New Zealand retail spending on credit and debit cards rose at its fastest pace in seven months in May, with gains across all six retail industries measured.

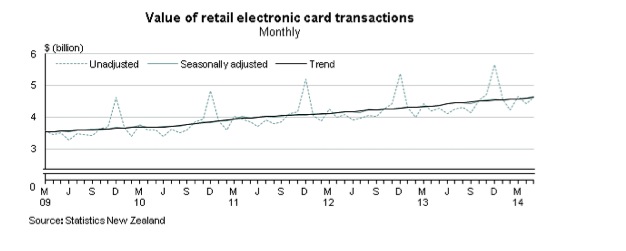

The value of retail spending on electronic cards rose a seasonally adjusted 1.3 percent in May from a 0.4 percent pace in April and no change in March, Statistics New Zealand said. That was the fastest pace since a 1.8 percent increase in October. (See graph below)

Spending appears to have picked up, having dropped off earlier in the year as consumer sentiment was hurt by a slowdown in the housing market and higher credit costs after mortgage lending restrictions introduced by the Reserve Bank in October started to bite and as the central bank began a cycle of interest rate hikes in March. Electronic card transactions account for about two-thirds of all retail spending.

"The solid increase in retail spending in May reflected continued high levels of consumer confidence, which helped to support spending in discretionary areas such as hospitality. Meanwhile, population growth is driving increased spending on necessities such as groceries," ASB Bank economist Christina Leung said in a note. "We expect continued positive developments, such as an ongoing recovery in the labour market, will encourage further growth in consumer spending over the remainder of 2014."

Reserve Bank governor Graeme Wheeler is tomorrow expected to hike the benchmark interest rate for a third time this year and signal further increases are on their way as he attempts to slow inflation.

"With a stronger household sector underpinning continued growth in the New Zealand economy, we expect the RBNZ will continue to tighten monetary policy over 2014 and 2015," said ASB's Leung.

Today's figures showed core retailing, which excludes spending on fuel and auto-related items, gained 1 percent in May, following increases of 0.2 percent the previous two months.

The value of total electronic card purchases, including services, rebounded 1.7 percent to $6.1 billion in May, following declines of 0.2 percent the previous two months.

(BusinessDesk)

Wed, 11 Jul 2018