It is the prospect of a 350% return on investment, Lamborghini Huracans and crown diamonds that brings me to Mount Smart’s East Lounge.

The haka and the police arrest turn out to be an added bonus.

I arrive ahead of time and dressed for the occasion, wanting to look the part for the multi-level marketing event of the year, Validus’s Spring into Summer Tour 2022.

Fresh shirt, pressed pants, polished leather shoes, and a blazer jacket to boot.

Validus has been hot on my radar for some months now. I have attended a small meeting, watched all the presentation videos online, and read up as much as I can.

Our local regulator, Financial Markets Authority, has issued a warning about this multi-level marketing scheme, the Australia financial regulator says it has the characteristics of a pyramid scheme, two of its three founders were connected to the infamous OneCoin scam, and another company called Validus has put out a press release saying this Validus is impersonating it online.

For all I know, there’s so much I don’t.

Just how big is this thing in New Zealand? How do these big events actually work? Who is the audience?

On top of that, a member of Validus’s top brass is going to be in the building.

Co-founder and chief networking officer Parwiz Daud has been on a tour throughout the Asia-Pacific region promoting Validus and is due to speak, along with some of the company’s most senior operators.

The welcome

I had hoped to interview Daud but am told on the door, no interviews. No reason given. Alas.

But I’m allowed inside, and make sure to get a good seat in the middle of the crowd to wait eagerly for the event to start.

Loud music is being blasted by the DJ in the corner of this long rectangular room and I almost forget I’m at a conference because this feels more like a party.

The audience slowly builds over the next half hour so, bolstered by kids, teenagers, young people, mothers, fathers, and grandparents.

I am a brown face in a sea of brown faces. The older couple behind me confer in Tongan.

Four white people can be counted in the room, excluding the camera operators.

Soon the seating is nearly at capacity, there’s more than 250 people here.

To our right, a group of teenagers, wearing piupiu and tāniko tātua, begin to position themselves.

The music fades and the crowd’s rumblings fall to a whisper as Daud and his disciples begin to walk into the room. They have an air of celebrity about them as they are greeted with a hair-raising haka and waiata.

A suitable way to start a multi-level marketing conference, seemingly.

At least 250 people showed up to the Validus event at Mount Smart.

The pitch

After the pageantry is over and the royalty have taken their seats, Souai Tito steps onto the stage.

She is a 40-year-old, Christchurch-based self-described “woman of integrity” who got into Validus after she grew tired of working herself to death in her nine-to-five job at a call centre for the past 20 years.

“I want to start building this because I want to provide financial freedom for myself, my family, and 10 generations to come,” she says.

She opens with a very important financial disclosure: “This is not financial advice.”

She goes on to say Validus was founded in 2021 by Mansour Tawafi, Parwiz Daud, and Howard Friend and was officially launched this year.

The Validus team.

She says the business is registered in the United States and headquartered in Dubai.

Validus is a trading academy, which sells financial trading courses, she says.

That’s it. That’s the product.

Where things get interesting is these courses or “packages” can only be purchased with cryptocurrencies and range in price from US$50 all the way up to a whopping US$10,000.

She doesn’t explain why I have to pay in crypto, nor does she say what the courses involve, who put them together, or why some of them are worth US$10,000.

But there’s no time to dwell on that because she reveals on the next slide that 100% of the money spent on a package is invested in what is called the “Validus Pool” – a smorgasbord of cryptocurrencies, equities, forex, NFTs, and decentralised finance for which I can receive a 2% to 3% return each week for 60 weeks.

The Validus Pool.

I can withdraw my funds every week but will be hit with a 5% withdrawal fee (ouch) so it’s best to leave my money in the pool so my returns can compound, resulting in a spectacular 350% return on investment.

How they achieve such stunning results, Tito won’t say, and it seems it doesn’t matter because there are five additional income streams to cover.

Residual income(s)

For this, Validus retires Tito and brings out the big guns.

Cue Sydney-based Validus promoter, introduced as “John ‘the Money Man’ Martinez”, who struts on stage as hip hop group Migos rings out through the speakers:

“No Master P/10 bad bitches and they after me/One bad bitch looks like a masterpiece.”

The crowd goes wild. It’s contagious.

Money Man Martinez gets under way with the obligatory disclosures.

“First of all, Validus is not an investment company, it’s not a trading platform, and we don’t give financial advice.”

Less than 30 seconds in, and Money Man Martinez has just contradicted Woman of Integrity Tito, who just told us before how the company invests the money spent on packages into the “Validus Pool”.

Contradictions aside, this chap – who is wearing a tight three-piece suit and loafers – has the gift of the gab.

He says he has a background in finance and sales and was relatively well-off, but his circumstances changed when he and his wife decided they wanted to start a family.

“How many people here can relate? Going on a single income but having multiple mouths to feed?”

He’s met with a number of cheers.

“If most of you were doing well, you wouldn’t be here right now.”

Oof, that’s a bit harsh Money Man.

But Money Man Martinez tells us not to worry because Validus is the answer to all our financial fears, with its multiple income streams.

First, there is the direct bonus. If I recruit someone else to buy a package, l can receive 10% of the total value of the package they have paid for. Easy.

As Money Man points out, Netflix does not pay me when I tell my friends about a great series I have just watched, nor does a restaurant I enjoy cut me in when I recommend it to my friends.

Money Man thinks that’s a bit stink and the good folk over at Validus want me to be rewarded for spreading the good word.

Then there’s the network bonus.

Validus’s Network Bonus.

As the diagram that definitely does not look like a pyramid shows, each person I recruit is added to the next available space on my downline.

Each week, the boys over at Validus will pay me 10% of whatever leg has the lower value. Of course, it makes sense for me to keep recruiting every week because why would you turn down the opportunity to make $10k in seven days, as their example shows.

It is revealed that the maximum amount I can make from bonuses is five times the value of the original package I purchased ie, if I drop US$1000 on an education pack, the maximum I can earn is US$5000.

For me to continue to make these sweet returns from my recruits, I have to repurchase another package and hopefully my recruits will do the same again, thus earning me another 10% for each person who does so. Huge.

Enter the Matrix

This is where the shit gets crazy.

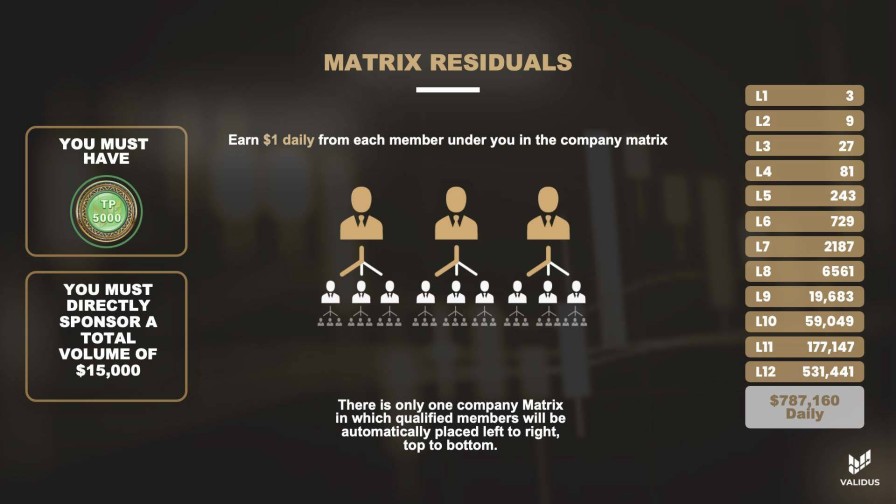

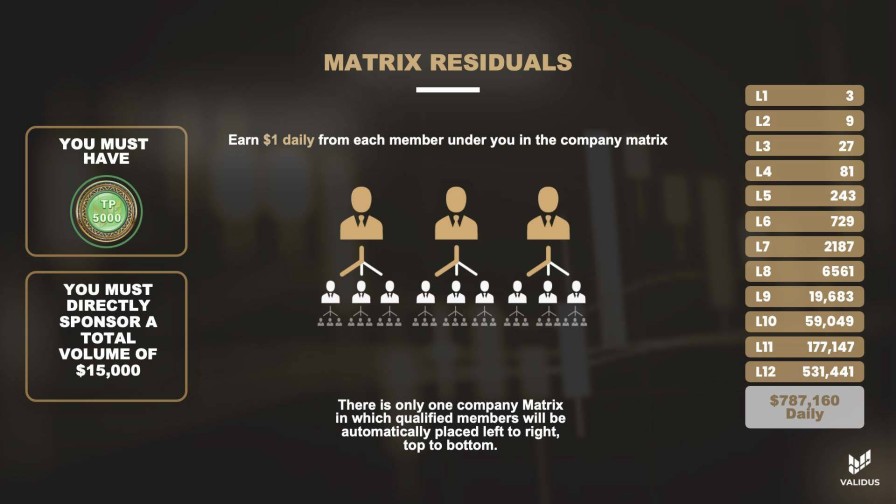

The Validus Matrix.

It’s difficult not to worry when the words ‘matrix residuals’ sit above a diagram that definitely does not look like a pyramid.

To qualify, I must have dropped US$5000 on a package and the total value of the packages of the people directly underneath me must be US$15,000 or higher.

The reward?

I get to enter the global Validus matrix.

How it works is, after I enter, I can start earning US$1 a day per available position that is filled in the level below me.

So, I could earn US$3 per day from level one when all the positions are filled. Once level two is filled, I get US$9 a day plus my $3. When level three is complete, I earn US$27 plus US$9 plus US$3 and so on for another 12 levels.

“It’s crazy right?” says Money Man Martinez.

Yes, Money Man that is crazy.

If I can get in early enough on this thing and I could be making $787,000 a day.

He says the matrix has nothing to do with recruiting for it to grow, rather it comes down to whether people choose to qualify or not.

However, there is every incentive for me to encourage other people not just to sign up but fork out the big bucks so they can meet the criteria and hopefully get them slotted after me in the matrix.

Before I can wrap my head around it all, Money Man Martinez hits us with the killer sales pitch.

“How many people heard about bitcoin in like 2010, 2011?”

A bunch of hands go up.

“Why didn’t you invest? Because you thought it was a scam! Ask yourself, how much did it cost you to miss that opportunity, and how much would it cost you now to miss this opportunity?”

Nice one, Money Man.

Good habits

Validus, in the spirit of good financial habits, is worried I might spend all my newfound wealth in one go, so takes it upon itself to hold 30% of all bonuses I earn in what is called a “passive wallet” and pays me out 10% of its value each month for 13 months.

I am a little upset Validus can just hold back 30% of my hard-earnedbonuses without my consent. I wish they would tell me where in the world my money is being held, how it is being secured, and if they will be doing anything with it.

You see, the idea of having my money tied up with a non-bank deposit taker that is not beholden to my local financial regulator makes me nervous, especially following the collapse of FTX.

Ranks and rewards

Finally, because no reputable multi-level marketing scheme is complete without one, there’s the ranking and reward system.

The ranks have an air of glamour to them.

At first there is Jade: to qualify, the total value of both my left and right downlines must be more than US$5000 each. There’s no reward for being a Jade, which is a bit rough, but if I graft and recruit hard enough, I can hit Sapphire and receive an Apple watch or US$250. Not bad.

There are another five levels of this gem-encrusted ranking system for me to climb before I reach the god tier, Crown Diamond.

Crown Diamond.

I will be honest, owning a green Lamborghini Huracan is not something I have ever thought about but now I am thinking about it.

Money Man Martinez reassures me: “Crown Diamond is very, very possible to achieve.”

This possibility only requires all the people in my downlines to have spent a total of US$16m in Validus packages.

I do a rough calculation. I would only need to convince 20,000 people to spend at least US$800 on Validus packages and the Lamborghini is mine.

Unfortunately, that concludes Money Man Martinez’s section of the show, and I am going to miss him.

Before he goes, he leaves me with a gem of wisdom: “For those of you who are here, you are here for a reason. Think of where you were five years ago, spiritually, financially, physically, emotionally, and look at where you are today.

“Five years goes past in a blink of an eye.

“How many times have you said, ‘I’m going to start my new year’s resolution’ and never completed it?”

Guilty as charged, Money Man.

“Look at the next five years … If not much is going to change, what have you got to lose by giving this a go?”

The grift

At this stage, I have been at this meeting for two hours and I have yet to learn anything I don’t already know.

The only promise I have is when Parwiz Daud, the guest of honour, takes the stage to the tune of Queen’s ‘We Will Rock You’.

He proceeds to speak for 70 minutes and, thankfully, he adds a few more pieces to the puzzle.

In the past 11 or so months, the company has 300,000 members in more than 190 countries and has pulled in $100m in revenue, he says.

Now this I struggle to get my head around, because it’s not clear how this company actually pulls in that much revenue.

The packages I pay for can be booked as a sale. But then what?

The company proceeds to invest my money and will pay me out 350% on my investment in 60 weeks.

The only income generation I can see comes from the 5% withdrawal fee it charges. Is that really it?

Doubts aside, Daud says the business will have one million members by 2024 (which is a bit of a slowdown in growth really, given they pulled in 300,000 people in 11 months) and will achieve $1 billion in revenue.

Validus road map.

Block out the haters

The brief financial component of his spiel is over. The rest is an impassioned and punishing masterclass.

Parwiz Daud in action at Mount Smart.

I am challenged over what I will be remembered for, what will be my legacy?

I am told to overcome my fears of trying something new and to stop being afraid of being successful.

Everything he says feels like a calculated and relentless attempt to break down any reservations I might have.

My favourite part is when Daud tells me about the haters I will encounter on my path to success as a Validus promoter.

“Some people think they are so smart; in two minutes they want to prove you wrong. IN TWO MINUTES!

“[They] pick up the phone, they search Validus [and say] ‘it’s a scam, it’s a scam!’.

“If this company is doing something good, delivering something good, instead of you coming to us, talking to the company, this person [doesn’t] do it.

“At the end of the day, who is responsible for paying your bills and my bills? Who is responsible for your future success? Why are you scared? Allow yourselves [to] learn, allow yourselves [to] see what this is.

“If you think I believe we’re doing something wrong then let us speak so we find the correct way.”

It is an annoying admission, given that Validus organisers declined my request for an interview with Daud because I had so many questions for him.

Questions remain

I wanted to know why it was when you Google the one American residential address posted on one of the company’s several websites, several other firms come up with the same address.

I wanted to know why his firm was offering financial services but had not registered with any of the financial regulators in the countries in which it was operating.

I wanted to hear his response to a warning by the Australian Securities & Investment Commission that Validus “had classical signs of a pyramid scheme”.

I wanted to know why it seemed as if the only way to make money in Validus was to recruit others to join.

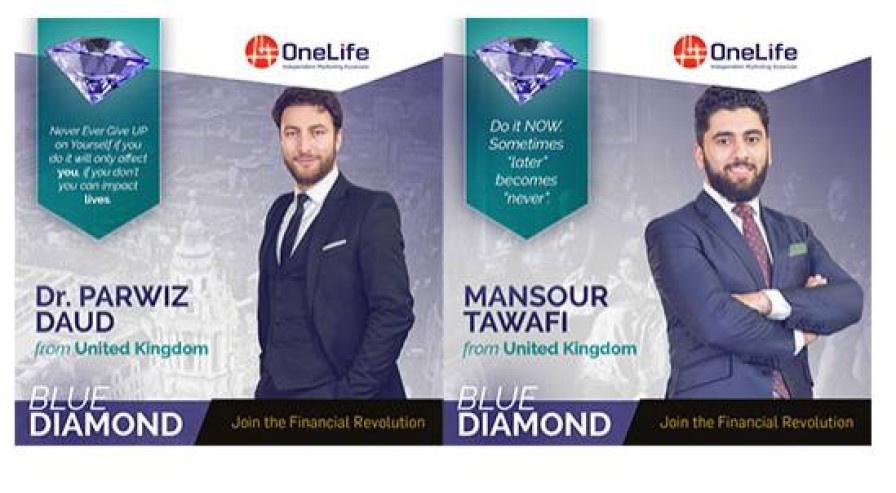

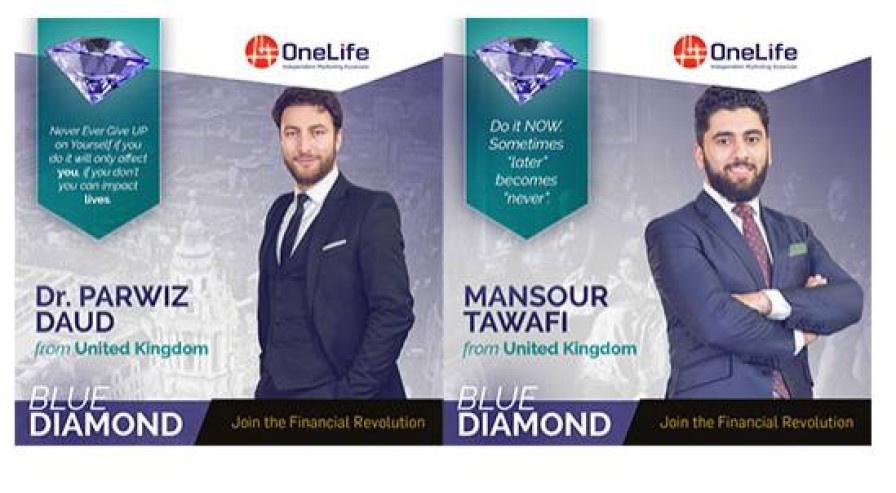

Parwiz Daud and Mansour Tawafi actively promoted OneLife, the multi-level marketing scheme associated with the OneCoin ponzi scheme.

I wanted to ask him about his and Mansour Tawafi’s involvement in the promotion of OneLife, the pyramid scheme that was associated with the infamous crypto ponzi scam OneCoin that saw people around the world lose millions.

‘Crypto queen’ Ruja Ignatova and Parwiz Daud in Sofia, Bulgaria, 2016.

I wanted to show him this picture of him with the crypto queen herself, Ruja Ignatova, to ask about his relationship with her and whether he had any knowledge about her whereabouts since she disappeared off the face of the earth five years ago.

I wanted to hear why it seems Validus only attracts people of colour.

I wanted to hear why the company shared the same name with Singapore-based business finance firm, Validus.

And I wanted to know if he truly believed the words that came out the mouths of people talking at this event.

Outside

While I was soaking up all the good vibes inside Mount Smart’s East Lounge, little did I know what was kicking off outside.

Tionly Fatukala and Alani Taione had tickets to the meeting and had planned to stage a protest. They were both recognised and were banned from entering.

That was when Taione pulled out his phone and started going ‘Live’ on Facebook.

When you watch the video you can see Taione yelling: “These scammers enter the border of New Zealand and that’s what concerns me … the criminals are in New Zealand.

“They come here and run their programmes and that’s why we want to alert the people in authority.

“These people will come and scam and take the money from the most vulnerable people of Tonga, and not only the Tongan people.

“I want you to share this with the world.”

The thing is, the relevant authorities already know about Validus.

On September 15, the Financial Markets Authority issued a scam warning on its website, saying it was aware seminars had been held in New Zealand to promote and offer financial services without being registered.

Despite the warning, NBR is aware of more than 20 Validus meetings that have taken place since then across the country.

More recently across the Tasman, the Australian Securities & Investments Commission put out a warning of its own, saying the returns promised by Validus should be treated with “extreme caution” and the encouragement to recruit new investors was a “classical sign” of a pyramid scheme.

Regulator, where art thou?

Tionly Fatukala became concerned about Validus when she saw a woman who scammed her out of $18,000 last year promoting the scheme.

She told NBR she rang the FMA in advance of the Validus Summer Tour event at Mount Smart and asked them what they were going to do, given they had already put an alert up.

They sent me an email thanking for the information, she said.

“I am so disappointed that the FMA didn’t act upon this. I went to the police; they failed. I went to the Serious Fraud Office; they failed.”

The FMA responded to NBR questions saying inquiries are confidential but did add the information it had indicates Validus may be a pyramid scheme, so it had passed the baton onto the Commerce Commission, which regulates these sorts of things.

To which the Commerce Commission says it received one enquiry regarding Validus – from the FMA – but it did not currently have an investigation under way.

“However, we continued to assess any information as it comes through.”

Meanwhile, a spokesperson for the Serious Fraud Office said it does not generally confirm or deny information about complaints or investigations.

Enforcement gap

Tionly has highlighted a weak spot in our regulatory system when it comes suspicious overseas investment schemes.

For one, the FMA and the Commerce Commission have different regulatory mandates.

The FMA is concerned with unlicensed financial products and harmful financial advice but doesn’t touch suspected pyramid schemes.

That falls into the lap of the Commerce Commission.

Validus warrants an investigation on both counts.

When it comes to enforcement, the regulators can issue stop notices, which, as the name suggests, directs the person in question to literally stop what they are doing or face a court penalty.

But an investigation has to take place before that can happen. Until then, events such as the one at Mount Smart can go on without interruption.

In this context, it is encouraging to see one arm of the Government did come to the event that Saturday.

The police arrived shortly before 2pm, following a call from security at the event.

But they were there to arrest Tionly Fatukala, who had been screaming at the event organisers, threw a chair at the entrance gate, and spray painted on the pavement, “Validus is a Scam”.