Xero hits $70m revenue target, doubles loss to $35m

The $5 billion company breaks out North American numbers for first time | Goldman Sachs initiates coverage with a "sell".

The $5 billion company breaks out North American numbers for first time | Goldman Sachs initiates coverage with a "sell".

LATEST: Analyst sharpens concerns about Xero’s US prospects, sees possible shareprice fall to mid-teens

Xero has nosed ahead of its target to increase revenue by 80% in FY 2014.

Revenue to March 31 grew 83% to $70.1 million, the company said in a statement this morning.

Revenue from monthly subscriptions to Xero's cloud accounting software reached an annualised $93 million as paid customers rose to 284,000 - up from the 250,000 reported in February and the year-ago 157,000.

The company has yet to finalise its profit/loss number. It expects a full-year net loss of $35 million.

Last year, it lost $14.4 million.

Xero had given not profit/loss guidance for the period, other than that it expected a "wider loss."

The company did not break down its spending but did say that headcount increased from the year-ago 382 to 758.

Late last year as staff hit 700, CEO Rod Drury told NBR he expected that number to double again over the next 18 to 24 months.

The company had $210 million cash on hand following a $180 million capital raising in October, up from the year-ago $78 million.

No profit or revenue guidance was given in today's update.

Modest North America numbers

For the first time, Xero broke out numbers for the North American market. Analysts says cracking the US is the key to Xero justifying its heady market cap - as well as paving the way for a Nasdaq listing.

The company said it had 18,000 customers in North American (up from the year-ago 6000), generating $3.3 million revenue.

Recently, Intuit - which holds a near-monopoly on the North American small business accounting software market overall - said paid subscribers to its QuickBooks online product increased 45,000 to 591,000 in the three months to January 31.

Click to zoom.

Earlier, chief executive Rod Drury told NBR that his company could not mount a full-force push in the US until it added support for payroll, which has to be customised state-by-state. Since late last year it had been in the process of rolling out the feature for several states.

Xero is in the process of increasing its US staff numbers to around 200. It recently recruited Peter Karpas - formerly chief marketing officer at Intuit - to head its North American operation and the New York-based Chris Liddell to be its new chairman.

The company will deliver more detail with its annual report, due May 22.

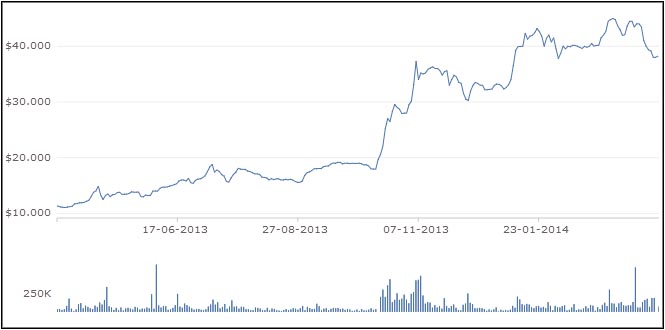

Xero 12-month price history (NZX.com)

Shares rise

Xero has been the top perfomer on the NZX over the past 12 months, rising 229%.

On March 6, Xero hit an all-time high of $45.01 in midday trading for a market cap of $5.74 billion.

But over the past week the stock has pulled back by about 9%.

An equity analyst who did not want to be named told NBR that Xero had been caught up in a global trend over the past fortnight to sell down tech and biotech holdings.

Goldman Sachs - sell

Another negative factor: Goldman Sachs initiated coverage (ahead of today's release) with a "sell" rating and a 12-month target of $32.23.

In early trading today, Xero [NZX:XRO] was up 2.15% to $38.00 (for a $4.85 billion market cap), reversing some of its recent decline.

Goldman analyst Robbie Aitken wrote, "Previously Xero provided a less expensive option to play the growth in cloud accounting software, but at current levels given we believe investors are already paying over the odds."

Ahead of today's operational update, brokers had the following ratings for Xero:

First NZ Capital: Outperform; 12-month target: $45.70

Goldman Sachs Sell; 12-month target: $32.23.

Woodward Partners Securities: Reduce; 12-month target: $27.00

Forsyth Barr: Underperform; 12-month target: $24.75