Inflation genie outwits central bankers

Former Bank of England governor defends Covid response, spruiks climate change.

Nevil Gibson speaks with Fiona Rotherham

Former Bank of England governor defends Covid response, spruiks climate change.

Nevil Gibson speaks with Fiona Rotherham

Central bankers are grappling with the first global outbreak of inflation since it was defeated by monetary policy in the 1990s.

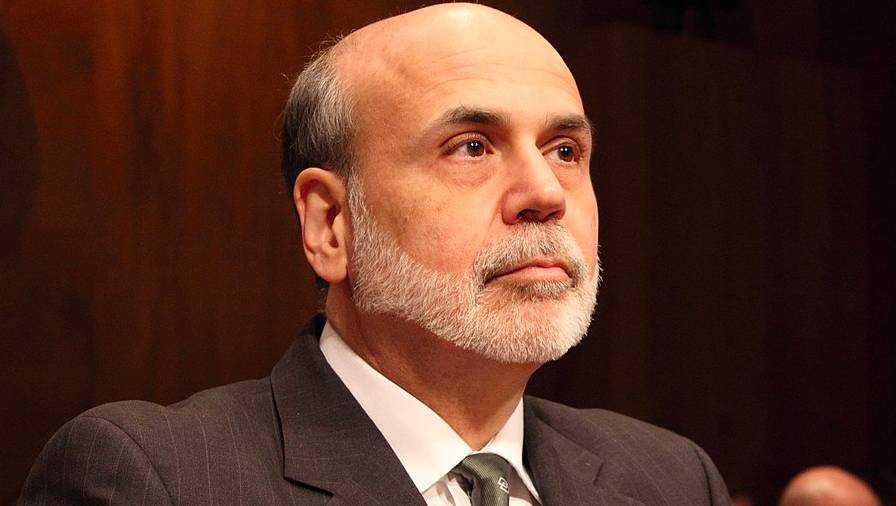

It is hard not to conclude the inflation resulted from the response of central banks to the Covid-19 pandemic. This explanation comes from the doyen of central bankers, Ben Bernanke, who chaired the US Federal Reserve System from February 2006 to January 2014.

Writing in Barron’s, Bernanke asked whether the Federal Reserve’s new framework, called flexible average inflation targeting, was responsible. This differs from the traditional model by allowing inflation to run above the target rate of 2% if it had persisted for some period under that rate. Under the traditional model, inflation was shut down regardless of the past.

It is apparent in the US, as in other Western economies, that central banks did not act quickly enough to end easy money policies and combat fiscal extravagance employed during the pandemic to assist post-lockdown recoveries.

Former US Federal Reserve chair Ben Bernanke.

Bernanke concludes the “unusual effects” of the pandemic caused central bankers to give economies a chance to recover, particularly when labour markets were experiencing shortages due to a reluctance or inability of many workers to go back.

A broader picture of this and many other issues is contained in Mark Carney’s doorstopper Value(s): Building a better world for all, a hefty volume that combines economic history with a personal memoir and a call to action over climate change.

Value and values

The clumsy title is a reference to Carney’s distinction between value as an economic concept and values that are basis for a thriving society. He has been the top central banker in Canada, where he was born, and in the UK. Before that he spent 15 years at Goldman Sachs.

Carney is now the world’s ‘fixit’ man on the financing of global climate action as the UN’s special envoy. He is also head of ESG (environment, social, governance) at Toronto-based Brookfield Asset Management.

Mark Carney began his financial career at Goldman Sachs.

His front-row seat during the credit crisis of 2008-09, Brexit (he was opposed), the Covid pandemic and now the transition to carbon-free economies gives him plenty of justification to lay out the future for business leaders, investors, and policymakers.

They will need some fortitude, however, as the text alone takes up 525 pages and runs to 600 with notes and index. Its core subject – the tension between market-determined value and human-led social values –provides a foundation for what Carney calls ‘mission-oriented capitalism’.

Readers will recognise yet another example of a one-time believer in free markets as the main contributor to prosperity morphing into one who thinks the proceeds are not spread around fairly.

Historical account

Catch phrases such as “the price of everything is becoming the value of everything” clutter a straight-forward historical account of economic thinking to the present day and a belief that the core purpose is to “improve our lives, expand our horizons, and solve society’s problems, both large and small.”

He is convinced sustainability and the road to net zero provide an opportunity to realign social values and value in the market. The book has extensive detail about what is achievable in the financial sector, and policies that would be consistent with those goals.

These include developing consistent metrics for ESG conduct and ensuring that executive pay is in line with long-term performance. As Carney wrote the book during the height of the pandemic in 2020-21, he was heartened by the social solidarity that was demonstrated in high-trust countries such as New Zealand.

Russian President Vladimir Putin’s invasion of Ukraine upset the post-pandemic recovery.

But absent from his analysis are the complications that Russian President Vladimir Putin added to the post-pandemic world recovery by a brutal assault on Ukraine, and China’s continuing efforts at elimination through oppressive lockdowns.

Both fuelled the inflation set off by excessive fiscal and monetary policies, adding to future generation debt as well as more immediate increases in energy and food costs. Some even expect famines and food shortages due to the lack of grain exports from Ukraine.

Superior performance

While world sharemarkets have plunged, stocks in the defence and fossil fuel sectors have risen, undermining Carney’s assertion that ESG produces superior performance. Already, some in the finance sector are doubting Carney’s climate change campaign.

At a Financial Times conference, HSBC executive Stuart Kirk questioned whether the risk to the world’s financial system was overstated, adding to claims that central bankers focused too much on climate change than the more immediate dangers of inflation.

Though Kirk’s presentation had been approved internally by HSBC, once it became public he was rapidly shut down and suspended as the head of responsible investing.

Worse, he highlighted Carney as guilty of “unsubstantiated, shrill, partisan, self-serving, apocalyptic warnings” that were always wrong, and claims that the dangers from climate change would dwarf any pain from inflation.

Kirk went on to challenge a regulatory regime as the solution to mitigating climate change rather than a more market-based approach to financing adaptation.

For his part, Carney uses behavioural economics to explain why popular notions about risk, both real and imagined, are often wrong. He, too, sees business as the solution through innovation, investment, and renewable energy.

"For a broad range of businesses, getting on the path to net zero will be one of their top three strategic issues – if not the top strategic issue – depending on the sector,” he writes.

Another strategic issue is the impact of new technologies, known as the fourth industrial revolution, which will bring big distributional shifts to those who are tech-savvy, and penalise those who aren’t.

The inequality implicit in digital transformation requires major changes in areas such as social welfare, the structure of the tax system, mid-career training and the financial payment system.

Leadership requires a similar movement, from the transactional to transformational. This is based on his call for mission-based capitalism that no longer puts profit at the centre of an enterprise’s purpose.

Instead, it is to provide a solution for society or is aligned with other stakeholders. Carney even has a chapter on humility, emphasising leadership is not an end in itself.

This is the language of political social democracy and familiar in the rhetoric of New Zealand’s Labour Government and public service. If only they could overcome their aversion to business and wealth creation, which Carney strongly advocates, rather than create obstacles.

Readers must make their own judgment on Carney’s extensive wish list in his final chapters, which are far removed from the evidence-based arguments of what precedes them. Carney’s knowledge is extensive and persuasive, giving comfort to those seeking transformational change rather than taking the incremental approach.

Amazon.com has an efficient means of making decisions.

One tidbit of advice I did like was one Carney picked up from Amazon, that bastion of aggressive capitalism. As outlined in a recent book by ex-Amazon executives, its decision-making process is highly structured and efficient.

Memos no longer than six pages are distributed before meetings, with the key points in the first few paragraphs. The meeting starts with everyone having 15 minutes of reading time before discussion and a decision.

Carney says pushback came from those who claimed central bank issues were too complex for such treatment, but the “quality of our discussions and the impact of colleagues were immensely improved”.

Value(s): Building a better world for all, by Mark Carney (William Collins).

Nevil Gibson is a former editor at large for NBR. He has contributed film and book reviews to various publications.

This is supplied content.