Annual trade deficit widens the most in nine years

Dairy exports surged in July but oil prices boosted imports even higher.

Dairy exports surged in July but oil prices boosted imports even higher.

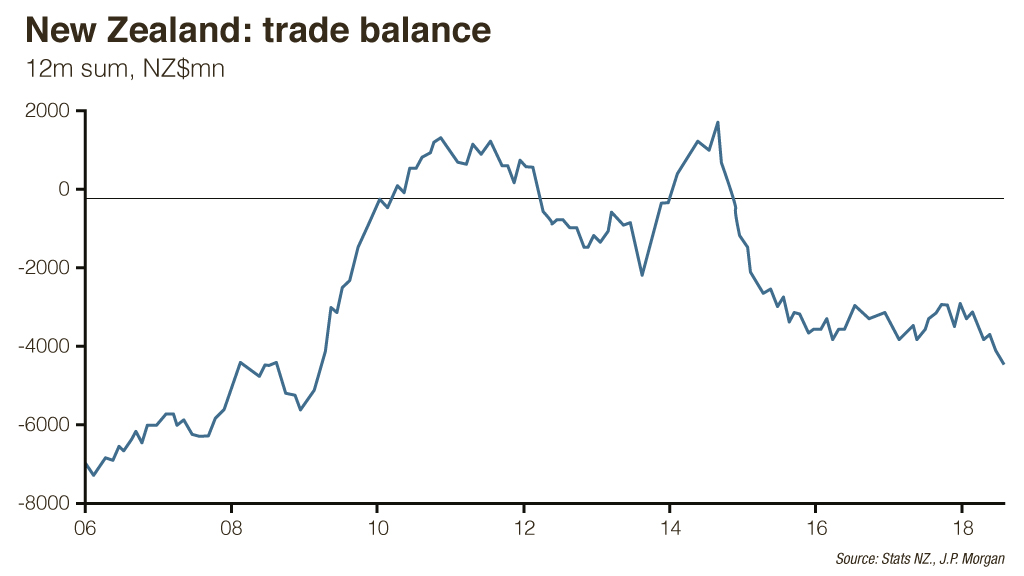

A $6.9 billion jump in the cost of imports to $60.7b in the year to July – a rise of 13% – has pushed the annual trade deficit to widest in nine years, Statistics NZ says.

Nearly a third of the increase was due to higher crude prices as total imports of petroleum and products rose $1.5b to $6.5b.

The value of exports rose 11%, or $5.7b, to $56.2b, leaving an annual deficit of $4.4b,

This is worth 7.9% of exports and is the widest annual deficit since March 2009.

“The rise in imports in the past year reflect large rises in both imports of petroleum and products, and in mechanical machinery and equipment,” Statistics NZ’s international statistics manager Tehseen Islam says. Dairy and meat products led the exports rise.

Deficit in July

The monthly figures for July show a deficit of $143 million compared with a surplus of $92m a year earlier. This was better than expected and was partly offset by a downward revision for June, Westpac economist Michael Gordon says.

Exports rose $729m, or 16%, to $5.3b compared with July 2017. Dairy products rose 21%, or $269m, to $1.5b compared with a year earlier, the highest value for all months since December 2017. Milk powder (up $136m) and milk fats including butter (up $116m) were the main contributors.

The rise in milk powder exports was price-driven. In contrast, the rise in milk fats including butter was quantity driven. Forestry products, and meat and edible offal were the other main export contributors.

Mr Gordon says the strength of exports in July may have been a matter of timing, with a greater-than-usual number of shipments during the month.

“There was also a strong lift in dairy export prices for the month but recent dairy auctions indicate that this will soon reverse.”

Oil prices jump

Imports surged 21% to $964m to $5.5b, the second-highest monthly import bill after November 2017.

“Crude prices are much higher than they were at the same time last year,” Mr Islam says. “These price increases have driven an increase in values, as quantities are much the same.”

Oil prices on international markets have eased slightly in recent weeks but remain at high levels. Brent crude is trading just under $US75 a barrel after going as high as $US78 in June and July. The New Zealand dollar has since fallen against the US dollar, wiping out the benefits of lower prices since then.

A $107m increase in mechanical machinery and equipment including computers also contributed to the imports rise in July.

JP Morgan economist Ben Jarman says while the July export performance has not been as weak as expected, the trend shows a continuing drop in the terms of trade.

“This highlights the consistent underperformance of agricultural export groups in the context of higher oil prices (agriculture usually demonstrating a decent correlation with oil),” he says. “There is also little sign to date of the 12% decline [in the New Zealand dollar against the US dollar] lifting trade receipts.

“We expect the trade balance to come under further pressure from here as the agricultural sector is held back by supply constraints (earlier dry weather, M.Bovis infestation) and as the terms of trade are falling.”

Sign up to get the latest stories and insights delivered to your inbox – free, every day.