“If Xero doesn’t start achieving serious traction in the US soon, my concern is that they never will,” says Woodward Partners Securities analyst Nick Lewis.

There is a real risk that Xero will run out of time to execute in the US he says as it's comprehensively out-spent by the incumbent Intuit [NAS:INTU]

And if that turns out to be the case, Mr Lewis warns the company’s share price could fall to the mid-teens.

Earlier today, Xero broke out numbers for the North American market for the first time as it delivered an operational update on revenue, profit and customer numbers.

The company said it had 18,000 paying North American customers as of March 31 (a 200% increase year-on-year), and revenue from the territory of $3.3 million (a 154% increase).

Mr Lewis tells NBR he would like Xero to break out how many of the 18,000 are in the US, and how many in Canada.

But even if all 18,000 are in the US, it should have been double that number given the time, money and human resource Xero has put into the country, he says.

Previously, Mr Lewis has raised the “small red flag” that Intuit – which holds a near-monopoly on the small business accounting software market – might kick back.

Now, he says, “Intuit has definitely woken up … they’re disrupting their own business and moving desktop customers to the cloud.” (Intuit says during its January quarter, numbers on its QuickBooks Online cloud product increased 45,000 to 591,000).

And it's true that Intuit no longer looks so flat on its feet. This week, Xero announced a new partnership with hot mobile payment startup Square, founded by Twitter alumnus Jack Dorsey - but Intuit rained on its parade, announcing its own Square hook up the same day.

$US2.5 billion cash

Right now, Intuit has around $US600 million in cash. In two weeks, as it closes its April quarter, it will have around $US2.5 billion, he says – dwarfing Xero’s $210 million (the reason is that Intuit’s Turbo Tax product is its cash cow, and revenue from the product is highly compressed over the tax season; a lot of the loot from last year was used for share buybacks).

Increasing aggression, price war fears

Another concern: Intuit has become “extremely aggressive outside the US” he notes. A $A4.99 a month Intuit QuickBooks Online offer recently launched in Australia is bad news for Xero and regional rival MYOB he says – and he’s wondering if Intuit will get more front-foot with pricing on its home turf. QuickBooks Online has a knockdown price, but also a recognised brand of 30 years behind it, and Mr Lewis considers that it can match any cloud feature offered by its rivals within two to three months, leading to what he calls a “race to the bottom.”

Why would Xero run out of time in the US market? Mr Lewis says the opportunity is smaller than it appears.

It’s widely quoted that there are 19 million small businesses in the US.

Mr Lewis says 9 million of those small businesses are sole traders – a market not in Xero or Intuit’s sights.

And of the 10 million that remain, around 5 million are using Intuit’s desktop product, and he sees a bias toward them upgrading to its cloud product.

With its daily TV ads – and recent $10 million Super Bowl splurge – Intuit is moving the process along he says.

The rise of the cloud has prodded many to reconsider what accounting software they use, he says. But overall, the category is sticky. Once people have settled on a cloud accounting solution, they won’t want to go through the hassle of changing vendors for years. Xero must push hard, and soon.

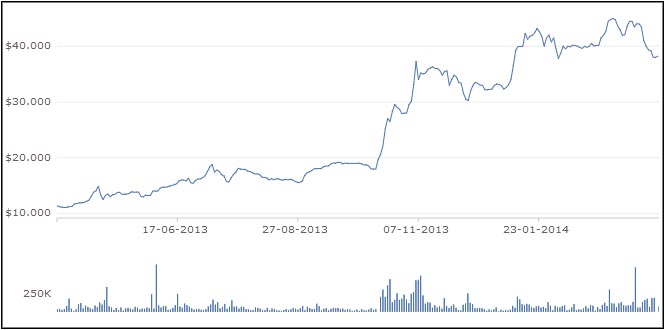

Woodward Partners Securities currently has a “reduce” rating on Xero and a 12-month target of $27 (in late trading today, Xero [NXZ:XRO] was up 0.81% to $37.50)

Mr Lewis’ comments come on the heels of Goldman Sachs initiating coverage (ahead of today's release) with a "sell" rating and a 12-month target of $32.23.

Goldman analyst Robbie Aitken wrote, "Previously Xero provided a less expensive option to play the growth in cloud accounting software, but at current levels given we believe investors are already paying over the odds."

Ahead of today's operational update, brokers had the following ratings for Xero:

- First NZ Capital: Outperform; 12-month target: $45.70

- Goldman Sachs: Sell; 12-month target: $32.23.

- Woodward Partners Securities: Reduce; 12-month target: $27.00

- Forsyth Barr: Underperform; 12-month target: $24.75

Xero 12-month price history (NZX.com)

Earlier, chief executive Rod Drury told NBR that his company could not mount a full-force push in the US until it added support for payroll, which has to be customised state-by-state. Since late last year it had been in the process of rolling out the feature for several states.

Xero is in the process of increasing its US staff numbers to around 200. It recently recruited Peter Karpas - formerly chief marketing officer at Intuit - to head its North American operation and the New York-based Chris Liddell to be its new chairman.

Mr Drury has also argued that there is widespread dissatisfaction with Intuit that his company can exploit, just as it did in Australia against MYOB and the UK against Sage.

The CEO says Intuit has sidelined accountants; Xero is re-engaging in the accounting software process and turning them into advocates for the product in the process.

Mr Drury has also said his company has raised increasing amounts of capital each year, and could easily raise more if required; a Nasdaq listing is a possibility once revenue tops $US100 million he says.

He also points out that Xero has only just brought on key staff in the US, including one-time Intuit CMO Peter Karpas - who now heads Xero's North American operation - and New York-based chairman Chris Liddell (whom Mr Lewis does rate strongly for his investment community ties; Mr Liddell lead GM's post-bankruptcy listing - the largest IPO in US history).

Xero global strategy head Chris Teeling has also argued to NBR that Intuit has lead its investors to expect constant profit growth - so it can't afford to take a hit in its legacy business, or wrack up losses in a bid to accelerate migration to the cloud.

Full circle

For his part, Mr Lewis has come full circle.

On December 19, 2012, as Xero's share price hit $7.70, pushing it to a $890 million market cap, Woodward Partners put a "buy" rating on Xero and a 12-month target of $12.00.

At the time, it seemed outlandish.

And more so, Mr Lewis' prediction that the company could ultimately go to $6.4 billion by 2019 amid Nasdaq listing hype.

In the the event, Xero sailed over the $4 billion mark by October 2013. And on March 6 this year, Xero hit an all-time high of $45.01 in midday trading for a market cap of $5.74 billion.

But since it's hit those heady levels - prodding the possible response the Woodward man has always feared from Intuit - Mr Lewis has become increasingly bearish.

Fri, 04 Apr 2014