Quick Takes of the Week to October 10

In case you missed it: News bites for the week.

In case you missed it: News bites for the week.

Peter Fredricson.

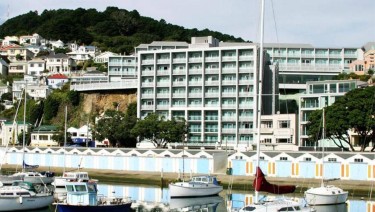

Copthorne Oriental Bay.

Singapore’s Prime Minister Lawrence Wong will visit Auckland this week as the two countries celebrate 60 years of diplomatic relations. Prime Minister Christopher Luxon said Singapore was one of New Zealand’s closest and trusted partners. It was the country’s fourth-largest trading partner, with two-way trade of $11 billion last year. “Together we’re working to shape global trade rules, strengthen supply chains, and harness technology to create jobs and lift incomes for our peoples,” Luxon said. Wong arrives on Thursday and leaves on Sunday.

The High Court has approved a fine of $5.06 million for Christchurch Casino to settle a civil complaint brought by the Department of Internal Affairs over its anti-money laundering failures.

The High Court has approved a fine of $5.06 million for Christchurch Casino to settle a civil complaint brought by the Department of Internal Affairs over its anti-money laundering failures.

The settlement is higher than the $4.16m payment SkyCity agreed last year to settle similar allegations. The court said although Christchurch Casino’s conduct was less serious, it had taken place over a longer period.

The allegations covered 2018 to 2023 and involved high-risk transactions where the casino had failed to meet the law’s anti-money laundering requirements. For example, in a sample of 24 customers, there were $56.2m of transactions that should have been subject to enhanced due diligence but were not.

The casino admitted breaching its obligations under the Anti-Money Laundering and Countering Financing of Terrorism Act.

Investment company Infratil has provided an updated valuation of its 49.7% stake in datacentre developer CDC, reporting an increase of A$32 million.

In a statement to the NZX, Infratil said a new independent valuer had estimated CDC’s overall value at A$12.8b to A$14.5b, as of September 30. The update represented an increase in the value of Infratil’s holding to A$6.78b from A$6.75b in June.

Infratil said the main causes of the change were minor operational and business plan updates as well as adjustments in the valuation approach.

Infratil said it expected to invest a further A$250m in CDC in the next six months to support its growth.

Scott Scoullar.

Converting more care beds to occupation right agreements (ORAs) has helped Summerset report another quarter of record sales.

The dual-listed retirement village operator sold 420 ORAs in the three months ended September, comprising 244 new sales and 176 resales. It compares with total sales of 289 in the same quarter a year ago.

The company has been converting its care beds to ORAs in an attempt to improve their profitability. Just less than 30% of all third-quarter sales were care ORAs.

“New and current residents have warmly welcomed this offering as an alternative to paying daily premium charges,” Summerset chief executive Scott Scoullar said.

He said the company’s diverse portfolio had been a strength for the business, with more than half of all sales coming from outside the three main cities.

Summerset reiterated it remained on track to build between 650 and 730 homes in the year ending December.

It is beginning work on its fourth village in Victoria, Australia later this month.

Black Pearl Group has successfully completed a $15.1m capital raising after issuance of approximately $1.5m of new shares, which are due to be allotted on Thursday. The NZX-listed software company said the capital raising was oversubscribed, with participation from "leading Australian institutional investors". The raise proceeds have enabled the settlement of the company's acquisition of B2B Rocket, as well as "continued progress towards an ASX listing", and further investment across its data and AI product suite to support expansion in the US market.

Its earlier retail entitlement offer raised gross proceeds of approximately $3.4m, while a placement and institutional accelerated non-renounceable entitlement offer raised approximately $10.3m.

Clive Jimmieson.

Two directors of lender Senior Trust Capital, under investigation by the Financial Markets Authority, have resigned.

On Monday company filings disclosed founding director John Jackson and lawyer Andrew Francievic had ceased as directors, leaving Clive Jimmieson as sole director.

In May Senior Trust Capital closed its offer to investors and financial statements filed in July said it was beginning a wind-up of the company. The move followed the FMA opening an investigation into Senior Trust Capital in December 2024.

The FMA said in July it was investigating whether the company’s disclosures and advertising material complied with the Financial Markets Conduct Act.

As of March this year Senior Trust Capital had raised $65.4m from investors.

A deed change with the Crown means New Zealand Post will only be required to deliver mail two days a week in urban areas, down from three, and three days a week in rural areas, down from five.

It can also cut up to 380 post offices, or ‘service points’, although it cannot close any more rural retail locations for another year.

Communications, Infrastructure, and Trade general manager James Hartley said NZ Post’s new minimum service obligations reflected how New Zealanders use the postal service and, without these changes, the cost of maintaining current services would not be financially sustainable.

“New Zealanders are sending fewer letters than ever before. The average delivery point now receives less than two letters per week, compared to 7.5 in 2013. Despite being used less, NZ Post has been required to maintain a network designed for much higher volumes."

The deed only covers mail delivery, with parcel/courier delivery not governed by it.

Naomi James.

Sign up to get the latest stories and insights delivered to your inbox – free, every day.