Your most popular NBR stories of 2025

ANALYSIS: The co-editors look back on the year that was, including Du Val, patsy directors, Eric Watson and Egyptian billionaires.

ANALYSIS: The co-editors look back on the year that was, including Du Val, patsy directors, Eric Watson and Egyptian billionaires.

© All content copyright NBR. Do not reproduce, even if you have a paid subscription.

BBQs, the beach, backyard cricket, Friday night news dumps, and the annual NBR most popular stories of the year – that’s right, we’ve hit the time where New Zealand’s Christmas traditions are finally in full swing.

As with the past four years, this is basically the time where your co-editors have largely run out of steam and so resort to the journalistic treasure that is a listicle for our final Last Word column of 2025.

These are the stories that were the most-read by you, our member subscribers. We’re proudly 100% subscriber funded, with no advertising, sponsorship, or government funding, and so this is also a massive thank you once again for all your support throughout the year.

It’s easily the strongest and most diverse set of stories yet (that’s why we’ve also included some Honourable Mentions at the bottom, of those just outside the top 10).

We’re stoked to have once again delivered award-winning journalism, ranging from scoops and investigations to yearly staples such as our flagship NBR Rich List. We’ve also continued to bring you several week-long, in-depth NBR Focus series providing commentary on influential industries, advisers, and issues affecting New Zealand business – adding The Lawyers to our stable this year – and Simon Shepherd and our production team have been busy bringing you weekly episodes of The NBR Podcast all year long. Our video production and storytelling has been first-class this year, too.

We’ll mostly all be knocking off for a break from next Friday and hope you all enjoy a restful summer break.

On Monday, we’ll also publish our annual Shoeshine Awards, where we’ll poke a bit more fun at some of the year’s biggest stories. In the meantime, here are this year’s most popular NBR stories (in reverse order).

Few NBR subscribers will be surprised to see a story about failed property developer Du Val in our top 10 for 2025. After being put into statutory management more than a year ago, much of the coverage has focused on legal skirmishes between PwC and Du Val’s co-founders Kenyon and Charlotte Clarke, with the former still trying to get info out of the pair while the latter claim they are being gagged and that the statutory management represents gross over-reach by the Government. In the meantime, our senior reporter Brent Melville got a copy of the most recent set of financial statements related to the Du Val Mortgage Fund, which showed it had funneled $50.3 million into six of the failed apartment developer's planned Auckland projects. A month or so later, PwC’s John Fisk said investors who put $54m into Du Val’s Mortgage and Opportunity funds were unlikely to see any return on their investment. Whatever will 2026 bring in this high-profile saga?

This Shoeshine column by senior reporter Nicholas Pointon was so good it won him an award. The column looks into the practice of appointing patsy, or ‘nominee’, directors to a company – or, more plainly, paying a random person who agrees to sully their good name to shield somebody else from unwanted attention when their company fails. It’s entirely legal, but the column questioned whether it was entirely wise. It also features some incredibly frank commentary from Gilligan Rowe & Associates managing partner Matthew Gilligan about the practice. “You’re trying to save your client's life – financial life, anyway – and it’s very tough. They’ve had a successful life, and suddenly they’ve got serious problems and they’re trying to survive. It’s a tough role, and I make no apologies for fighting hard for my clients. If you’re ever in trouble, you’ll remember me.”

Illustration: Michael Hickmott.

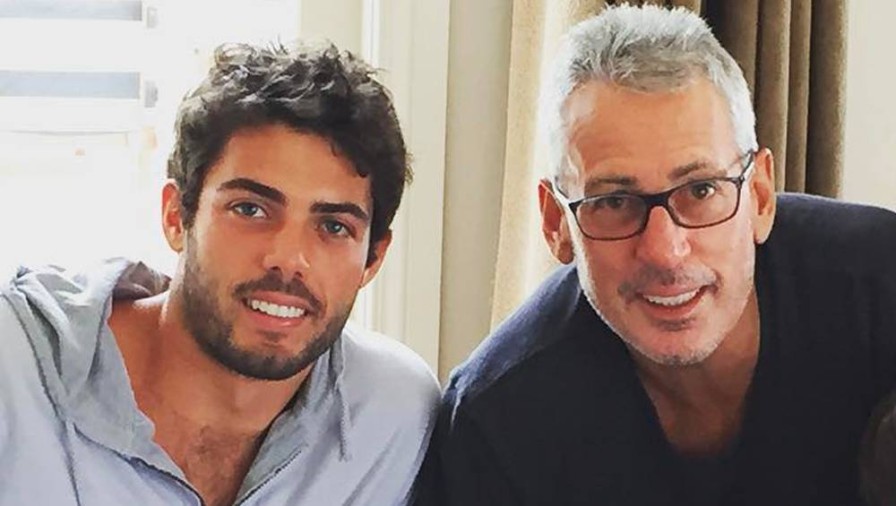

A classic Tim Hunter story that has it all: disgraced businessman Eric Watson and his son Sam; Watson’s long-time associates Tim Connell, William Gibson and Miles Leahy; a Cayman Islands company; a UK company controlled by the multi-billionaire Sawiris family through matriarch Yousriya Nassif Loza-Sawiris and her grandson Onsi Naguib Onsi Sawiris; and a US$100m fraud claim. It is understood the case is set down for a 10-week trial in 2026 and the claim was filed in January 2023, “alleging fraudulent misrepresentation, breach of contract, breach of fiduciary duty and unlawful means conspiracy in relation to an investment in a group of companies purportedly engaged in the establishment of a foreign exchange business”. Read the story and sit tight for the 2026 update.

Sam and Eric Watson.

The New Zealand Business Hall of Fame has been around since 1994 and was established to honour individuals who have made a significant and lasting impact on economic and social development. One of this year’s inductees was experienced company director Dame Joan Withers, who last year was also appointed a Dame Companion of the New Zealand Order of Merit for services to business, governance, and women. NBR got the opportunity to speak with a few of this year’s inductees, and Withers didn’t hold back on one issue in particular – climate-related disclosure reporting requirements. These requirements had been widely criticised and we understand the interview made its way around many of the country’s top boardrooms, with the Government a few months later changing the thresholds to capture far fewer companies in the legislation. We would encourage other directors and senior business leaders to more regularly speak their mind in 2026 (especially to NBR 😉).

Dame Joan Withers.

The Sacred Hill winery group was placed into receivership way back in May 2021 owing creditors nearly $100m, including $52.4m to appointing creditor Westpac. But – as increasingly seems to be the way whenever a matter gets tied up with the courts and/or regulatory bodies these days – only more than four years later are we starting to get an understanding of what went down. This story, which came a few months after another very popular story relating to this saga – PwC partner was ‘severely reprimanded’ for Sacred Hill audits – detailed the reasons why the Deputy Registrar of Companies Peter Barker banned the former boss of the group, Richard Foddy, from being a professional director for nine years. In a nutshell: Foddy approached his role with “arrogant self-entitlement”; did not separate his personal interests from his professional duties; and personally benefited from the mismanagement of the companies. Woof.

This story was not only one of our most popular, but led to the second-most new NBR subscriptions of any piece of content we put out this year. It’s got all the ingredients of a popular NBR story: a high-profile financial advisory firm; wealthy clients; and struggling real estate investments. Although the firm at the centre of the story, Alvarium, does not report on its investments publicly, documents obtained by NBR revealed it had warned investors in recent months of problems at projects in New Zealand and Europe. It was understood clients had not taken this well. Enough said.

An office development in Paris, dubbed Project Debussy, part-financed by Alvarium investors.

Similar to Sacred Hill, this was another long-running story we were unable to report the substance of for several years, as a Rich Lister fought for years to keep his identity suppressed. In this instance, former Pushpay director and Rich Lister Peter Huljich had sought suppression orders to keep his identity secret since the Financial Markets Authority brought the case in February 2022. In May this year, however, he outed himself as the person convicted of insider trading at the formerly listed church payments and management software company, a week after he lost an appeal against his conviction. Huljich had been convicted of insider trading after a four-week trial in mid-2023 and sentenced to six months of community detention plus a fine of $100,000. As the Appeal Court dismissed his appeal against conviction, it also increased his fine to $200,000. The case related to events in June 2018 when Eliot Crowther, co-founder of the online payments software company Pushpay, announced the sale of his 9% stake for $100m – we covered much of the specific detail here. Your NBR co-editors have taken some solace in the fact that, even though we could only identify Huljich more than three years after the case was first brought, subscribers were still sufficiently interested in the case – as well they should be.

Peter Huljich.

We’re starting to sense a theme here … We must warn that the details in this story are some of the most horrific ever published in NBR’s pages but, once again, we’ve found ourselves in a position where a member of a wealthy family was able to obtain name suppression when most others in the same situation were not. Simon Shepherd, who broke this story exclusively on NBR, addressed that issue in this week’s NBR Podcast, which also gets into how name suppression in this case led to two NBR Rich Listers – Wayne Wright Jr and Mat Mowbray – being wrongfully accused as being the person at the centre of these heinous crimes. Customs has correctly opted to appeal the name suppression ruling from the District Court – coverage of which we will bring you next week. We won’t let this one get away.

It’s easy to say with hindsight that Adrian Orr’s tenure as Reserve Bank of New Zealand governor was always going to end in tears but after a relatively quiet start to the year news-wise, Orr’s sudden resignation from the role one March afternoon came from nowhere. As is always the way, we now know, with the passage of time, that there was much more to his resignation than was first communicated, and RBNZ chair Neil Quigley in August quit with immediate effect following ongoing criticism of the bank’s handling of information relating to the exit of Orr. It was exceptionally messy and new governor Anna Breman – who has come from Sweden’s central bank and has promised greater transparency as a priority – faces a long road to build back credibility and respect for one of the country’s most important institutions.

Illustration: Michael Hickmott.

Which brings us to this year’s most popular story … The NBR Rich List’s 2025 newcomers. Every year, several people feature on the NBR Rich List for the first time and this year we profiled a dozen newcomers – the most for many years – collectively worth close to $4.3 billion. That included the likes of the Morrison family, Anna Mowbray, the O’Sullivan family, Jamie Beaton, and the Carr family. This year’s NBR Rich List also saw the introduction of our first Women’s List, and next year is the 40th anniversary of our marquee project, which celebrates the country’s leading wealth creators. Expect bigger and better things from the Rich List in 2026.

Graeme Hart takes legal action against Auckland anaesthetist

US President Donald Trump imposes global 10% tariff

MinterEllisonRuddWatts won’t comment on why partner exits

Luxury retail giant to walk away from its Australia/NZ stores

Kāinga Ora boss: no more ‘magic money tree’

Sign up to get the latest stories and insights delivered to your inbox – free, every day.