Gold’s glitter – going, going, gone?

Gold has long been recognised as a “store of value” and a “medium of exchange”. But how does it fare in the modern age?

Gold has long been recognised as a “store of value” and a “medium of exchange”. But how does it fare in the modern age?

Gold surged from $US255 in April 2001 to a high of $US1913 in September 2011 – that’s over 20% pa compounded for a decade! It has since lost its shine and retreated about 35%.

The market sell-off included a monumental 13% freefall over two days in April. You have to go back 30 years to see this rate of wealth destruction in gold markets.

This article is an overview of gold investing – looking at why invest in the precious metal and the different investment options.

1. Gold – from a 'gold bug' perspective

Gold has long been recognised as a “store of value” and a “medium of exchange” – i.e., as a currency. The Kingdom of Lydia (located in modern-day Turkey) is thought to have been the first to mint gold coins around 650BC.

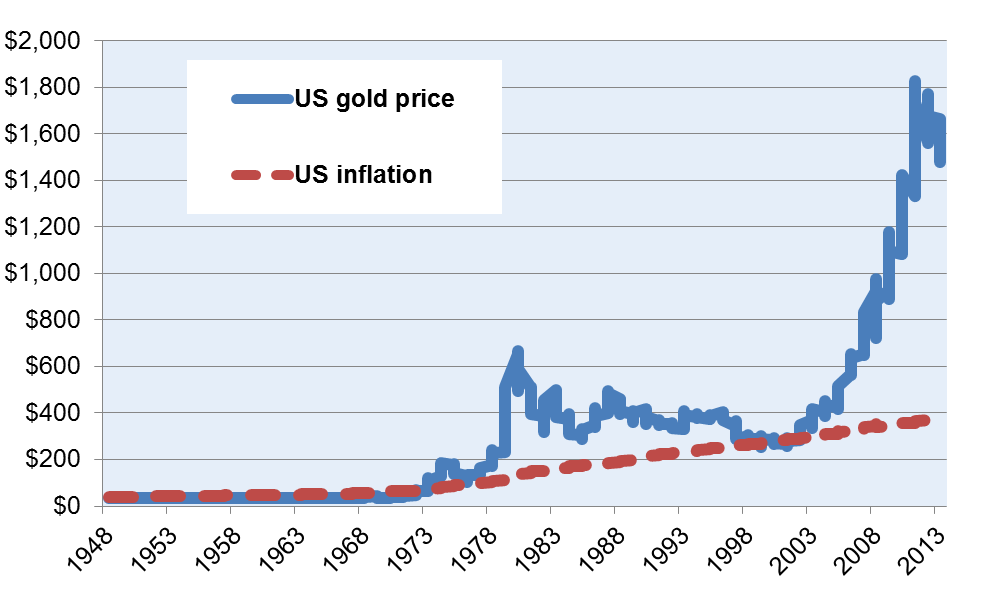

Supporters of gold hold it out as an inflation hedge and this was particularly true until the “gold window” (ability to freely convert the US dollar into a fixed amount of gold) was closed by President Richard Nixon in 1971. Since the 1970s the investment return from the metal has exceeded inflation (see graph below) but it can hardly be called an “inflation tracker”. It is clearly volatile and can trend (up or down) for a decade or more.

Sources: Bloomberg, Pathfinder

Gold is also seen as insurance against financial catastrophe, particularly the risk that fiat currencies become worthless. Given its historical importance, fungible properties, restricted supply and global recognition, the insurance argument seems reasonable. Just how much it should make up of an investment portfolio is another question entirely.

2. Gold – from a 'greater fool' perspective

Gold has inherent beauty and value, but its beauty and value are definitely in the eye of the beholder. From the 7th century to the 14th century Africans (in what is now Ghana, Mali and Sudan) were bemused by the European and Arab fascination for gold – and happily traded itfor an equal weight of salt. To them, a life-sustaining mineral was of much greater value than a metal used only for adornment.

Gold has some significant drawbacks as an investment. Here are three for starters:

If financial stress returns to the global system, gold will likely shine again. It could be a eurozone breakup, out-of-control inflation, geopolitical tension or some other financial catastrophe – gold could be good insurance. But a global recovery would not be a happy environment for it – growth means interest rates move higher and the opportunity cost of holding gold becomes very clear.

3. Accessing gold as an investment

The most common ways to access gold are:

With gold certificates a provider issues you a right to a certain amount of the metal that they hold. The actual gold may be specifically allocated to you or it may just be a big unallocated pool for investors. Many New Zealand investors tap into Australian or Canadian certificates where they may have some form of state guarantee. Tax implications of these are dealt with below.

Gold ETFs are along the same lines as unallocated gold but employ a different structure. A listed fund buys a pool of gold and issues shares to investors (the shares are “physically backed” by unallocated gold holdings). The fund buys and sells gold as new units are issued or redeemed – the listed ETF price should therefore track the gold price less management fees. The most popular is GLD – a $US42 billion US-listed ETF managed by State Street, where gold is held in several (secret) sites – although there is no shortage of conspiracy theorists arguing that a large part of the ETF gold simply does not exist.

Shares in global gold mining companies are a popular way to get gold exposure, but do they behave more like shares than the commodity? Mining company shares often track the gold price to a reasonable degree – but at the moment of financial crisis when you really want to rely on them, they tend to behave like a share. A great example was 2008, when global uncertainty hammered gold miner shares along with equity markets generally. See the graph below comparing the $US5 billion gold miner ETF (GDX) with the US$ gold ETF price:

Sources: Bloomberg, Pathfinder

Why can gold miner shares behave differently to the precious metal? They mine gold but they are still a company and:

4. Tax on Gold ETFs and Gold Mining shares

As they are shares Gold ETFs are taxed under the FIF rules for individual investors, meaning a choice of tax on actual gains (CV) or an assumed 5% income (FDR). So long as you can make the election, you will never be taxed on a gain above 5% in any year. This advantageous tax treatment also applies to shares in international gold mining companies. This is, however, different to the tax on gold itself.

5. Capital Gains Tax (CGT) and gold investing

In New Zealand we have a “loose” capital gains tax regime for property. If a house or building was bought with the intention of resale then gains are taxable. It’s all about intention at the time of purchase. Financial instruments are the same in this respect as property. If bought with the intention of resale then capital gains tax could apply. In the case of shares, establishing that they were bought for their dividend income (not capital growth) is helpful to establishing whether CGT should not apply.

Gold as an investment is more of a struggle. The capital gains tax rules applying to property also apply to gold in physical or certificate form. If the gold was bought with the intention of resale then CGT could well be payable on any gain. There is no guidance from the IRD on this, but an investor may be hard pressed to establish a reason for buying gold other than capital gain. There is no yield, there are no dividends – it was clearly not bought for an income purpose.

If you buy gold as an inflation hedge it is likely you are expecting a capital gain and are therefore vulnerable to a CGT claim. Why would you buy gold without expecting a gain? Deflation protection? (Japanese investors may have hoped gold would just hold its value over the last decade). Doomsday protection? (If you hold physical gold to survive a future world ravaged by global financial collapse, as long as you don’t sell before the collapse you probably won’t trigger CGT).

The point of raising this is that investors and advisers should be aware capital gains tax may apply to gains on physical or certificated gold. The purpose of purchase is likely to determine whether CGT applies. If an investor buys expecting a capital gain then look out!

6. Returns from gold investments

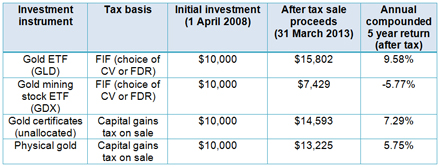

So how has gold performed as an investment after tax? Well, that depends on what period you held for and how you accessed gold. We look below at after tax returns over five years investing in gold through a gold ETF (GLD), gold mining stocks represented by a gold miners ETF (GDX), allocated gold certificates and holding physical gold. We assume the $10,000 was invested for five complete tax years (April 1, 2008, to March 31, 2013) and then realised:

The five-year returns vary widely. The Gold ETF benefited from FIF tax as opposed to CGT on physical gold and gold certificates (note, if CGT was not paid then gold certificates would have returned 10.39% pa and physical gold would have returned 8.49% pa). Gold mining stocks “blew up” compared to gold in 2008 and have not recovered – and so produced significantly lower (and negative) returns.

Note that our calculations include an allowance for transaction costs and that none of these are NZ dollar hedged (in each case the strength of the NZ dollar has had a negative return impact). Physical gold struggled vs the Gold ETF because of transaction costs – the buy/sell spreads for physical gold we were quoted by two NZ-based bullion dealers each ranged 9%.

This means if you invested $100 and immediately sold without the market price changing you were returned $91. That is the cost of having physical gold rather than gold in the form of a financial instrument. Assuming this is properly disclosed to investors, it is for them to decide if the potential benefit exceeds the cost.

7. Final thoughts

What does this tell us? Everyone has their own ideas on gold as an investment. Here are some points to ponder:

Same exposure but different outcomes: Where different investment instruments are available to access the same investment, do consider the different transaction costs and tax treatment. These can make a significant difference to returns for physical gold vs Gold ETFs vs gold miner shares vs physical gold.

Challenge accepted thinking: Most investors and advisers do not pay tax on physical or certificated gold. The general hope is “safety in numbers” with this approach. We question this thinking as CGT probably does apply. Do the research. If you buy physical or certificated gold for a reason other than price appreciation, then make a file note recording this.

When a precious metal behaves like a share: Many investors want gold exposure as “insurance” against global financial crisis. They may also use gold mining shares as a proxy for gold returns. But take care. The moment you want to call on the insurance the mining shares may behave like equities and not gold. Gold shares may not shine at the very moment you need them most.

John Berry is executive director, Pathfinder Asset Management Ltd. Pathfinder is a fund manager and does not give financial advice. Seek professional investment and tax advice before making investment decisions.

Sign up to get the latest stories and insights delivered to your inbox – free, every day.