Nokia shares [NYSE:NOK] were up 17.01% in late trading.

BlackBerry maker RIM [NAS: RIMM] jumped 10%.

Apple and Microsoft were both up around 1.5%.

Meanwhile, Google [NAS:GOOG] shares were down around 2%, despite a broader market rise (Motorola Mobility shares [NYSE:MMI] were up 55%, reflecting the premium being paid for the company. Motorola was split into separately listed enterprise and mobile companies earlier this year - although its unified New Zealand office has yet to catch up with that development, let alone today's. Motorola NZ had yet to be brief on the deal when spoken to by NBR this morning - although accounts director David Ross told NBR a phone briefing was pending at midday).

Investors were clearly betting that Samsung, Sony Ericsson, HTC and others that make Google Android smartphones would be wary of the search giant buying a handset maker – on the face of it, putting it in direct competition for their hardware revenue.

Samsung and co. are seen as now more likely to experiment with different smartphone software, such as Windows Phone (although there are complications on that front, too, given Microsoft’s multi-billion partnership with Nokia).

And RIM investors are clearly betting that the Android camp will splinter – or at least fracture a little – providing BlackBerry with a chance of a comeback.

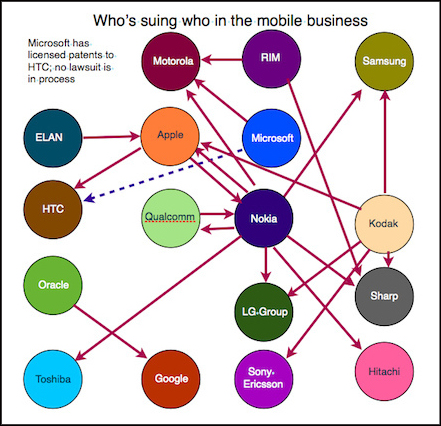

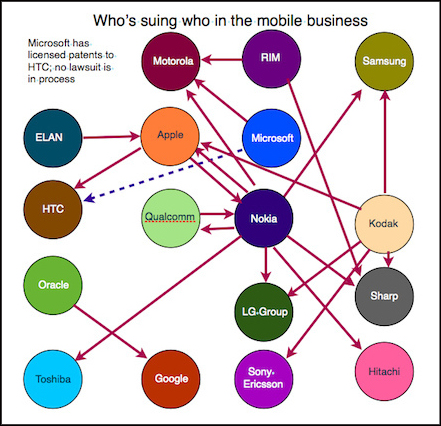

ABOVE: This infographic, doing the social media rounds today, captures the patent suit madness - but not quite, failing to illustrate Apple's recently-launched actions against Motorola over its Xoom Android tablet, and Samsung over its Galaxy Tab 10.1 (an action that has blocked EU, Australian and NZ sales of the Android device). Click to enlarge.

But Google hasn’t bought Motorola to go into the handset business.

Rather, the deal is seen as a patent play - and was outlined so explicity in a blog post by Google CEO and co-founder Larry Page, who wrote that patents, and a need to protect Android from "anti-competitive attacks" from Apple and Microsoft were two motivations behind the deal.

And indeed, securing Motorola’s treasure trove of intellectual property (which includes 17,000 worldwide patents and 7500 in process), could help Google keep the Android camp together, because the search giant is now in a better position to insulate all of its hardware partners from patent trolls (no small detail at a time when Apple legal action has blocked the release of one of the highest profile Android devices – the Samsung Galaxy Tab 10.1 in the EU and Australasia; Apple also recently filed suit against Motorola's Xoom).

In a snap analysis of the deal, IDC vice president mobile & consumer platforms Scott Ellison offered the personal prediction that “Google may just keep Motorola patents and spin off Motorola hardware to preserve a vibrant Android OEM ecosystem.”

As things stand, the Android camp seems to have fallen into line, and bought the "patent play" argument.

Google's press office this morning rolled out a series of pre-canned quotes form Samsung, HTC, Sony Ericsson and others in support of the deal (and, let's face it, for Android partners you could just as well read "advertising platform partners"; the search giant needs to keep them onside for the mobile version of Ad Words to have maximum reach)

“We welcome Google‘s commitment to defending Android and its partners,” LG's president said in a typical example.

The question now: can Google keep them onside as it starts to step into their core handset business?