The gift of giving effectively

‘Donor-advised giving’: fastest-growing form of charity internationally, Kiwi philanthropists are cottoning on.

‘Donor-advised giving’: fastest-growing form of charity internationally, Kiwi philanthropists are cottoning on.

Imagine you’ve won Lotto.

You’ve splashed the cash on a dream house and luxury car, you’ve set the family up, and now you’d like to make a bit of a difference in the world.

But where do you start?

It’s a question The Gift Trust is in the business of helping people answer.

While the Lotto scenario isn’t one it deals with every day, it does assist a significant group of well-heeled New Zealanders who want to share their success with those less fortunate.

These folk often aren’t experienced philanthropists, nor are they interested in setting up their own charitable foundations.

The Gift Trust connects them with charities that best meet their vision and aims, and does all the administration around their giving, executive director Cheryl Spain says.

“So, just like you might have a financial adviser for your financial investments, you can have a philanthropic adviser for your donations to charities,” she says.

This style of philanthropy is called ‘donor-advised giving’ or ‘donor-advised funds’ and, while it is relatively new in New Zealand, it is the fastest-growing form of charitable giving internationally.

The Gift Trust is also developing a corporate giving service; publicly listed fast-food operator Restaurant Brands, aerospace juggernaut Rocket Lab, and construction firm Rabo Construct are among the businesses it acts for so far.

Handling the admin

A donor-advised fund is set up as part of a registered charity. It is like a waiting room for charitable donations. Donors deposit money into a gift account and receive an immediate tax benefit, and then make decisions about how the funds are used over time.

This way they save on the costs and compliance of setting up their own charity.

The Gift Trust deals with all the charities receiving the donations, makes the payments, handles the tax receipting, and provides as little or as much reporting as the donor desires.

With a total of $10 million in its gift accounts, The Gift Trust isn’t anywhere near as large as some overseas donor-advised funds, but it offers a more bespoke service.

“We really help donors dive deep into what their passions are, what their charitable causes of interest are, and then we help them research and find out about those organisations,” Spain says.

“The ones I love doing are family sessions.

“One family, which is a good example, tells each of their adult children they have $10,000 a year to decide how to give, and they can spend it on their pet projects.

“So, they can all have different kinds of charitable donations going out from the same fund.”

If people are donating as much as $5m, it may be worth them setting up their own charity, but the trust’s ‘sweet spot’ is helping those who are well off but not quite at that level, Spain says.

Tax-efficient climate change action

Six months ago, tech entrepreneur Jamie Heather gave up his “very nice” income as chief executive of an Auckland software company to concentrate on a new challenge: finding solutions for the climate crisis.

He and a business partner are the founders of Carbon Critical and the Net-Zero Fund, a mechanism enabling New Zealanders to donate to international climate change efforts and get the local tax rebate.

“It started as an evenings and weekends project, but I just wondered if there was more that I could be doing and more initiatives that could be launched in New Zealand to try and combat climate change,” he says.

He had wanted to contribute to climate change action but found many of the charities were registered in the US.

Seeking a more tax-efficient way of giving, he researched setting up a New Zealand-based charity. That was when he came across The Gift Trust.

“They offered this all-in-one convenient package, where they take care of all the compliance issues and they are a registered charity already.

“It just made it incredibly simple to get going, and with a very low upfront commitment, actually.”

The Gift Trust administers the Net-Zero Fund and Carbon Critical pays the 2% administration fee, guaranteeing that 100% of every dollar donated goes to climate charities.

The fund has raised $150,000 so far and has attracted donors such as local group Lawyers for Climate Action, which has moved its donation portal over to use the Net-Zero service.

Heather would like to see mechanisms such as The Gift Trust more widely used.

“New Zealand does have an unusually high number of small charities, and a lot of them probably aren’t very cost-effective to run; I’d assume they do lose quite a lot of their donations through supporting admin and lawyers and accountants and so on,” he says.

Corporate focus on youth

Business giving is a smaller but growing part of The Gift Trust’s work.

It helps firms consider things such as their values as an organisation, and whether their employees will be engaged in the effort, Spain says.

“You could just go out there and pick the big-name charities, that’s easy, but do they align with your corporate brand? Do they have the impact you want them to have?”

Restaurant Brands, operator of fast-food chains including KFC and Pizza Hut, has held an account with The Gift Trust for the past three years.

It had been looking at setting up its own charitable foundation and was impressed when the trust was referred to it, chief brand and marketing officer, Geraldine Oldham, says.

Its aim was to support youth-oriented organisations with an educational focus and a good geographical spread.

“They gave us expert advice, they researched a whole lot of options for us based on the criteria we gave them,” she says.

“We feel really confident the charities we’re working with are the right ones.”

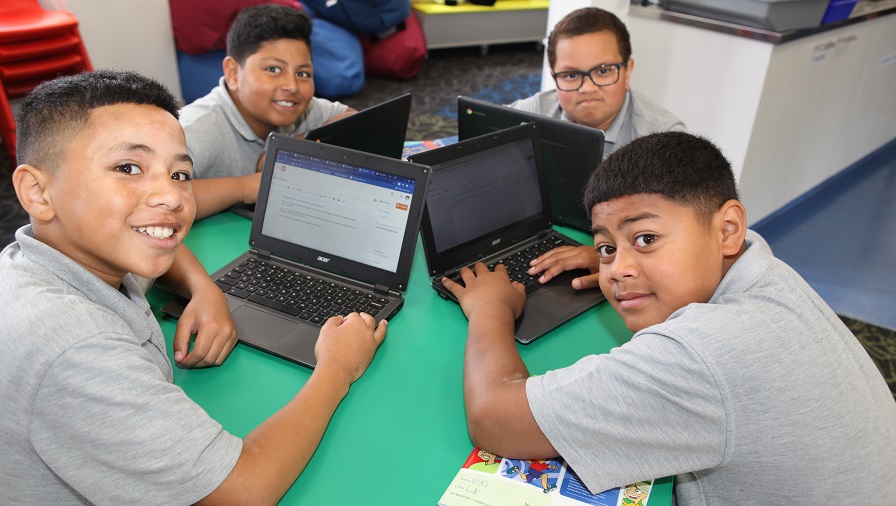

The company now donates to Birthright, a provider of social services for single parents, and Manaiakalani, which supplies devices and digital learning to underprivileged families.

It is also supporting four students through tertiary study via the First Foundation.

Criticism overseas

Donor-advised funds have not been without their critics. One gripe is that the giver gets a tax break in the year they put money into their gift account, not when it’s distributed to the charity, and the funds can languish there for some time.

This is more of an issue overseas, where funds can be dealing with billions of dollars, Spain says.

In the last financial year, The Gift Trust donated out $1.6m, and the prior year $500,000.

It has both ‘pass-through’ funding and funds that build up and most money is donated within 10 years.

Some philanthropists like a fund to build up for future generations, which is a valid thing to do, she says.

Another issue has been that when funds arrive from a donor-advised vehicle, the charity doesn’t always know who made the donation.

This has particularly been an issue in the US where right-wing extremists have used the model as a means of obscuring their identities.

The Gift Trust has kept a close eye on these controversies and has put in place policies to deal with them, Spain says.

It reserves the right to do its due diligence and, if an entity is unsuitable, can decline to pass on funds.

The bar to becoming a registered charity is much higher in New Zealand anyway, so concerning organisations don’t tend to get through, she says.

Most effective way to give

The Gift Trust has grown steadily, from handling about $4m in donations in 2018 to its current $10m, and it is now investing more in marketing its services.

Development and engagement lead Yvonne Trask, who has recently joined from Philanthropy New Zealand, says traditionally people were quite reactive in their giving.

“I’d sometimes talk to individuals and say: ‘How do you give? Where do you give?’ And they’d say: ‘I give to what I see on television.’

“What we’re seeing is a lot of them stepping up, saying: ‘Actually, what is out there? Is this the most effective way for me to give?’

“A massive global not-for-profit that has a huge amount of money invested, they probably don’t need your few thousands of dollars, but there are some organisations that that would change everything for.”

* This article was first published in December 2021 as part of NBR's summer coverage