Should you get an international price when you sell your house? Or face a market were some buyers could be put off by a special tax?

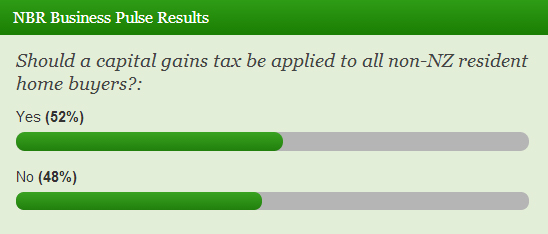

In the emotional debate over house prices, NBR ONLINE readers, by a slim margin, favour a capital gains tax on foreign buyers.

For some, the debate is a red herring, given a BNZ-Real Estate Institute study found 8% to 9% of homes were going to offshore buyers (hard numbers are thin on the ground). Is xenophobic distracting from the core issues of consents and artificial restrictions on land supply?

So far, the Green Party has been most active in trying to crimp the free market, pushing legislation to restrict land sales to foreigners, and floating the idea of a 15% surcharge on non-NZ resident home buyers. NBR's poll indicates such polices could haven broader political currency.

Realsestate.co.nz CEO turned Properazzi founder Alistair Helm begs to differ with readers.

"I think the concept of a capital gains tax applied to non-NZ resident is mad," he tells NBR ONLINE.

"It would be a nightmare to police and would be evaded by the structuring of ownership through a myriad of devices. It's a classic taking a sledgehammer to crush a nut."

Beyond the debate on a special tax for foreign buyers, Mr Helm argues a capital gains tax is wrong for the housing market full stop.

"A CGT is not the solution to dampen the property market," he says.

It would cause some turmoil but in the short to medium term, but in the long term it will become irrelevant as it becomes a recognised and accepted part of property sales.

"Naturally for the amateur property investor it would cause some mild panic but the economy and the property market would potentially be better off without such people, there is a need for private investors but too much of NZ tenanted property rests in the hands of too many amateurs that see short term gains and fail to delver a quality of tenanted housing stock," the commentator says.

"New Zealand would be better off with more patient capital from institutional sources vested in rental property especially the new medium density property of the future of Auckland."

As always, voting was restricted to NBR ONLINE paid subscribers only; 264 participated.

Tue, 25 Jun 2013