called the second tier … Well, I think they’re now saying the top five [firms] and then the others, although we’re definitely the smallest of the top five.”

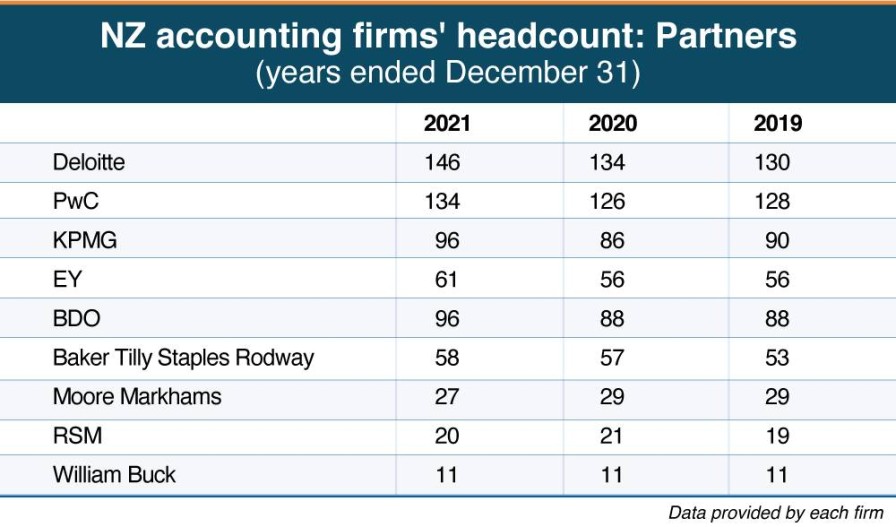

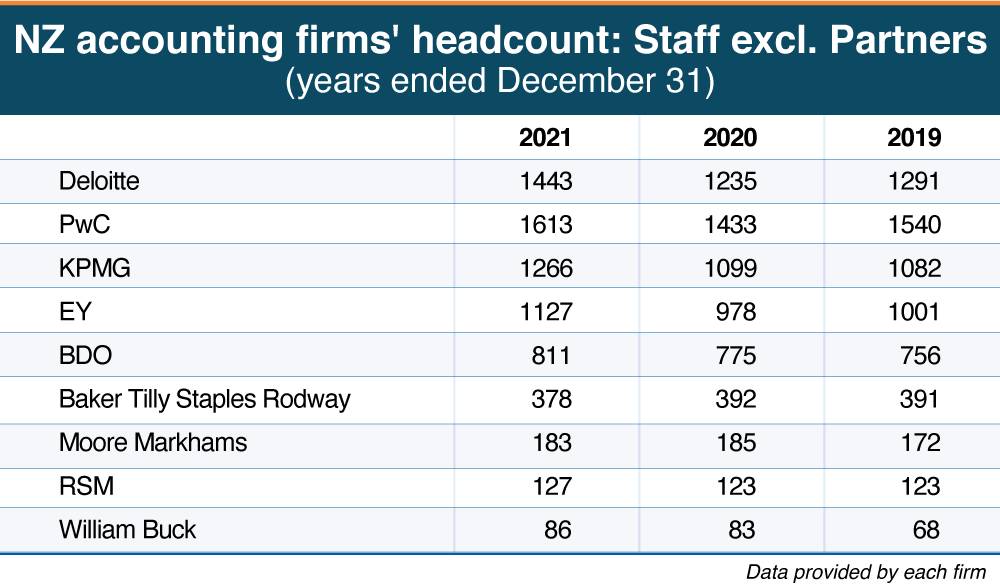

By headcount, for the year ended December 31, Deloitte boasts the most partners with 146. PwC was next with 134, although notes that on January 1 this year, it promoted a further 10; the firm also has the most staff, at 1613.

Overall, each of New Zealand’s firms have seen decent year-on-year revenue growth, while staffing levels have mostly grown too (albeit with a bit of a dip in 2020).

“We’ve had very strong growth over the last few years and have been investing strongly; I’d argue we probably invested ahead of the curve,” EY New Zealand managing partner Simon O’Connor says.

The firm just this month launched a dedicated, 100-person financial services-focused practice to help clients in that sector tackle a multitude of challenges, for instance. That included hiring former Resolution Life chief actuary and chief investment officer Greg Bird to start an actuarial practice.

“It is difficult to get people, but when you’re growing really strongly and doing exciting jobs, you find that people come to you.”

EY New Zealand managing partner Simon O'Connor.

Off the back of clients

It’s been well-traversed by now, but back in 2020 at the onset of Covid-19 in New Zealand, many firms were bracing and gearing up for an increase in restructuring work.

Instead, governments around the world poured money into economies and provided unprecedented support to businesses and activity boomed.

“We literally just swing off the back of our clients,” BDO’s O’Connor says. “Money going into an economy flows through pretty quickly. Clients, suddenly, were inundated with orders, debtors were paying and cashflow was there. That gave clients a lot of confidence.”

KPMG New Zealand chief executive Godfrey Boyce adds: “Last year was an interesting year because we started it with that uncertainty of ‘just what was going to happen coming out of 2020?’ It was a bit of a slow first couple of months.

“But, thereafter, it rolled through and that inherent activity in the economy, by virtue of the Government stimulus, low-interest rates, all of those things … created activity, and that really drove our year along. All of those factors probably played out across the industry.”

BDO chair David O'Connor.

Another benefit of that stimulus, as NBR covered in its Dealmakers 2021 series last year, was the booming transaction market it sparked.

These M&A deals create demand for professional services, particularly lawyers and investment banks, but accounting firms also touch and advise on various aspects of transactions.

PwC in New Zealand even has one of the most prominent deal shops in the market, targeting mid-market transactions valued between $20m and $400m and predominantly advising local private companies on their sale. It has been ranked the top M&A team in New Zealand by Thomson Reuters since 2005, based on the number of deals.

PwC New Zealand chief executive Mark Averill says the firm has differentiated itself from domestic competitors by building a larger deals team, which he was involved with the establishment of in 1998.

“We’ve always been a very strong mid-market M&A player, but I think what’s happened over the last few years is that we’ve continued with the mid-market deals, but also got involved in a number of the larger transactions as well,” Averill says. “That has been an important part of that growth strategy for the firm … That also has a flow-on impact in terms of other parts of our firm getting involved in some of those transactions as well, such as due diligence and tax.”

With most New Zealand firms part of international networks, they also benefit from referrals from sister firms overseas, which again provided a boon for many – particularly with the interest from foreign investors in New Zealand assets over the past 18 months or so.

Change agenda

The final areas accounting leaders mention are consultancy and advisory, the engine room of many of these firms. Deloitte’s Horne, for instance, attributes about three-quarters of the firm’s revenue to consulting and advisory practice (similar to Australia and global proportions), while KPMG’s Boyce puts it at about 40% for his firm.

Key components for consulting have been digital transformation and what is loosely described as the Government’s ‘change agenda’ or, more specifically, massive reforms in sectors such as health, transport, and housing.

The former is, again, a Covid-19 beneficiary. Corporates have talked for years about digital transformation – moving to the cloud, remote working capability, etc, – but were suddenly forced to take tangible steps when lockdowns and Covid restrictions stopped people going to the office. Cyber security has also been top of mind in the wake of some high-profile local attacks.

“Covid has provided, obviously, numerous challenges, but one aspect that it has really driven is that intense focus around businesses transforming how they operate, digital engagement, and upgrading their whole technology platforms,” Deloitte’s Horne says. “That’s been a huge driver of demand at our end.”

PwC’s Averill added: “Digital transformation was probably kicked down the road a little bit a few years ago. But the need to operate virtually, and the progression of technology, has seen many clients bring that into their agenda right now.”

Finally, while staffing shortages have been a major challenge for the accounting firms (see more in tomorrow’s Bookkeepers 2022: the battle for talent), the firms’ clients have also had the same issues.

“There’s a real shortage of people … One of the impacts, from a professional services firm perspective, has been that a lot of businesses have needed to backfill,” EY’s O’Connor says.

“So, not only have they been trying to acquire our staff, but then they’re still short anyway, and so they need a lot of help on some key projects.”

Mark Averill.

Clients leaving

But it hasn’t all been one-way traffic.

As mentioned, demand for restructuring and insolvency services has been down, particularly on predictions in early 2020. Expectations are building this could be set for a return and the long talked about ‘wall of insolvencies’ is about to arrive, however (see more in Thursday’s "Bookkeepers 2022: where to next?").

Another area that is also becoming increasingly strained is audit and assurance, as highlighted in NBR’s Is New Zealand running out of auditors? feature in late 2020.

Last December, following extensive lobbying led by Chartered Accountants Australia and New Zealand, the government announced border exceptions to allow up to 180 external auditors, along with their partners and children, into the country.

That came after the professional body had surveyed the country’s leading audit firms and found there were hundreds of specialist audit vacancies among them. The audit profession is historically reliant on overseas recruitment and the shortage created by closed borders was variously labelled “acute” and a “risk”.

Baker Tilly Staples Rodway even concedes it had a down year in 2020 – before growing nearly 11% in the year ended December 31 last year – as the initial level four lockdown restrictions coincided with the firm’s busiest audit season, locking clients at home and making the job unusually difficult.

"It happened for us at our worst time of year," Baker Tilly Staples Rodway NZ chair David Searle says. “But our client base has been pretty strong over the last year. We weren't overly exposed to the tourism sector, or the restaurant and entertainment sectors.”

KPMG’s Boyce says increased scrutiny of auditors and the importing of expectations and regulations from overseas jurisdictions, not all of which are fit for purpose in a New Zealand context, has seen the firm re-price some of its work.

“There's been quite a big push to be really clear on what we're doing and why we're doing it,” he says. “To be fair, the corporate governance in New Zealand, by and large, gets that and gets the challenge and the problem and is reasonably accepting of what that means in terms of the number of audit hours and that we can't just absorb all that time cost.”

“But in some cases, that's actually meant some clients leaving, because they're not comfortable with what we're saying is required.”

Godfrey Boyce.

Pivoting

There are challenges ahead, too.

The issues around audit and assurance are not going away anytime soon while many fear the red-hot transactional market cannot continue forever.

But by far and away, the biggest challenge of the last 12-18 months, highlighted in every interview, has been attracting and retaining talent.

Borders re-opening eases some of that tension, but it goes both ways: there is pent up demand from a generation whose OE has been delayed by two years and fears of another Brain Drain surfacing.

This presents an immense challenge for accounting firms, and indeed all professional services, as they are fundamentally people businesses. Talent is everything.

Tomorrow, we look at how firms have adjusted their attraction and retention policies in the face of such a tough labour market, covering everything from pay transparency, improved parental leave policies and even using the office kitchen to send cooked meals to staff at home.

“One of the things you take out of 2020 and 2021 is even relatively larger organisations – and I don't think we're really large, but we're relatively large – can actually move and change and, dare I say that horrible word, pivot, more easily than you thought you could previously,” KPMG’s Boyce says. “We've just got to back ourselves to go on that journey and if things get a bit tougher, we’ll respond.”