SoftBank exits Nvidia; AI companies accused of fudging books

And 12 people have been killed in Pakistan’s capital after a suicide attack.

And 12 people have been killed in Pakistan’s capital after a suicide attack.

Happy Wednesday and welcome to your morning wrap of the key business and political headlines from around the world.

First up, SoftBank Group has sold its entire stake in Nvidia for US$5.8b ($10.25b) in a move that has jolted stock markets and stoked fears that the frenzy around artificial intelligence may have peaked, Reuters reported.

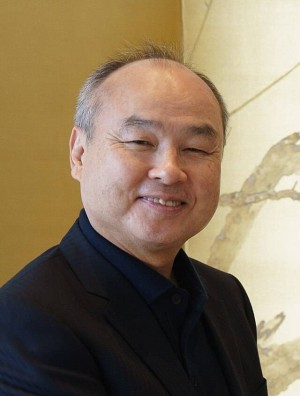

SoftBank chief executive Masayoshi Son. (Source: Wikimedia Commons.)

The Japanese tech investor announced in its quarterly results that it had sold all 32.1 million shares in Nvidia it held in October to fund its sweeping push into AI, built around the chief executive Masayoshi Son’s all-in bet on OpenAI.

The timing of its sale has deepened some investor doubts about valuations in the industry.

Nvidia shares were down more than 2% in early trading, while AI cloud provider CoreWeaver added to the jitters when it cut its revenue forecast over a contract delay that sent its stock tumbling 9%.

Several analysts have said the sale suggested Son sees the blistering rally that turned Nvidia into the first US$5 trillion company last month cooling.

But a few have noted SoftBank’s patchy record managing its Nvidia shares. The company, by some estimates, missed out on a more than US$100b rally in Nvidia shares by selling them off in 2019 before the AI boom took off, only to buy the chipmaker’s shares again.

Staying with AI, famed short seller Michael Burry, who recently took large bets against Palantir and Nvidia, has accused some of America’s largest tech companies of using aggressive accounting to pad their profits from the AI boom, CNBC reported.

In a post on X, the Scion Asset Management founder alleged that major cloud and AI infrastructure providers were understating depreciation by estimating that chips would last longer than was realistic.

“Understating depreciation by extending useful life of assets artificially boosts earnings – one of the more common frauds of the modern era,” Burry wrote. “Massively ramping capex through purchase of Nvidia chips/servers on a 2-3 yr product cycle should not result in the extension of useful lives of compute equipment. Yet this is exactly what all the hyperscalers have done.”

He singled out Oracle and Meta, saying the accounting manoeuvre would overstate their profits by roughly 27% and 21% respectively by 2028.

CNBC pointed out that Burry’s claim is hard to prove because of the leeway companies are given in estimating depreciation.

In the Middle East, a suicide attack outside a court in Pakistan’s capital, Islamabad, has killed 12 people and injured at least 27 others, the BBC reported.

The country’s interior minister, Mohsin Naqvi, said the bomber was planning to attack the district courthouse but was unable to get inside.

Pakistani Prime Minister Shehbaz Sharif has alleged that extremist groups “actively backed by India” were involved, although a spokesperson for the Indian government denied what they described as “baseless and unfounded allegations”.

A splinter group of the Pakistani Taliban (TTP), Jumaat Ul Ahrar, has claimed responsibility, but two local journalists told the BBC that the TTP’s central leadership had sent messages to them saying it had no link to the explosion.

Moving to the United States, where members of the House of Representatives headed back to Washington for a vote that could bring an end to the longest US government shutdown in history.

With more than 1000 flights cancelled due to the shutdown, some lawmakers said they were carpooling across the US to reach the Capitol.

The Republican-controlled House is due to vote tomorrow on a compromise that would restore funding to government agencies and end a shutdown that started on October 1. The Republican-controlled Senate approved the deal on Monday night, and House Speaker Mike Johnson has said he expects it to pass his chamber as well.

In other business news, British assets wobbled overnight as investors digested the impact of a weakening labour market, CNBC reported.

Official data showed that the country’s unemployment rate rose to a higher-than-expected 5% in the three months ended September, while the estimated number of payrolled employees fell by 32,000 between August and September.

The news caused 10-year bond yields to drop 5 basis points, as investors bet on an end-of-year cut by the Bank of England.

As GAM Investments chief multi-asset investment strategist Julian Howard pointed out, the labour market adds further pressure to Finance Minister Rachel Reeves as her critical autumn Budget looms.

“Today’s unemployment numbers increase the pressure on both the Government and the Bank of England to change course and go easy on the tax rises and cut rates respectively,” he told CNBC. “But neither is straightforward. The Government somehow has to fix the dire fiscal position the country finds itself in without strangling animal spirits.”

British Finance Minister Rachel Reeves.

Finally, the Chinese “cryptoqueen” behind a US$6b bitcoin laundering scheme has been jailed for 11 years in the United Kingdom, the ABC reported.

Zhiman Qian pleaded guilty to two money laundering charges in September after an investigation during which British police seized 61,000 Bitcoin.

Prosecutors said Qian ran an investment fraud between 2014 and 2017, into which around 128,000 people invested billions of dollars.

After siphoning off a large chunk of the money, Qian fled China via Myanmar, Thailand, Laos and Malaysia, before she flew to London on a St Kitts and Nevis passport. She began trying to convert bitcoin bought with the proceeds of the fraud into cash, prosecutors said.

Sign up to get the latest stories and insights delivered to your inbox – free, every day.