Partnership with OpenAI sets AMD’s share price soaring

However, caution grows around the potential risks of pumped-up tech stocks.

ChatGPT’s parent company, OpenAI, has signed a multi-year agreement with chip manufacturer, AMD.

However, caution grows around the potential risks of pumped-up tech stocks.

ChatGPT’s parent company, OpenAI, has signed a multi-year agreement with chip manufacturer, AMD.

A high-profile handshake in the tech sector was followed by concerns about a potential AI bubble, with financial institutions such as the Bank of England joining the chorus of those concerned.

A standout event for markets this week was the multi-billion-dollar chip deal between OpenAI and US electronic chipmaker Advanced Micro Devices (AMD).

In that deal, OpenAI agreed to buy six gigawatts-worth of chips over the next few years, and will also have the opportunity to buy up to 160 million shares in the company, which could equate to 10% of AMD.

AMD said it expected the deal to be worth tens of billions of dollars in revenue. OpenAI, the ChatGPT creator, is valued at about US$500 billion ($869b).

Shares in AMD surged more than 30% following the news, adding US$80b to its market capitalisation, which sits at about US$380b.

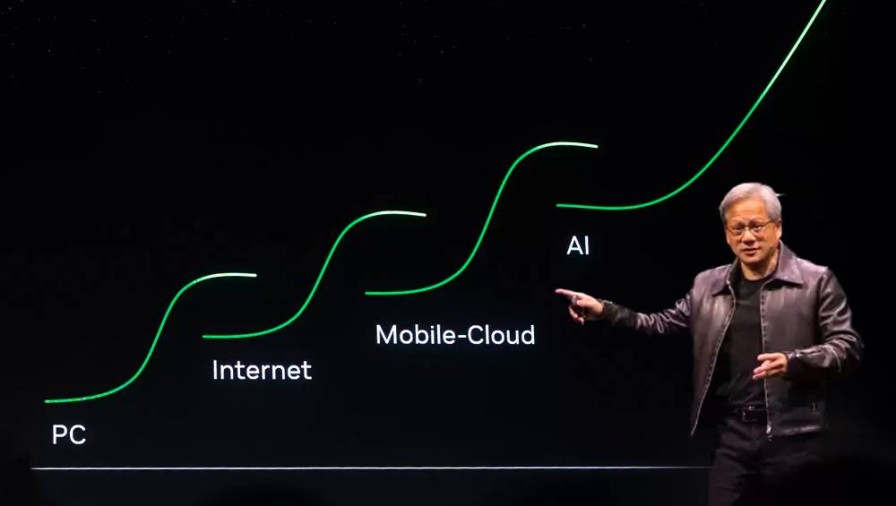

News of the partnership surprised even those in the industry, with Nvidia's chief executive Jensen Huang describing AMD’s move as imaginative, unique, and surprising.

“I’m surprised that they would give away 10% of the company before they even built it [referring to a new series of chips being produced]. And so, anyhow, it’s clever, I guess,” he said.

Nvidia CEO Jensen Huang.

However, AI’s continued rise has spurred fears of an ‘AI investment bubble’.

Officials at the Bank of England on Wednesday flagged the growing risk that tech stock prices pumped up by the AI boom could burst, and warned of the risk of a “sharp market correction”.

While the central bank didn’t name names, meeting minutes recorded concerns about “a number of measures, equity market valuations appear stretched, particularly for technology companies focused on artificial intelligence.

“The market share of the top five members of the S&P 500, at close to 30%, was higher than at any point in the past 50 years.”

The International Monetary Fund has raised similar concerns, with its managing director, Kristalina Georgieva, saying global stock prices have been surging, fired up by “optimism about the productivity-enhancing potential of AI".

However, she warned financial conditions could “turn abruptly”.

This week, Oracle’s share price slipped 3% after analysis from business and technology publication The Information raised questions about Oracle’s plans to buy billions of Nvidia chips to rent as a cloud provider to clients such as OpenAI.

The report said Oracle may run into profitability challenges because of how expensive Nvidia chips are and aggressive pricing on its AI chip rentals.

Amova’s Michael Sherrock.

At home, this week was marked by the Reserve Bank’s decision to cut interest rates by 50 basis points to 2.5%.

Amova head of New Zealand equities Michael Sherrock said there was some guesswork regarding whether the central bank would opt for a 25 basis point cut or go for 50 basis points.

Sherrock said the market was pretty well split on the question, so the larger cut was a pleasant surprise. Markets have now priced in another 25 basis point cut for November, and potentially further reductions next year.

Retirement village stocks Ryman Healthcare and Summerset both reported quarterly earnings this week.

Ryman said it was performing ahead of its full-year guidance for unit sales after a quarterly lift in unit sales. Meanwhile, converting more care beds to occupation right agreements (ORAs) helped Summerset report another quarter of record sales.

Sherrock pointed out Summerset’s mix was different in this update due to the decision to include ORAs, which could distort the results, but said there was nothing bad in either of the results, “nothing bad is generally good news”.

Sign up to get the latest stories and insights delivered to your inbox – free, every day.