United States Federal Reserve chair Jerome Powell highlighted concerns over the slumping job market this week, with the markets interpreting it as leading to another interest rate cut by the Fed later this month.

That played a part in directing the S&P 500 index into positive territory by mid-week, though US stocks retraced that by Friday, after regional banks Zions Bancorp and Western Alliance reported issues with loans, prompting concerns about 'systemic' stress in credit markets.

If the Fed does move at its October 28/29 meeting, it would be the second consecutive cut after it brought the federal funds target range down to 4-4.25% in September.

But the employment news is indeed dire, with Automatic Data Processing data on labour market trends showing US companies shedding 32,000 jobs in September.

DeVere Group chief executive Nigel Green said Powell was exhibiting a delayed reaction to a trend that had been apparent for months, with data and the economic slowdown forcing the central bank to “shift from patience to panic”.

Green said earlier tightening, combined with tariff pressures and weakening global demand, had finally hit home. “When policy lags, volatility rises. Investors want clarity and consistency. Right now, they’re getting neither,” he said.

Still, Green thought the market response could be more appetite for equities, particularly high-quality growth stocks with “strong balance sheets and exposure to technology and digital infrastructure”.

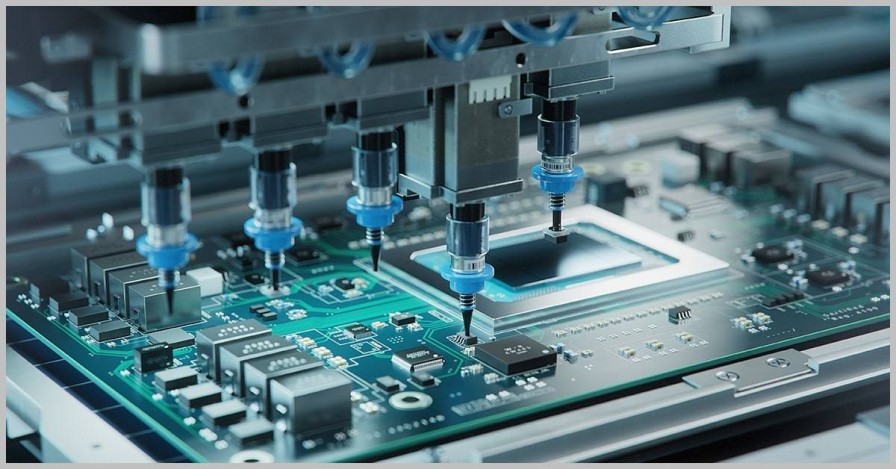

TSMC’s record results help drive the markets higher.

Nothing artificial about the gains

The AI theme remains in full force, meanwhile, after a consortium including BlackRock, Microsoft, and Nvidia announced the purchase of US-based Aligned Data Centers (ADC) for US$40 billion ($69.7b) from Macquarie Asset Management.

ADC is one of the world’s biggest data centre operators, with nearly 80 facilities, and the move is seen to be targeted at securing computing capacity for artificial intelligence.

Asian markets followed the lead, with Japan's Nikkei up 1.2% on Thursday, also led by chip and AI-related shares.

That was partially fuelled by a record 40% jump in net profits for Taiwan Semiconductor Manufacturing Corp for the September quarter, to 452.3 billion new Taiwan dollars ($25.2b), ahead of analysts' forecasts.

Gold futures surged above US$4200/oz.

Crude oil also bounced back briefly off five-month lows after Indian Prime Minister Narendra Modi was reported to have pledged to stop buying oil from Russia, which supplies about one-third of imports to the world’s most populous country.

Gold, for its part, continued to hit new highs, with US futures closing in on US$4300 ($7500) per ounce by the end of the week.

Faward Razaqzada, a market analyst at Forex.com, said the 60% surge in the metal’s fortunes so far this year has been driven primarily by geopolitical jitters including heightened US-China trade tensions.

Razaqzada said he wouldn’t bet against gold breaching the US$5000 level – driven by rate cut bets, de-dollarisation, and strong exchange-traded fund (ETF) inflows.

Investor enthusiasm for the safe-haven asset extended into a positive start locally for gold prospector Uvre, which climbed 16% to 32.50 cents on its NZX debut on Thursday.

RBNZ’s Paul Conway.

The company, also listed on the ASX and abbreviated from Uranium Vanadium Rare Earth, said the dual listing was designed to help it increase its investment appeal and boost liquidity.

The data centre frenzy spilled into a 5% gain for Infratil on Thursday, its most solid rise since mid-April. That was after the infrastructure investor's CDC Data Centres business announced a new 40 megawatt contract with an AI centre in Sydney.

In a speech to a Sydney investment conference, NZ Reserve Bank chief economist Paul Conway defended the central bank’s $53b money printing programme through the pandemic as necessary to keep the economy functioning.

Conway said that, while the bond-buying large-scale asset purchase programme had cost the economy about $10.5b in mark-to-market losses, it had positive benefits in boosting tax revenues.

He also noted the 50bp cut to the official cash rate (OCR) earlier this month was to address the risk of a more prolonged period of excess capacity. He said the Monetary Policy Committee was open to further monetary easing, though felt it was still working with the 2.5% OCR toward the lower bounds of the 2.5% to 3.5% ‘neutral zone’.

ASB senior economist Mark Smith, however, said it was the bank’s view that a lower OCR is needed and is expecting a 25bp drop to 2.25%.

Sarah Hunter, the chief economist and assistant governor (economic) at the Reserve Bank of Australia, meanwhile, expressed concern after higher than expected monthly CPI readings and a tight labour market.

The RBA has scaled down estimates of potential growth in the Australian economy to 2% per annum, with markets not pricing in any cuts until March next year.