BoE warns of ‘sharp market correction’; gold tops US$4000

And Cristiano Ronaldo has become football’s first billionaire player, Bloomberg says.

And Cristiano Ronaldo has become football’s first billionaire player, Bloomberg says.

Mōrena and welcome to your wrap of the main business and political headlines from around the world that you need to know this Thursday.

First up, Bloomberg reports that the Bank of England has warned that stretched valuations for artificial intelligence companies and challenges to the independence of the US Federal Reserve are fueling the risk of a "sharp market correction".

The warning came in the UK central bank's quarterly financial stability update, which said equity market valuations appeared "stretched", with technology companies "focused on AI" particularly vulnerable if "expectations around the impact of AI become less optimistic".

The BoE also cautioned of "persistent material uncertainty around the macroeconomic outlook", according to minutes of the Financial Policy Committee's October 2 meeting, adding that "bottlenecks to AI progress" – such as power, data, or commodity supply chains – could impact valuations.

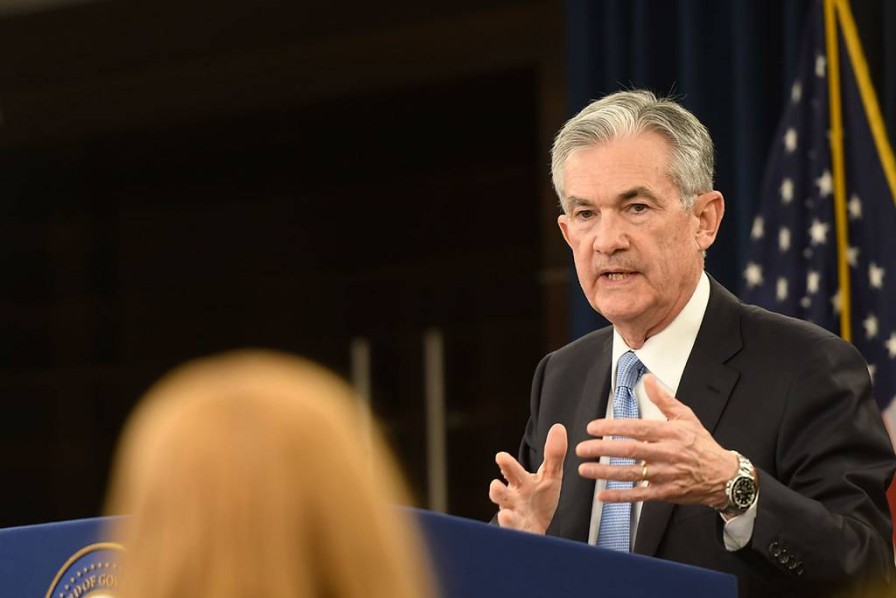

Meanwhile, ongoing criticism of Fed chair Jerome Powell's views and US President Donald Trump's attempt to change the central bank's board was seen as another threat to the financial system.

"A sudden or significant change in perceptions of Federal Reserve credibility could result in a sharp repricing of dollar assets, including US sovereign debt markets, with the potential for increased volatility, risk premia and global spillovers."

US Federal Reserve chair Jerome Powell.

At the same time, International Monetary Fund managing director Kristalina Georgieva has told an audience at the Milken Institute in Washington to "buckle up" because "uncertainty is the new normal and it is here to stay," the Guardian reported.

She said the global economy had shown surprising resilience in the face of Trump's trade war so far but pointed to growing signs of strain, including exceptionally high valuations for US stocks and gold hitting a record high above US$4,000 an ounce.

“Before anyone heaves a big sigh of relief, please hear this: global resilience has not yet been fully tested. And there are worrying signs the test may come,” she said.

The IMF forecast global GDP growth of 3% this year in its last update in July, which would be down on the 3.3% recorded in 2024. It publishes its next projections next week.

IMF managing director Kristalina Georgieva.

Returning to gold, and the continued rally in its price is seen to have been fueled by concerns over the US economy and the government shutdown, which has entered its eighth day.

Gold has now jumped more than 50% this year as investors seek protection from potential market shocks, Bloomberg reported.

"Gold breaking $4,000 isn't just about fear – it's about reallocation," Saxo Capital Markets strategist Charu Chanana told the publication. "With economic data on pause and rate cuts on the horizon, real yields are easing, while AI-heavy equities look stretched. Central banks built the base for this rally, but retail and ETFs are now driving the next leg."

Shares in AI company Nvidia, meanwhile, rose more than 1% after chief executive Jensen Huang said demand had risen in recent months.

He told CNBC that "this year, particularly the last six months, demand of computing has gone up substantially".

The S&P 500 was up 0.6%, the Nasdaq Composite was up 0.8%, and the Dow Jones Industrial Average climbed 0.4%. Overall, the tech-heavy Nasdaq 100 Index is up 18% this year.

In other news, former FBI director James Comey has pleaded not guilty to charges of making false statements to Congress and obstruction of justice in his first appearance at a US federal court.

Comey was indicted last month days after President Trump urged Attorney General Pam Bondi to take action, leading to accusations by Democrats and legal experts that Trump was using the Department of Justice to seek retribution against his enemies. Trump had fired Comey during his first presidential term.

Cristiano Ronaldo.

Finally today, and with all the talk of inflated valuations, and 40-year-old Portuguese footballer Cristiano Ronaldo has become the world's first billionaire football player, according to the Bloomberg Billionaires Index.

The valuation comes after he signed a new two-year deal with Saudi Arabian club Al-Nassr, reportedly worth more than US$400 million ($691m). Ronaldo is believed to have become the highest-paid player in football history when he first joined the Saudi Pro League in 2022, on a reported annual salary of £177m.

Bloomberg assesses Ronaldo's net worth at US$1.4 billion, taking into account career earnings, investments and endorsements.

Ronaldo's long-time rival, Argentina's Lionel Messi, is estimated by Bloomberg to have earned more than US$600m in pre-tax salary during his career. He currently plays at US club Inter Miami, where he is set to take an ownership stake on retirement.

Sign up to get the latest stories and insights delivered to your inbox – free, every day.