Fund managers eyeing property amid investment confusion

Fund managers chasing growth are eyeing up equity investments, shunning global bonds, and checking out property.

Fund managers chasing growth are eyeing up equity investments, shunning global bonds, and checking out property.

Fund managers chasing growth are eyeing up equity investments, shunning global bonds, and checking out property.

The results, from a survey of 10 New Zealand managers, undertaken for Russell Investments quarterly Investment Manager Outlook, partly reflect confusion as markets try to digest the latest turbulent news from overseas.

Half of the managers surveyed consider New Zealand equities to be fairly valued, a contrast to a consensus that Australia’s share prices are undervalued.

However, there is a nearly 50:50 split in opinion as to whether New Zealand or Australia will offer the best future performance.

Half of the managers surveyed either had no opinion or considered the markets would perform in line with each other.

NZX hedge in bad times

Daniel Mussett, head of consulting at Russell Investments New Zealand, said local markets were somewhat insulated from the global economic turbulence of the past year while Australia was more exposed.

“It appears to be a case of overseas markets playing catchup to New Zealand rather than the reverse,” he said of managers’ assessment of NZX stocks as more expensive compared to Australia.

Uncertainty in the global outlook – particularly the continuing European debt crisis – is behind the split decision of managers as to the relative performance of the New Zealand and Australian markets, Mr Mussett said.

A general recovery would benefit resource-heavy Australia, while more bad news would work in favour of the NZX.

“If the economic environment was to worsen, and there is a very real possibility that this could happen, then this would likely lead to relatively better performance for New Zealand equities,” he said.

Retreat to property

Russell said that beyond Australasia growth-hungry managers were looking further afield for equities and back toward bricks and mortar.

“We prefer growth assets and inflation protection offered by property,” one manager told Russell.

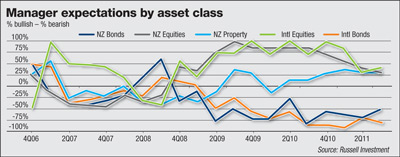

Managers were most bullish about property, local and international equities and cash.

Managers were most bearish about bonds, both New Zealand and international, with the latter begin given a thumbs down by 80% of survey respondents.

NZD, not rugby, key

All managers surveyed said New Zealand had escaped the possibility of a double-dip recession, with 50% picking stronger growth over the next year.

The managers have also not bought into hype surrounding the Rugby World Cup, with it even not featuring as a key driver of growth.

Rather, the Canterbury rebuild and fears over the high value of the New Zealand dollar were domestic concerns occupying their minds.