US hikes tariffs on India; Uber announces US$20b share buyback

And Donald Trump says ‘great progress’ has been made on a ceasefire in Ukraine.

And Donald Trump says ‘great progress’ has been made on a ceasefire in Ukraine.

Happy Thursday, and welcome to your morning wrap of key business and political headlines from around the world.

First up, multiple outlets are leading with the news that US President Donald Trump has signed an executive order increasing tariffs on imports from India by 25% for purchasing Russian oil, taking the total levies on the country to 50%.

According to the Associated Press, the new tariffs will come into effect 21 days after the executive order, giving both Russia and India time to negotiate.

India’s Foreign Ministry spokesperson Randhir Jaiswal called the tariffs “unfortunate”.

“We reiterate that these actions are unfair, unjustified, and unreasonable,” he said, adding that India would take all actions necessary to protect its interests.

Trump had warned of the increased tariffs earlier in the week, stating that India’s purchase of Russian oil was fuelling the latter’s “war machine”. India hit back at the US and Europe over their own purchases of Russian oil, noting it began importing it after “traditional supplies” were diverted to Europe following the outbreak of the Ukraine-Russia war in 2022.

Until recently, India was seen as a viable alternative to China for American companies looking to relocate their manufacturing.

Donald Trump.

To Russia, where President Trump said “great progress” had been made on Ukraine between his envoy, Steve Witkoff, and Russian President Vladimir Putin, according to the BBC.

In a post on social media, Trump described the meeting about a ceasefire as “highly productive”. Meanwhile, the Kremlin issued a vague statement of its own, saying the two sides had exchanged “signals” as part of “constructive” talks in Moscow.

The meeting comes just days before Trump’s deadline for a ceasefire in Ukraine. He has said Russia could face harsh or secondary sanctions if it does not take steps to end the war.

Turning to the Middle East, Israel’s military chief has pushed back against Prime Minister Benjamin Netanyahu’s plans to seize parts of Gaza not already under Israeli control, Reuters reported.

Eyal Zamir warned Netanyahu during a three-hour meeting that taking the remainder of Gaza could trap the military in the territory – which it withdrew from two decades ago – and could put the hostages held there at greater risk, according to sources briefed on the meeting.

Israel currently controls about three-quarters of the Palestinian enclave but has opposed imposing military rule or annexing the territory. Netanyahu is under intense pressure, both domestically and internationally, to reach a ceasefire. However, members of his parliament have threatened to quit if he ends the war. Netanyahu is expected to discuss military plans for Gaza with other ministers later this week.

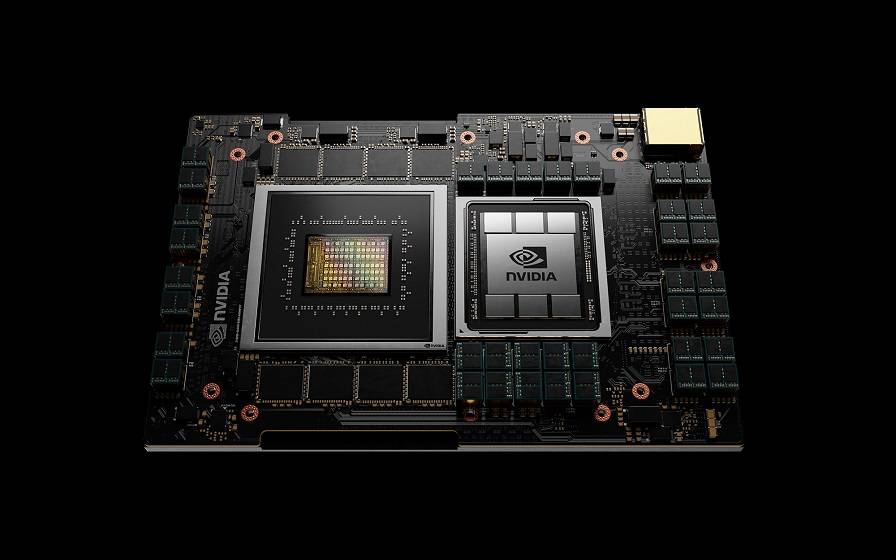

In business news, two Chinese nationals have been arrested and charged by the US Department of Justice (DOJ) with illegally shipping millions of dollars’ worth of AI chips to China, the BBC reported.

The DOJ alleges that over the past three years, ALX Solutions – a company run by Chaun Geng and Shiwei Yang – exported Nvidia’s H100 graphics processing units from the US to China without a licence.

The chips have become a key focus of US export controls aimed at limiting the transfer of sensitive technology to China.

Still with business, ride-sharing company Uber has announced a US$20 billion share buyback and delivered a better-than-expected forecast for the third quarter, Reuters reported.

The company just released its second-quarter earnings, with net income rising to 63 cents per share from 47 cents a year ago, which was in line with market estimates.

Uber said demand for its Uber One membership programme jumped 60% in June compared to a year ago, to more than 36 million subscribers, accounting for over a third of its bookings. These users generate more than three times the profit of a typical user.

Its expectations for current-quarter gross bookings, a measure of the total dollar value of transactions, were also above analysts’ estimates.

However, the company’s shares were down by nearly 1% in late trading. They are still up almost 50% for the year.

Big Mac.

Finally, McDonald’s has posted quarterly earnings above analysts’ expectations, as promotions such as its tie-in with the Minecraft movie boosted sales, CNBC reported.

The company’s second-quarter revenue rose 5% to US$6.84b, ahead of analysts’ forecasts of US$6.7b. Its earnings per share were US$3.19, compared with expectations of US$3.15.

The improved result was driven by the largest increase in same-store sales in nearly two years, the Minecraft movie partnership in the United States, and the return of the Snack Wrap to menus.

However, the company said that re-engaging low-income consumers was critical, as they tended to visit stores more often than middle- and high-income earners.

McDonald’s shares were up close to 3.8%.

Sign up to get the latest stories and insights delivered to your inbox – free, every day.