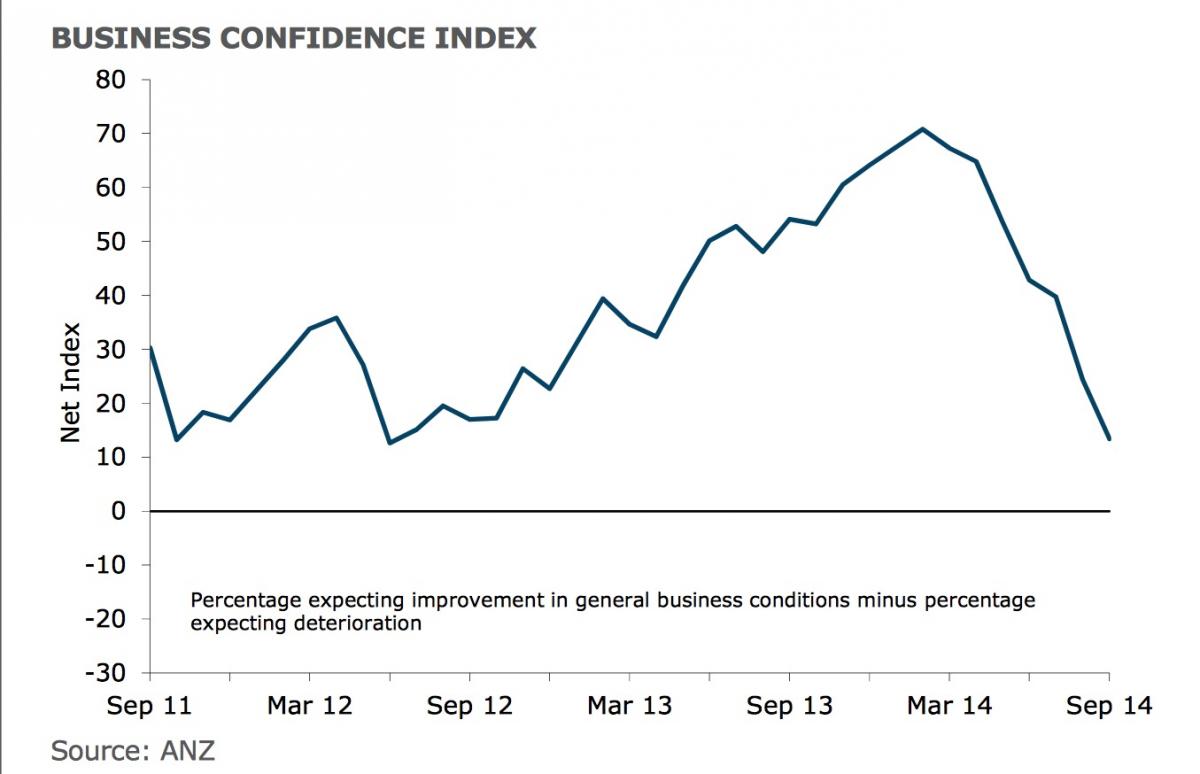

New Zealand business confidence declined for a seventh month in September, to the lowest level in more than two years, as election uncertainty added to concerns about slowing economic growth, according to ANZ Bank's latest Business Outlook survey.

A net 13.4 percent of respondents were optimistic business conditions would improve in the coming year, down from a net of 24.4 in August, and 58 points below the 20-year confidence high in February. Those picking their own activity to get better edged up to a net 37 percent, from 36.6 percent the previous month. (See graph below)

The survey was taken before the results of New Zealand's Sept. 20 general election were known, and ANZ expects next month's survey will reflect Prime Minister John Key and his National government returning for a third term.

"Businesses hate uncertainty," said Cameron Bagrie, ANZ's chief economist. "When survey responses were received the outcome was unknown. Businesses looked, sighed, and signaled a willingness to carry on as normal."

Since the start of the year, expectations for New Zealand's economic growth have slowed, withTreasury last month cutting its forecast for gross domestic product growth to 3.8 percent in the year ending March 31, 2015, from a previous estimate of 4 percent. A faster decline in terms of trade from the highest levels in 40 years, a sharp drop in international dairy and log prices, New Zealand largest and third-largest export commodities, and a slower pace of domestic inflation suggest economic momentum may be slowing.

"Decelerations in growth can be perceived as downturns," Bagrie said. "The cycle is now maturing from strong growth rates off lows to moderate growth off good levels."

Meanwhile, the agricultural sector is firmly in the red, with a net 32.4 percent expecting business conditions to deteriorate, compared with last month's 34.4 percent. The construction sector was the most positive in the month, with a net 26.1 percent expecting conditions to improve, while the service industry had a net 23 percent expecting improvement.

In line with a slower pace of growth, earlier this month Reserve Bank governor Graeme Wheeler paused in raising the official cash rate, in order to assess the impact of four hikes since March, which raised the benchmark interest rate 100 basis points to 3.5 percent.

Today's survey shows expectations for inflation decreased to 2.46 percent from 2.51 percent, while those expecting higher interest rates fell to a net 50.6 percent from 66.6 percent. Those expecting their exports to increase rose to a net 22.1 percent, from 19.5 percent.

A net 21.3 percent of businesses planned to hire more staff, up from 18 percent the previous month, while a net 20.3 percent expected to increase investment, rising from 16.8 percent. Of the firms surveyed, a net 19.2 percent expected to increase profits, down from 20.7 percent in August.

(ANZ)

(BusinessDesk)

Tue, 30 Sep 2014