Rakon opens $US35m plant in China

The Kiwi-based high technology company has taken its biggest step in ramping up its manufacturing output overseas.

The Kiwi-based high technology company has taken its biggest step in ramping up its manufacturing output overseas.

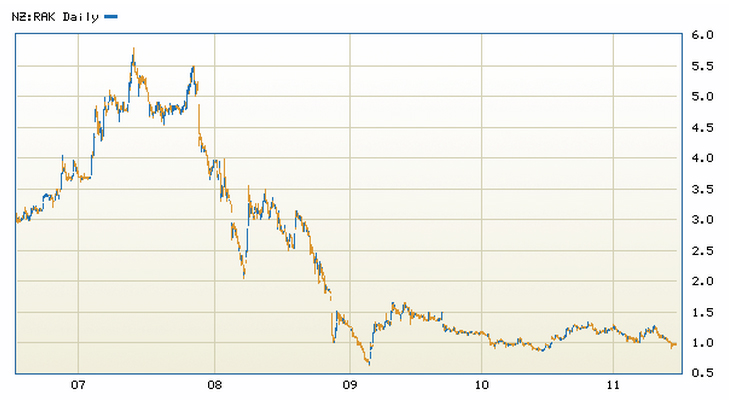

ABOVE: Rakon has wowed the media, and awards show organisers, but investors have been disappointed in the bottom line (chart courtesty NZX.com).

High technology company Rakon has its biggest step toward ramping up its manufacturing output overseas with the opening of a new $US35 million quartz crystal plant in China.

Speaking from Chengdu today after the official opening, executives and directors said the plant was China’s most advanced high-technology factory and surpassed anything the Japanese have.

“We have the most automated plant in China by a large margin,” Rakon executive director Brent Robinson said. “It is actually more advanced than what we have in New Zealand.”

He added that it was also the largest high-technology investment by any New Zealand company in China.

The 85%-owned Chengdu plant already has the capacity to make more of Rakon’s specialist products than in New Zealand and is situated next to the quartz blank factory of the venture’s other shareholder, Timemaker, with a 15% stake.

Quartz blank wafers are main source from which Rakon (NZX:RAK) creates its crystal oscillator products, which are used in a wide range of electronic devices.

“It’s the combination of these two companies [Rakon and Timemaker] that makes this such a formidable business in China and why is has attracted so much attention {here],” Rakon chairman Bryan Mogridge said of local reaction to the venture.

Chengdu, situated in Sechaun province in western China, has a population of 14 million and is aiming to be China’s leading high-tech manufacturing centre.

The Rakon factory is in the same industrial park as Foxcon, which is the main manufacturing plant for Apple products such as the iPhone and iPad. The Foxcon plant covers a total of 2.8sq km, compared with Rakon’s single-floor of 12,000sq m.

The factory is mainly geared to supplying the domestic market, which is one of the world’s largest for cellphones and other hand-held devices, but will also enable Rakon to remain the world’s leading and most cost-effective supplier.

Rakon shares last traded at 98c