Dividends declared as Restaurant Brands hits $1b sales target

The company announced dividends for the first time since 2018.

The company announced dividends for the first time since 2018.

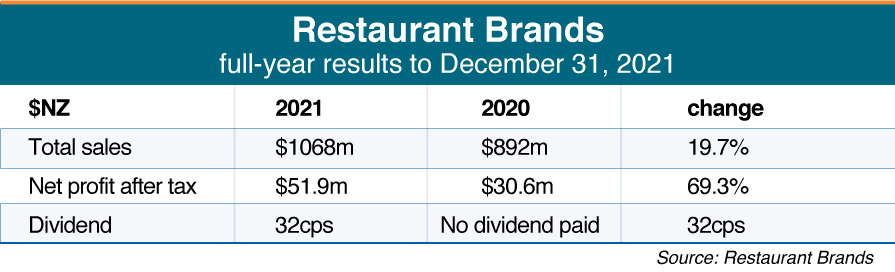

Restaurant Brands has declared an interim dividend for the first time since 2018 after hitting its $1 billion sales target in the 2021 financial year ending December 31.

Restaurant Brands CEO Russel Creedy said New Zealand had taken a bit of a Covid-related hit in sales, particularly during the first lockdown, but the overall health of the company was good.

The NZX-listed group operates a mix of KFC, Pizza Hut, Taco Bell, and Carl’s Jr stores across New Zealand, Australia, Hawaii, and California. Total sales of nearly $1.07b in the year for the group was up 19.7% from the previous full-year 2020 result, while net profit after tax (npat) was up 69.3% to $51.9 million from $30.6m.

Offsetting the adverse Covid impacts, the company saw its federal PPP loan in Hawaii forgiven, which resulted in an additional $11.4m income and the company also received $7.2m in wage subsidies in New Zealand that were fully passed on to staff.

The fast-food company declared an interim dividend of 32c per ordinary share - its first since 2018. The dividend is payable on April 22 to all shareholders registered April 8, 2022. It reported more than 5.6c additional to overseas shareholders.

In 2019 it was reported that Restaurant Brands had deferred paying dividends while focusing on rolling out New Zealand and Australian Taco Bells, US mainland acquisitions, and refurbishments in Hawaii.

Creedy said the company had decided to resume paying them this year following growth and profit from overseas, including strong sales in Hawaii and California, and Covid-19 having an impact on further acquisitions.

Due to Covid-19 and the inability to travel, the company hasn’t been able to complete as many acquisitions as it usually would - only about seven in Australia and the US.

New Zealand

Total store sales in New Zealand were $461.1m, up 12.4% year-on-year. The 2021 result was affected by the level 4 lockdown across the country (including an extended lockdown in the major Auckland region, which resulted in lost sales of approximately $26m).

During 2021, two poorly-performing Carl’s Jr stores rebranded as Taco Bell and KFC but, despite this, Restaurant Brands has plans to open two new Carl’s Jr stores in the country.

“We still have a good appetite for Carl’s Jr,” Creedy said.

Taco Bell is a growing brand for the company, with four of the six stores opened in 2020 meeting expectations. It also opened three new Taco Bell stores in the South Island.

In 2021 Restaurant Brands sold seven Pizza Hut stores to franchisees, continuing to sub-franchise the brand.

Overseas

Offshore expansion remains key for Restaurant Brands.

In New Zealand dollars, the Australian business contributed total sales of $244.1m up 13.6% year-on-year, largely due to additional store openings over the year and the acquisition of five Sydney stores in February 2021 that have traded above expectations.

Creedy said the US and California has more space for growth, and he predicts the US will become its biggest market.

In NZD, Hawaiian operations contributed $206.5m in revenue. While reported sales in New Zealand dollars were down $8.6m due to the strengthening NZD/USD exchange rate, they were up by $US7m in $US terms.

Delivery and online ordering options has proven popular with both Taco Bell and Pizza Hut customers. The Pizza Hut ordering system now accounts for more than 60% of orders performed online.

The California operations contributed $156.5m in full-year revenue. Restaurant Brands saw higher sales and consumer spending in the US, coinciding with stimulus payments.

Two new stores were acquired during the year. More capital expenditure is planned for this market, including new store builds.

Creedy said that three new KFC stores are expected to open in the first quarter of 2022.

Looking forward

In terms of outlook, Creedy is concerned about the Russian/Ukrainian conflict pushing up the price of wheat and grain. While he does not believe the company will be directly affected by this, he is concerned about pressure on other markets and growing food instability.

Supply chain issues and the changing nature of the pandemic are also concerns.

The focus for Taco Bell in New Zealand and Australia continues to be investing to build brand presence with about 15 new stores expected to open by December 2022. The brand contributed $25m in sales during the 2021 financial year - still a small financial impact on the overall group at this stage.

The company said while trading remained strong across all divisions, due to the continued uncertainties from the pandemic, it was too hard to provide firm guidance for the 2022 financial year.