Wall Street bounced around in choppy late-week trading after the market digested positive numbers from Nvidia, though suffering a reversal on Thursday with the AI chipmaker leading a downward slant to tech stocks including Advanced Micro Devices, Sandisk, and GE Vernova.

On the positive side, US retailer Walmart showed upward mobility to its share price, after returning better-than-expected quarterly revenue on Thursday.

By midday on Thursday, Walmart's stock price had jumped 6.46% to US$107.11, after posting a 5.8% rise in revenues to US$179.5 billion ($321.3b) for the three months ending October 31.

While that had exceeded analysts' expectations, the retailer also lifted its outlook, now expecting growth in net sales of between 4.8% and 5.1%, from a prior top end of 4.75%.

The company – the NYSE's fourth-largest listing by market capitalisation at about US$852b – will transfer its listing to the Nasdaq Global Select Market from December 9.

Walmart told Reuters the move to the tech-heavy exchange would underscore its "technology-forward approach".

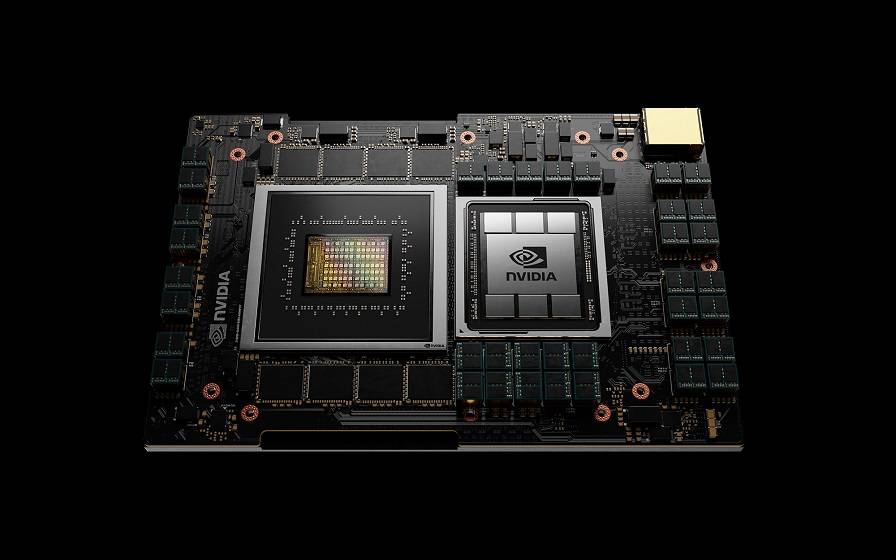

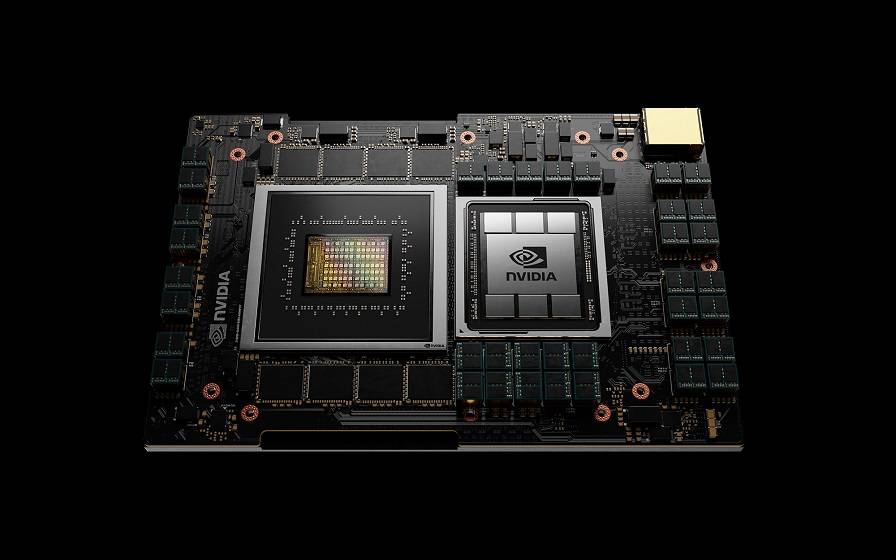

Nvidia's revenue for the same period, meanwhile, jumped 62% to US$57b, which was driven by demand for its chips used in AI data centres. Sales from that division alone rose two-thirds to more than US$51b, ahead of expectations.

The results, released on Wednesday, had come under the microscope amid concerns over the massive valuations accorded to AI stocks, with analysts comparing the AI surge to the dotcom boom of the late 1990s.

Investors took profits in Nvidia.

Retracing gains

And while Nvidia's stock price initially jumped about 5% on the performance – spilling over into data tech stocks including New Zealand's Infratil – it had retraced those gains by Thursday, ending 3.2% down. That pulled the semiconductor index down overall by 4.8%, helping the Dow Jones industrial index to a 1% drop.

Octagon Asset Management chief investment officer Paul Robertshawe said he wasn't surprised the price didn't kick on.

Paul Robertshawe.

"I don't know that it's really answered the question around where the revenue is coming from, and given the collapse of prices of older chips."

That's reinforced by research by Miami-based automation platform Cast AI, which indicated graphics processing units (GPUs) were approaching a tipping point. That could seed a "sharp decline" in GPU pricing over the coming quarters.

Those units have typically been worth tens of thousands of dollars, but price differences are partly determined by performance and prices can also vary by region.

Nvidia's largest customers are generally in North America, where Amazon Web Services, Google Cloud Platform, and ‘neocloud’ companies were building massive data centres. Those companies tend to purchase their GPUs in advance, and can sell that capacity before their infrastructure is even built.

Robertshawe said that meant these companies needed to keep spending on innovation, creating the ‘next new thing’. And while there were no "immediate cracks", the revenue side for Nvidia still needs to be answered for the sector.

DeVere Group chief executive Nigel Green agreed, suggesting that exceptional results "don't remove the need for discipline.

"The AI ecosystem is growing fast, but fast growth doesn’t protect anyone from the consequences of over-extension."

He said the results also magnified concerns around market concentration, with a "small cluster" of companies now carrying extraordinary influence over global equities and shaping sentiment with a single update.

“The numbers show demand. They don’t show durability, and they don’t show how businesses will respond when input costs rise or regulation sharpens.

“Investors must now evaluate the difference between the promise of scale and the reality of execution.”