India hits out at US; Tesla sales in UK, Germany nose dive

And Israel’s Prime Minister is reportedly planning to fully reoccupy Gaza.

And Israel’s Prime Minister is reportedly planning to fully reoccupy Gaza.

Happy Wednesday and welcome to your morning wrap of the latest business and political headlines from around the world.

First up, India has hit out at the United States and Europe over its imports of Russian oil, after President Donald Trump threatened New Delhi with much steeper tariffs, CNBC reported.

Trump warned India earlier this week of levies because of its imports of Russian oil, which he said was funding the country’s war machine.

However, India’s foreign ministry has defended its decision overnight, saying it began importing the oil after “traditional supplies” were diverted to Europe following the outbreak of the Ukraine-Russia war in 2022.

“It is revealing that the very nations criticising India are themselves indulging in trade with Russia,” India’s foreign minister said in a statement. “Unlike our case, such trade is not even a vital national compulsion.”

The EU’s bilateral trade with Russia stood at US$78.1 billion in 2024, according to European Commission data, while trade between New Delhi and Moscow hit a record US$68.7 billion for the year ended March.

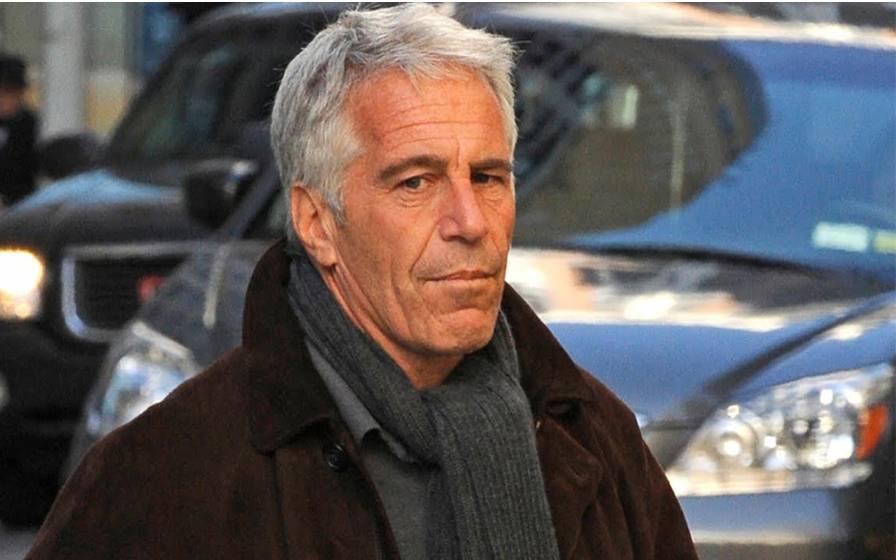

Moving to the United States, former US President Bill Clinton and his wife, Hillary, are among several high-profile names to receive subpoenas from a congressional committee to testify about Jeffrey Epstein, The Guardian reported.

The House Oversight Committee’s Republican chair, James Comer, sent the subpoenas in search of more information about Epstein, after President Trump decided against releasing additional files on the late financier.

CNN reported that the closed-door depositions are expected to take place between August and October.

Republicans zeroed in on Clinton for his association with Epstein, which has publicly surfaced as part of civil lawsuits. They want to depose Hillary Clinton because she hired Ghislaine Maxwell's nephew for her 2008 election campaign.

Jeffrey Epstein.

To Israel, where local media are reporting that Prime Minister Benjamin Netanyahu is proposing to fully reoccupy the Gaza Strip when he meets with his security cabinet.

“The die has been cast. We're going for the full conquest of the Gaza Strip – and defeating Hamas,” local journalists quote a senior official as saying, according to the BBC.

The Associated Press reported that there were disagreements between Netanyahu and the army chief, Lt Gen Eyal Zamir, over how to proceed. Zamir reportedly opposes Israel trying to conquer the territory and could step down – or be pushed out – if the proposal is approved.

Benjamin Netanyahu.

Back to the US, where President Trump has ruled out Treasury Secretary Scott Bessent from consideration for an open seat on the Federal Reserve’s board, Reuters reported.

Trump told CNBC in an interview that Fed Governor Adriana Kugler’s decision to vacate her seat early was a “pleasant surprise”. Two of the possible candidates he has suggested to replace her are current White House economic adviser Kevin Hassett and former Fed Governor Kevin Warsh.

Trump said Bessent was not a candidate because he wants to remain in the top Treasury job.

In that same interview, the US President also suggested that tariffs on pharmaceuticals could reach up to 250%. It is worth noting that Trump has repeatedly threatened, then changed course on, tariffs – a trend that has not gone unnoticed and spurred the initialism Taco (Trump Always Chickens Out).

In business news, CNBC reported that Tesla’s new car sales in Britain and Germany plummeted in July.

Industry data shows sales volumes in Britain fell 60% to 987 vehicles in July, while car sales in Germany were down by more than half, to 1110.

In contrast, China’s BYD recorded massive growth in Europe’s two largest car markets last month. Its vehicle sales for July were more than four times higher than a year ago, at 3184 in Britain, while sales in Germany were up nearly 390% year-on-year.

BYD vehicle sales in Europe have surged.

Staying with business, drug giant Pfizer has lifted its full-year profit guidance following cost cuts and strong trading, Reuters reported.

The company has just reported its second-quarter results, which were ahead of Wall Street’s estimates, as revenue from its Covid products increased.

Pfizer’s shares rose by close to 4% on the news, as the company now expects adjusted earnings of US$2.90 to US$3.10 per share – up from its prior guidance of US$2.80 to US$3.00.

The increased profit guidance comes as the company continues to implement its massive cost-saving programme, which aims to deliver US$7.2 billion in net savings by the end of 2027.

Sign up to get the latest stories and insights delivered to your inbox – free, every day.