Paramount sweetens Warner Bros bid; BP cuts buybacks

And Indonesia is preparing to send troops to Gaza.

And Indonesia is preparing to send troops to Gaza.

Happy Wednesday and welcome to your morning wrap of the latest business and political headlines from around the world.

We begin with the latest developments in the battle to own Warner Bros Discovery (WBD).

Reuters is reporting that Paramount Skydance has sweetened its bid for the company by offering shareholders extra cash for each quarter the deal fails to close after this year, and by also agreeing to cover the break-up fee it would owe rival suitor Netflix if it walked away.

Paramount did not raise its overall offer of US$30 per share, or $108.4 billion ($180b) including debt, for the whole of the company, but the revised bid is its latest attempt to woo WBD shareholders and steer them away from accepting an offer from Netflix.

In contrast, Netflix’s current offer is an all-cash bid of $27.75 per share for just the company’s most lucrative assets.

Both suitors are in hot pursuit of Warner Bros for its leading film and television studios, extensive content library and major franchises such as Game of Thrones, Harry Potter and DC Comics superheroes Batman and Superman.

Unlike Netflix, Paramount would also acquire Warner Bros’ television networks, which include CNN, that would be spun out into a separately traded company.

WBD’s board has previously told shareholders to reject the Paramount deal because it has less chance of getting regulatory approval.

Overnight, Paramount called on WBD’s board to declare the amended offer a superior proposal and resume negotiations, but there has been no response.

WBD’s board favours Netflix’s offer.

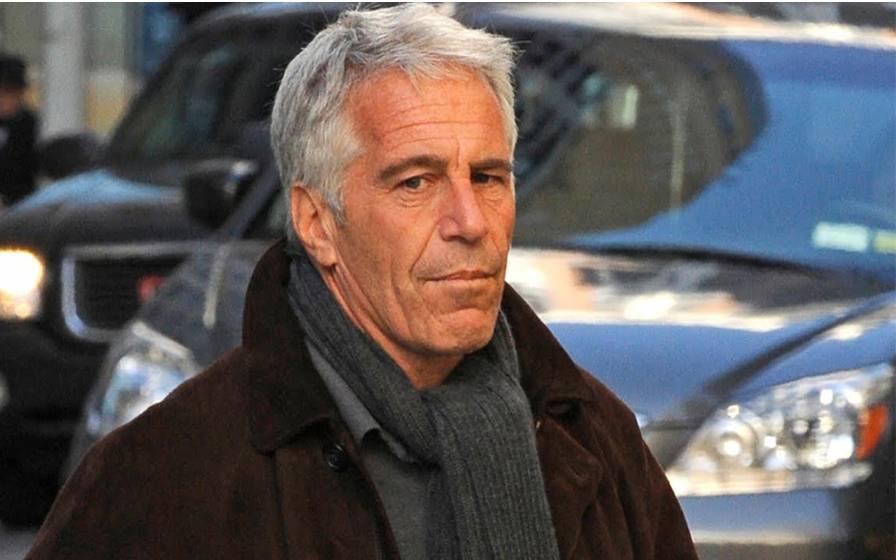

In the US, lawmakers say files related to convicted sex offender Jeffrey Epstein were improperly redacted ahead of their release by the Department of Justice, the BBC reported.

Members of Congress this week began a review of the unredacted versions of the nearly 3 million pages of files released under the Epstein Files Transparency Act since December.

Representatives Thomas Massie and Ro Khanna, who co-sponsored the law, told reporters they had a list of 20 people, in which every name was redacted except for Epstein’s and his convicted sex trafficker associate Ghislaine Maxwell.

Massie said six of the names could belong to men who are “likely incriminated by their inclusion in these files”.

At least one document has been unredacted since the lawmakers’ complaint, with Deputy Attorney General Todd Blanche saying on X: "The DOJ is committed to transparency."

The late Jeffrey Epstein.

Indonesia has said it is preparing to send up to 8000 troops to Gaza to be part of a peacekeeping force under Donald Trump’s Middle East plan, The Guardian reported.

The announcement makes it the first country to deliver a specific commitment to the international stabilisation force envisaged by the US president.

The arrival of Indonesian forces in Gaza would be the first outside force on the territory since 1967. It would also put the world’s most populous Islamic country at the heart of the conflict.

According to a version of the Trump plan put forward by his son-in-law, Jared Kushner, at the World Economic Forum in Davos last month, an interim administration run by Palestinian technocrats would take on daily governance in Gaza, including the disarmament of Hamas.

In corporate news, BP has become the first oil major to suspend its share buyback programme, as the company looks to shore up its balance sheet after its push into green energy backfired, the Financial Times reported.

BP said it would instead allocate excess cash to cutting its US$22b debt pile, acknowledging that “urgency” was needed to revive the fortunes of the company.

As the FT points out, the move underlines that the company is still contending with the consequences of its radical attempt to transform itself into a green energy company under former boss Bernard Looney.

Alongside putting the brakes on its buybacks, the company wrote down the value of its renewable business by $3.1b and scaled back its capital plans for the year.

Halting buybacks will save the company more than $6b but leaves it as an outlier among its competitors, which continue to use buybacks to boost returns for shareholders.

Staying with business, Alibaba has launched an artificial intelligence model designed to power robotics. CNBC reported the model, called RynnBrain, is designed to help robots comprehend the physical world around them and identify objects.

A video released by Alibaba shows a robot identifying fruit and putting it in a basket. While it may seem simple, complex AI is required to govern the robot’s understanding of individual items as well as the required movement. RynnBrain sees Alibaba join Nvidia and Google in the quest to develop what is known as “physical AI”.

To Wall Street now, where the Dow Jones Industrial Average has continued its winning streak and hit a fresh record.

The index was up 227 points, or 0.5%, following a boost from Disney and American Express as investors moved into software stocks and more value-oriented areas of the market.

Meanwhile, the broader S&P 500 ticked slightly higher while the tech-heavy Nasdaq was flat.

As CNBC noted, the broader market was supported by gains in software after this group led a market sell-off last week as concerns grew among investors that artificial intelligence could threaten established businesses.

Gold fell 1% to US$5,017 per ounce overnight as markets braced ahead of US jobs data later this week and what it may mean for the Federal Reserve’s interest rate outlook, while silver slipped 3.76%.

Bitcoin was down 1.3% to US$69,745.

Sign up to get the latest stories and insights delivered to your inbox – free, every day.