Israel circles Gaza City; Trump targets another Fed official

And tech stocks continue to tumble.

Israel Defence Force tank. (Source: Wikimedia Commons).

And tech stocks continue to tumble.

Israel Defence Force tank. (Source: Wikimedia Commons).

Happy Thursday and welcome to your morning wrap of the latest political and business headlines from around the world.

First up, Israel’s military has taken the first steps of its plan to seize Gaza City, following a clash with Hamas south of Khan Younis overnight, Reuters reported.

Brigadier General Effie Defrin said troops had already begun circling the city, and Hamas was now a “bruised and battered” guerrilla force.

"We have begun the preliminary operations and the first stages of the attack on Gaza City, and already now IDF forces are holding the outskirts of Gaza City," he said.

Earlier, Israel’s military called up 60,000 reservists ahead of an expanded military operation to capture Gaza City, Al Jazeera reported.

An Israeli military official told reporters that a new phase of combat would involve a “gradual, precise and targeted operation in and around Gaza City”.

Hundreds of thousands of Palestinians in Gaza City are expected to be ordered to evacuate and head to shelters in the southern part of the enclave.

Mediators Qatar and Egypt are trying to secure an agreement before the offensive begins and have presented a new proposal for a 60-day truce and the release of around 50 hostages. Hamas accepted the proposal on Monday, but Israel is yet to submit a formal response.

Destroyed homes in Gaza.

To the United States, where former US President Donald Trump is pressuring Federal Reserve official Lisa Cook to resign, after one of his allies alleged she committed mortgage fraud, CNN reported.

Federal Housing Finance Agency director Bill Pulte, in a letter, urged the Justice Department to investigate a pair of mortgages taken out in recent years by Cook, a Joe Biden appointee.

He alleged she falsified bank documents and property records to acquire more favourable loan terms when she took out two mortgages in 2021.

Trump referenced the allegation on social media: “Cook must resign, now!!!”

Pulte, a Trump ally, has frequently criticised the Fed and its leader Jerome Powell for not lowering rates. He told CNBC that his call for Cook to resign was apolitical.

The US Federal Reserve Building.

In business news, UK inflation has come in higher than expected, increasing the chances that the Bank of England will keep interest rates on hold for the rest of the year, CNBC reported.

Headline inflation in the UK rose to 3.8% in the 12 months ended July, its highest level in 19 months, and was slightly above economists’ expectations of 3.7%. Core inflation also rose.

The increase was driven by higher food prices and a large rise in air fares.

Money markets are now betting on the Bank of England to leave rates unchanged at 4% until its final meeting in December.

But ING developed markets economist James Smith said in a note quoted by CNBC that a November rate cut was still on the cards.

“Much also hinges on the jobs market, where employment has fallen in eight out of the past nine months, but where the survey data is looking a little less worrisome than it did earlier this year,” he said.

To China, where officials are considering allowing the use of a yuan-backed stablecoin for the first time to boost wider adoption of its currency globally, Reuters reported.

China’s cabinet, the State Council, will review and possibly approve a roadmap later this year for greater usage of the currency globally, including catching up with a US push on stablecoins.

The country’s plan to use stablecoins, which are cryptocurrencies backed one-to-one by a country’s fiat currency, would mark a major shift in its approach to digital assets.

It banned crypto trading and mining in 2021 due to concerns about financial system stability.

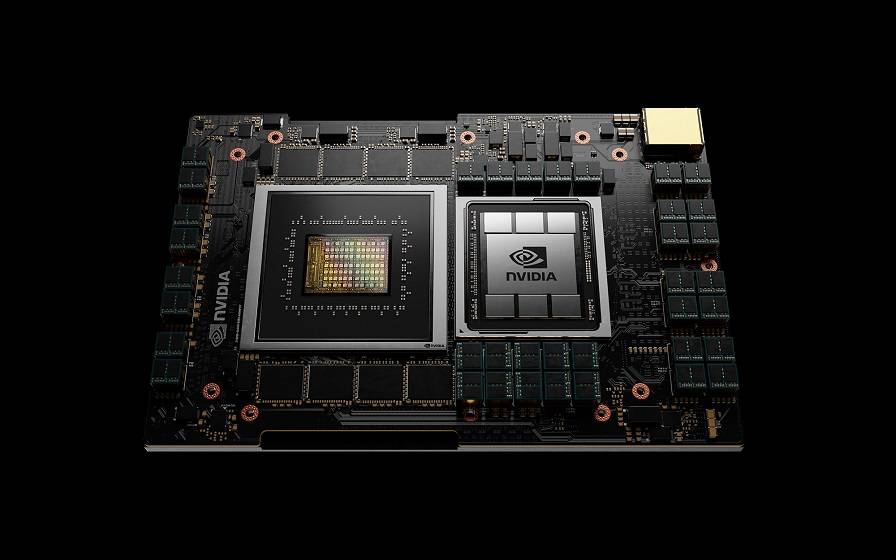

Finally, stocks on Wall Street have continued to tumble, pressured by a broad sell-off in tech stocks for the second day in a row, CNBC reported.

In late trading, the S&P 500, the Dow Jones Industrial Average, and the tech-heavy Nasdaq were all down by 0.42%, 0.03% and 0.98% respectively.

Investors continued to take profits from several tech and semiconductor heavyweights, fuelling concerns about their high valuations and the long-term strength of the AI trade.

Nvidia was down by about 3%, while Advanced Micro Devices and Broadcom were down more than 3.5%.

“It’s not a surprise to see some investors taking profits in tech stocks, which have had an incredibly strong run — with some up over 80% since the early April lows,” BMO Private Wealth chief market strategist Carol Schleif said.

“Market volume in general is typically quite sparse in late August, leading to wider swings than fundamentals would warrant.”

Sign up to get the latest stories and insights delivered to your inbox – free, every day.