© All content copyright NBR. Do not reproduce, even if you have a paid subscription.

Monday November 24

Santana shares in trading halt

Santana at Bendigo.

Gold mine developer Santana Minerals has sought a trading halt in its shares pending an announcement about its fast track application for the Bendigo-Ophir project.

The halt application was made late on Friday and announced to the NZX on Monday morning.

Santana gave no further information on the nature of the fast track announcement but asked for the halt to be in place until the start of trading on Tuesday at the latest.

Santana is seeking fast track consent for its proposed gold mine in near Tarras in Central Otago. Its application was submitted on November 3.

The project proposes mainly open pit mining on land to be acquired from Ardgour and Bendigo Stations. According to company presentations the Rise and Shine prospect has an indicated resource of 1.5 million ounces and a probable reserve of 1.2 million ounces.

A2 Milk makes progress on Pōkeno plant approvals

Infant formula marketer A2 Milk has made unexpectedly fast progress on regulatory approvals for its newly acquired processing plant at Pōkeno.

In a statement to the NZX, the company said the plant’s two existing infant formula product registrations had been approved for transition to A2 Milk brands by the Ministry for Primary Industries and the General Administration of China Customs.

The final regulatory step is approval by China’s State Administration for Market Regulation. A2 Milk said it would apply for approval in December and expected the process to take about six months.

A2 Milk said although the MPI and GACC approvals were received earlier than expected, “at this stage there is no change to the company’s timeline regarding potential launch timing of the new products which is expected to be late in 1H27”.

A2 Milk completed its $282 million acquisition of the Pōkeno plant from Yashili in September.

Ryman extends debt facilities

Naomi James.

Ryman Healthcare has extended the maturity of $2 billion worth of its debt facilities.

The dual-listed retirement village operator this morning announced the refinancing, which increased the average term to expiry to 4.8 years from 1.2 years.

The change sees the bulk of the company’s debt mature in FY31, when $1.3b is due to both its New Zealand and Australian banking syndicates.

Its total loan facilities remain relatively unchanged at $2.05b.

Chief executive Naomi James said the new facility better aligns the company’s funding structure with its operating model, creating increased headroom and resilience.

“This refinancing represents the completion of Ryman’s balance sheet reset.”

An interest coverage ratio covenant of 1.5x – which was waived following the company’s capital raise earlier this year – will commence in September 2026.

The ratio excludes interest on designated development debt.

Ryman will report its half-year results on Thursday.

Santana trading halt lifted

Damian Spring.

Gold mine developer Santana Minerals has advised that the Environmental Protection Authority has formally accepted its fast-track consent application for the Bendigo-Ophir project.

A trading halt on Santana shares, put in place on Monday morning, was lifted after the announcement.

The company said the EPA had confirmed its application met lodgement requirements under the Fast-track Approvals Act.

Chief executive Damian Spring said the announcement was a procedural milestone for the project.

“We look forward to constructive engagement with the EPA, and other agencies as the assessment progresses,” he said.

Santana is seeking to develop a mainly open pit gold mine at Bendigo Station in Central Otago.

Tuesday November 25

Fonterra cuts milk price forecast

Dairy co-op Fonterra has reduced its milk price forecast for the 2025/26 season by 50c a kg of milk solids, saying increasing supplies have put downward pressure on market prices.

On Tuesday, the co-op said its forecast price range would be $9 to $10 a kg, down from $9 to $11 in September, reducing the mid-point to $9.50.

Chief executive Miles Hurrell said there had been seven consecutive price drops at GlobalDairyTrade commodity auctions.

“As a result, we have narrowed the forecast farmgate milk price range for the season and adjusted our midpoint,” he said.

“Fonterra started the season with a wide forecast range of $8.00 to $11.00 per kgMS. The new midpoint of $9.50 per kgMS is in the middle of this range and remains a strong forecast for the season.”

Fonterra also increased its forecast for milk collections to 1545 million kgs of milk solids, from 1525 million forecast in September. The new figure represents a 2% increase on the 2024/25 season.

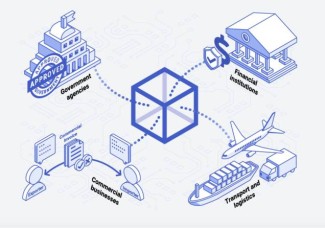

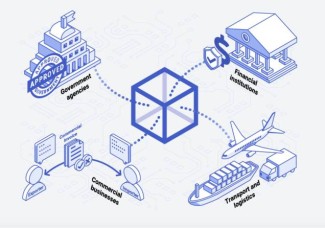

Trade Window receives firm commitments in $5.8m raise

Trade Window Holdings has completed a conditional institutional placement, receiving firm commitments for approximately A$5 million ($5.8m) before costs.

Trade Window Holdings has completed a conditional institutional placement, receiving firm commitments for approximately A$5 million ($5.8m) before costs.

The placement will result in the issuance of approximately 22.9 million new fully paid ordinary shares at an issue price of A$0.22 (or $0.25) each. The company said the placement received strong support from both existing shareholders and a number of new Australian institutional and sophisticated investors.

The issue and allotment of shares in the placement is conditional on shareholder approval at a special meeting to be held in mid-December 2025, as well as ASX approval of Trade Window’s application for a foreign exempt listing on that exchange, and the company’s eventual listing there.

The company said the conditions were expected to be met by the middle of December 2025.

Trade Window’s NZX-listed shares have been in a trading halt to facilitate the placement, which will cease at the market’s opening today.

Wednesday November 26

Channel Infrastructure buys stake in Melbourne jet fuel pipeline

Fuel terminal operator Channel Infrastructure has acquired a 25% stake in a Melbourne jet fuel pipeline for A$14.2 million.

The 34km Somerton pipeline serves Melbourne Airport and is operated by ExxonMobil.

Channel Infrastructure bought the stake from private equity firm CVC’s infrastructure fund CIF I. The other shareholders are ExxonMobil, Viva Energy and BP.

Chief executive Rob Buchanan said the deal offered a unique and exciting opportunity to invest into critical infrastructure.

“Channel is a long-term investor in critical infrastructure and as part of considering this investment, we have also identified a number of adjacent growth opportunities which have the potential to materially enhance the value of our existing investment and provide new capital deployment opportunities, while adding to the resilience of jet fuel supply to Melbourne Airport.”

Christchurch Council to be consenting authority for supermarkets

The Christchurch City Council has been chosen to act as the one-stop consenting authority for large-scale supermarket developments. Finance Minister Nicola Willis said the change meant new supermarket developers looking to build in multiple locations only had to deal with one authority. Previously, they had to deal with up to 66 different councils and 66 different processes. “Christchurch is a leader in commercial builds, and the council has well-established working relationships with other councils that will be used to ensure smooth processes on the ground,” Willis said. She said a single consenting authority would make it easier and faster for new supermarkets to enter the market and build at scale.

Hospo company Savor reports lower interim results

NZX-listed Savor Group has reported revenue down 6% to $24 million for the six months through to the end of September. Earnings before interest, tax, depreciation, amortisation, and restructuring costs were down 3% to $1.9m year on year. Meanwhile, the group's net loss after tax was flat at $1.1m. Savor said challenging market conditions had persisted, but the company remained "resolute" in its determination to protect margins. Trading through the winter months "varied", but momentum built through spring. "The resilience of the group through the year to date provides a good base to maximise returns through the significant summer trading period," directors said. Savor had also agreed to new arrangements with key suppliers, resulting in $1m of cash payments that would be received before the end of this year.

New civil aviation rules and drone policy seek to cut red tape

The Government will allow the designation of 'regulatory sandboxes' for aerospace purposes where "technology can be tested freely and safely", according to Space Minister Judith Collins. Changes to the current rules around drone use have also been introduced, meaning they can be used for low-risk work like surveying and mapping without certification. The rules should also provide clarity and certainty for technical and higher-risk activities like agricultural spraying and top dressing, Associate Transport Minister James Meager said. “These changes cut through red tape, reduce paperwork and make it much clearer when drones and other aviation technologies can be used and when they can’t," he said. Collins said the sandbox rule would directly benefit Tāwhaki National Aerospace Centre, near Christchurch, which was granted permanent Special Use Airspace earlier this year alongside $5.85 million in operational funding. The rules come into effect on December 22.

Stride signs $17.5m deal at Auckland’s North Wharf

Listed real estate investor Stride Property has signed a development agreement with Auckland Council for a 125-year pre-paid ground lease worth $17.5 million at North Wharf, Wynyard Quarter. The agreement, conditional on resource consent, will extend to redevelopment of the hospitality precinct into a 10,500-12,500sqm mixed-use retail and office development. The site, which currently spans 3672sqm across three buildings, houses tenants including Good George, Gelatiamo, Joy Chic Bar, Seafood Paradise and Wynyard Pavilion. The developer said it would also preserve the heritage Red Shed, as part of the development. It has enlisted Ngāti Whātua Ōrākei as its cultural lead for the development. The council's Urban Development Office said it was delighted to bring Stride on board as its preferred development partner. Stride, which manages $3.3 billion in assets, reported after-tax profit of $42.6m for the half year to September, up 30.9% on the comparable period.

Government extols virtues of increased trade

The Government says it is reducing non-tariff barriers affecting about $600 million worth of New Zealand exports. These barriers include complex labelling rules, certification costs and quotas. Economic Growth Minister Nicola Willis said market access, predictable trade rules and investment certainty were all crucial to business confidence and a growing economy. Trade Minister Todd McClay said annual exports had exceeded $100 billion for the first time, with food and fibre exports contributing $60b. Driven by strong growth into the European Union and United Kingdom – free trade agreements negotiated and signed by the previous Labour-led Government – total export value had increased more than 10% to $21.7b in the three months to the end of June, compared with the same period last year. “New Zealand is a trading nation and when our exporters do well, New Zealand does well,” McClay said.

Friday November 28

IkeGPS reaffirms full-year guidance on robust sales pipeline

Utilities-based software company IkeGPS believes it will still hit its target of earnings before interest, tax, depreciation, and amortisation (ebitda) being “break-even on a run rate basis" for the 2026 financial year.

That's after the company reported 6% revenue growth for the six months ended September 2025, to $12.9 million. The company's gross margin percentage increased to 75% from 67%, with its net loss of $4.3m a 39% improvement on its first-half performance last year.

The company completed an A$24m capital raise during the period and has total cash of $34m with no debt.

"2Q26 was another strong quarter for Ike across multiple dimensions – operational performance, product innovation, balance sheet strength, and team capability," IkeGPS chief executive Glenn Milnes said. "The business continues to execute on our strategic plan, and we remain confident in delivering FY26 guidance."

TradeWindow narrows net loss

NZX-listed TradeWindow Holdings is on track to achieve a foreign exempt listing on the ASX by December 19 and has reaffirmed revenue guidance for the 2026 financial year.

The trade software company said today its revenue for the six months ended September 30 was up 25% to $4.6 million. Average revenue per customer was up 20% to $2484 a month for shippers and $1097 a month for freight forwarders, with the company narrowing its net loss after tax to $1.3m from $2.4m.

The company said it was on track to list on the ASX by December 19 and its performance was in line with its full-year revenue guidance. Previous guidance predicted ebitda breakeven in 2026, however, in early November this was pushed back to 2027 as it looked to develop its Freight AI to meet growing demand.

“The first half of FY26 has been a period of strong execution for TradeWindow," chief executive AJ Smith said.

Green Cross Health reports topline growth

Green Cross Health reported a lift in earnings for the six months through to the end of September.

Operating revenue for the NZX-listed heathcare provider behind Unichem, Life Pharmacy, and The Doctors increased 2% to $264.4 million, from $259.9m.

Meanwhile net profit after tax increased 27% to $7.2m, and earnings before interest and tax was up 9% to $17.5m.

Revenue for the medical division grew 6% to $82.7m, while revenue for the pharmacy division was flat on $181.7m.

Green Cross chief executive Rachael Newfield said the company had met the requirements to become a primary health organisation contracted by Health New Zealand from July next year. Investment in technology, targeted refurbishments, and cost management will be a priority in both division will be a priority in the second half of the financial year.

The board declared an interim dividend of 3 cents per share.

Trade Window Holdings has completed a conditional institutional placement, receiving firm commitments for approximately A$5 million ($5.8m) before costs.

Trade Window Holdings has completed a conditional institutional placement, receiving firm commitments for approximately A$5 million ($5.8m) before costs.

Utilities-based software company IkeGPS believes it will still hit its target of earnings before interest, tax, depreciation, and amortisation (ebitda) being “break-even on a run rate basis" for the 2026 financial year.

Utilities-based software company IkeGPS believes it will still hit its target of earnings before interest, tax, depreciation, and amortisation (ebitda) being “break-even on a run rate basis" for the 2026 financial year. Green Cross Health reported a lift in earnings for the six months through to the end of September.

Green Cross Health reported a lift in earnings for the six months through to the end of September.