Court hears appeal application in Gibbs family trust dispute

Ant Gibbs wants to remove his mother and sister as trustees claiming unfair treatment.

Ant Gibbs wants to remove his mother and sister as trustees claiming unfair treatment.

A dispute over a family trust set up by the late Tony Gibbs and his wife returned to the High Court this morning over an application for leave to appeal an earlier ruling.

Media were barred from the chambers hearing and a related case was adjourned this afternoon, but details were traversed in a High Court judgment from Justice Christine Gordon in September last year.

The plaintiff in the case was Gibbs's son Ant, who sought to remove his mother, sister and a lawyer as trustees of a family trust he claimed was worth $200 million, citing unreasonable treatment.

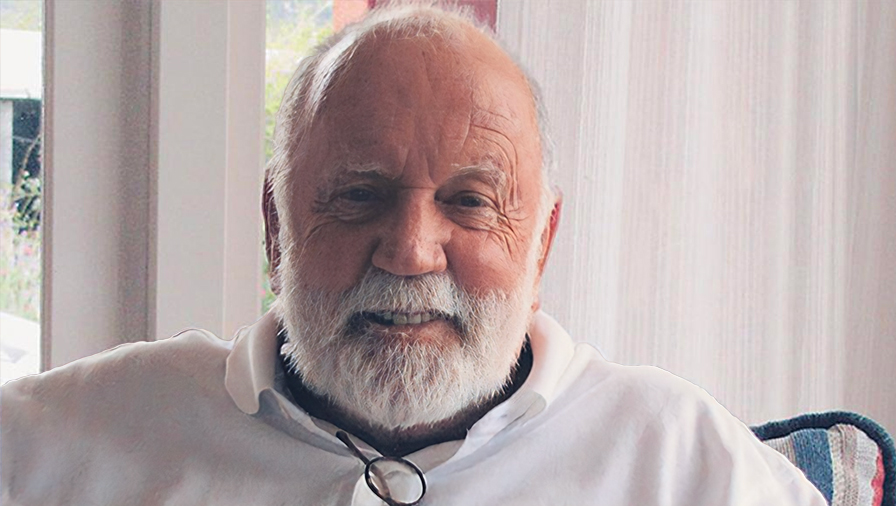

Tony Gibbs, a New Zealand business icon and dealmaker, died in June 2020.

A family trust, Ruby Cove Legacy Trust, was set up in 2015 with its primary assets being mandarin and avocado orchards. According to its founding principles it was not set up to fund lifestyles of beneficiaries unless there was a genuine need for support.

Ant, a qualifying discretionary beneficiary of the trust, was seeking to remove his sister Charlotte and mother Val, as well as lawyer Joseph Windmeyer, as trustees of the trust, stating the trustees could not act and were not acting fairly or reasonably towards him, were hostile to him, and were unable to act impartially or in good faith towards him.

He said he also believed Charlotte and Val had a conflict of interest as beneficiaries and should also be removed as trustees on that basis.

Ant's claim sought to rely on certain correspondence and the earlier hearing traversed whether the evidence was protected by settlement privilege under the Evidence Act.

The claim, opposed by the trustees, wanted privilege set aside because its maintenance would provide "a cloak for unambiguous impropriety" and it should be disallowed under the dishonest purpose test in the Act.

The court heard the trust purchased Ant’s house following the breakdown of his marriage and he receives a weekly payment. He was the only beneficiary receiving material distributions from the trust, though it is used to pay for schooling of Ant and Charlotte’s children. Val also lives in a trust property.

Orchard work

Ant had previously worked at the family’s orchard, but his admittedly “combative” style had led to a series of disputes, including one with his father in May 2020 that saw his father remove his position in the business, last year's judgment says.

Val claimed that when Ant had no other employment, Tony tried to involve Ant in the orchards. She said for periods it would work quite well, but ultimately it would break down and Ant would leave.

She described his employment in the orchards as occasional and generally only for relatively short periods, the judgment says.

Following Tony’s death, Ant was brought back on board, but Val said once again his behaviour, including towards staff, had made it impossible for him to be involved.

Around this time, Ant arranged to meet with Windmeyer and requested his weekly sum be increased, saying he had turned down a job offer but expected to find a new position in two or three months and that there was no role for him at the orchard.

Windmeyer said that acknowledging there was no place for Ant at the orchard may have upset him.

After some correspondence and Ant’s engaging of a QC to understand his place as a beneficiary, Windmeyer says he received a “very abusive” phone call from Ant.

He said that Ant told him the value of the Trust assets totalled some $200 million, that he and his mother and sister should be treated equally and that he had a legal opinion that he was entitled to his share of the trust and he wanted it.

Ant’s version of events involved Windmeyer questioning whether he was looking to break up the trust. Ant said he responded by saying it was not his intention because he knew the trust was a legacy trust to benefit the future family.

Windmeyer said that he was left in no doubt from what Ant said that he wished to receive one-third of the assets of the trust, though Ant said he had repeated that he did not intend to break up trust assets.

Windmeyer also said Ant later called to apologise for the call, but Ant did not comment on that point.

Val also gave evidence that Ant wanted to break up the trust, which would be impossible without the sale of assets.

Legal proceedings

Ant engaged Vanessa Bruton, a QC specialising in trust law, to act for him and in February 2021 made a proposal for settlement, which included distributions of $10m to him personally or to a trust for he and his son’s benefit, including three properties and cash payments of close to $5m.

Under the proposal, Ant would remain a beneficiary of the trust but would agree to not approaching the trustees for further financial or other assistance for a period of 10 years from the date of settlement or the date of Val’s death.

After the offer was rejected Ant launched the legal proceedings to remove trustees. He said the issues would be resolved if one-seventh of the trust assets were resettled for his benefit and the benefit of his descendants with him as one of the two trustees.

The trustees said this proposal directly contravenes the guiding principles of the trust.

In the September 2021 judgement, Justice Gordon dismissed Ant’s application, finding the claim fell "well short" of the threshold for "unambiguous impropriety" or "dishonest purpose".

The judge also did not accept that a family trust dispute deserved less protection from privilege than a commercial dispute.

"Parliament has specifically encouraged alternative dispute resolution because of the extent of contentious family disputes coming before the courts," she said.

The judge said privilege would not be set aside and privileged material would be struck out of Ant's affidavit of May 2021.

The matter of access to trust information was the subject of a separate interlocutory hearing, the judgment said.

Sign up to get the latest stories and insights delivered to your inbox – free, every day.