Food ingredients exceed target for Scales Corporation

The division exceeds long-term ebitda $25m target by $10.1m.

The division exceeds long-term ebitda $25m target by $10.1m.

The food ingredients business continues to skyrocket for New Zealand agribusiness group Scales Corporation, lifted by the growing pet food market.

Prices spiked for food ingredients as more people added furry family members to their households during Covid-19.

The NZX-listed (SCL) business has diversified from its agricultural roots and expanded from horticulture into food ingredients and logistics. It has operations in New Zealand, Australia and the United States.

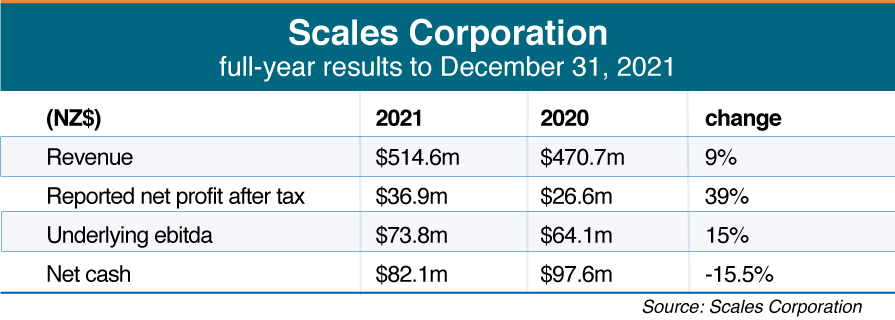

In its full-year results ending December 31, 2021, this morning, Scales chair Tim Goodacre said its diversified agribusiness strategy had underpinned record revenue of $514.6 million, up 9% of the previous year. It also achieved record net profit after tax of $36.9m, a 39% uplift on the previous period.

Underlying net profit after tax for the group also exceeded its own expectations; in December, the company predicted it would sit between $32m and $37m but delivered $39.8m today.

Managing director Andy Borland said: “We like to be realistic about what business can do and we’re always really pleased when that is overachieved.”

During the year the company declared dividends of 19c per share and, as in previous years, said the board hoped to declare a final dividend in respect of the 2021 financial year in May, with payment in July.

Food Ingredients

Food ingredients exceeded the company’s long term ebitda target of $25m by $10.1m and the division reporting an underlying ebitda of $35.1m from 23.1m in the previous year.

“The Food Ingredients division has recorded another outstanding result, partly aided by the growing demand for pet food together with its geographical and protein diversity,” Goodacre said.

This growth is underpinned by a rise of pet ownership during the pandemic, and an increased focus on pet health and wellbeing. Volumes of pet food ingredients sold 29% more than the previous financial year.

Scales expected this to normalise in 2022 and it didn’t expect the same numbers for the next financial year as the lockdowns and pandemic behaviour such as stockpiling eased internationally.

It continues to invest in the division, with growth and expansion to its manufacturing facilities in Dodge City, Kansas, US. The American plant was built during Covid and Scales has plans to add an additional six cold plate freezers and an additional bone processor to increase beef yield.

Divisional CEO John Sainsbury is expected to relocate to Kansas at the end of March to oversee and progress growth opportunities for both its pet food ingredient divisions, Shelby (in the US)and Meateor NZ.

Borland said it had no current acquisition plans for the region, but the company was in discussions with a few parties in both the US and Europe.

As of the end of December 2023, Scales will no longer have an exclusive relationship with its Australian supplier responsible for around 20% of volume. The company said it was hard to assess the situation right now but it would continue to talk to the supplier. Borland said the company was not looking for another exclusive relationship in the country.

Horticulture

The horticulture division of Scales delivered an underlying ebitda of $39.1m from $40.8m year-on-year. The division was affected by weather, orchard redevelopment, and the global supply chain.

Mr Apple picked, packed, and exported about 3.7 million TCEs and, according to Scales, on average there are 116 apples in a TCE. Volume was down this year with a hailstorm affecting the Nelson harvest.

Scales is in the process of redeveloping orchards into higher-value varieties and has seen a 6% increase in these premium varieties. The company is pushing for higher prices for these varieties.

“We experienced continued growth in the Asia and Middle East markets despite disruptions caused by Covid-19. In-market pricing was also strong, with pricing above the prior year for most varieties,” Borland said.

Mr Apple also began the multi-year packhouse automation project, that aims to reduce handling between picker and consumer. Currently there are 80 people to a shift and Scales hopes it can reduce this down to about 30 through automation. The company expects it to increase productivity and sustain margins.

Labour was in short supply as a consequence of Covid, with many migrant workers unable to get into the country. Borland said while all the RSC workers are not in the country yet, he believes the company will have enough labour for the picking season.

Scales is not planning on chartering ships for apple exports this year and is relying on its own network of shipping companies. However, it may participate in other charter programmes and would be interested in working with other exporters that do decide to charter.

Logistics

The logistics division delivered an underlying ebitda increase of 17% of $4.9m up from $4.2m in 2020 but volume decreased due to lower agricultural exports and Covid.

“The strategic value of Scales Logistics was once again apparent, with the business successfully navigating a challenging and complex international supply network on behalf of its customers. Financially, it generated a strong full-year result despite being impacted by global logistics pressures and increased costs,” Borland said.

Issues with the global supply chain are expected to continue, but logistics will continue to support its in-house customers such as Mr Apple and Meateor and Borland said having logistics inhouse had been a huge benefit.

Borland is aware there may be future pandemic-related disruptions, but Scales was trying to prepare for them. “There are some challenges there for sure, but what we know today, we’re planning to execute it and achieve better results,” he said.